How to Write a Business Plan: Complete Step-by-Step Guide

Jan 16, 2026

To write a business plan, start with a one-page executive summary, then work through nine core sections: company description, market analysis, organization structure, product/service line, marketing strategy, logistics and operations, funding request, financial projections, and appendix. Most first-time business owners complete a solid working plan in 15-25 hours spread over 2-4 weeks.

A business plan forces you to answer hard questions before you spend money. What problem are you solving? Who will pay for the solution? How much will it cost to get started, and when will you break even?

This guide walks through every section of a traditional business plan, explains when a one-page lean plan makes more sense, and shows you how to avoid the mistakes that get funding applications rejected.

What Is a Business Plan?

A business plan is a written document, typically 15-20 pages, that explains what your business does, what you want to achieve, and the strategy you'll use to get there. It details the opportunities you're pursuing, the resources you'll need, and how you'll measure success.

Think of it as a roadmap. When you hit a fork in the road six months from now, you'll have a document that reminds you where you were trying to go in the first place.

Business plans serve two audiences. First, they help you think through your business model before you commit time and money. Second, they show banks, investors, and partners that you've done your homework. Most lenders won't consider a loan application without one.

Research suggests that entrepreneurs who write a plan grow their companies 30% faster than those who don't. The exercise forces you to research competitors, estimate costs, and define your target market, revealing problems on paper rather than after you've signed a lease.

Why Do You Need a Business Plan?

Some business owners skip planning. They have a good idea, customers seem interested, and writing a 20-page document feels like busywork. Then they run out of cash in month four because they underestimated startup costs by 40%.

Attract Funding and Investors

Banks and investors review hundreds of proposals. A business plan gives them a standardized way to evaluate risk. The plan shows you've thought through obstacles, understand your market, and can repay the loan or deliver returns. Without one, most lenders won't even take a meeting. If you're pursuing outside capital, understanding how to get a small business loan starts with having a solid plan in place.

Clarify Your Strategy

Writing forces research. You might discover your pricing won't cover expenses, or that your "unique" idea has twelve competitors you didn't know about. Better to find these problems on paper than after committing capital.

Guide Decision-Making

Once launched, you'll face dozens of decisions weekly. Should you hire or outsource? Expand or consolidate? A business plan provides a framework for making these calls when you're overwhelmed by day-to-day operations.

The Two Types of Business Plans

Not every situation calls for a 40-page document. Before you start writing, decide which format fits your needs.

Traditional Business Plan

A traditional plan is comprehensive, typically 15-40 pages. Banks, SBA lenders, and most investors expect this format.

- Best for: Bank loans, SBA loans, investor pitches, franchise applications, buying an existing business

- Time to complete: 15-40 hours over 2-4 weeks

Lean Startup Plan

A lean plan fits on one page using bullet points and charts. Create one in a few hours and update it as conditions change.

- Best for: Internal planning, self-funded businesses, early-stage validation, quick pivots

- Time to complete: 1-3 hours

If you're seeking outside funding, start with a traditional plan. If you're bootstrapping and need to clarify your thinking, a lean plan works fine. You can always expand it later.

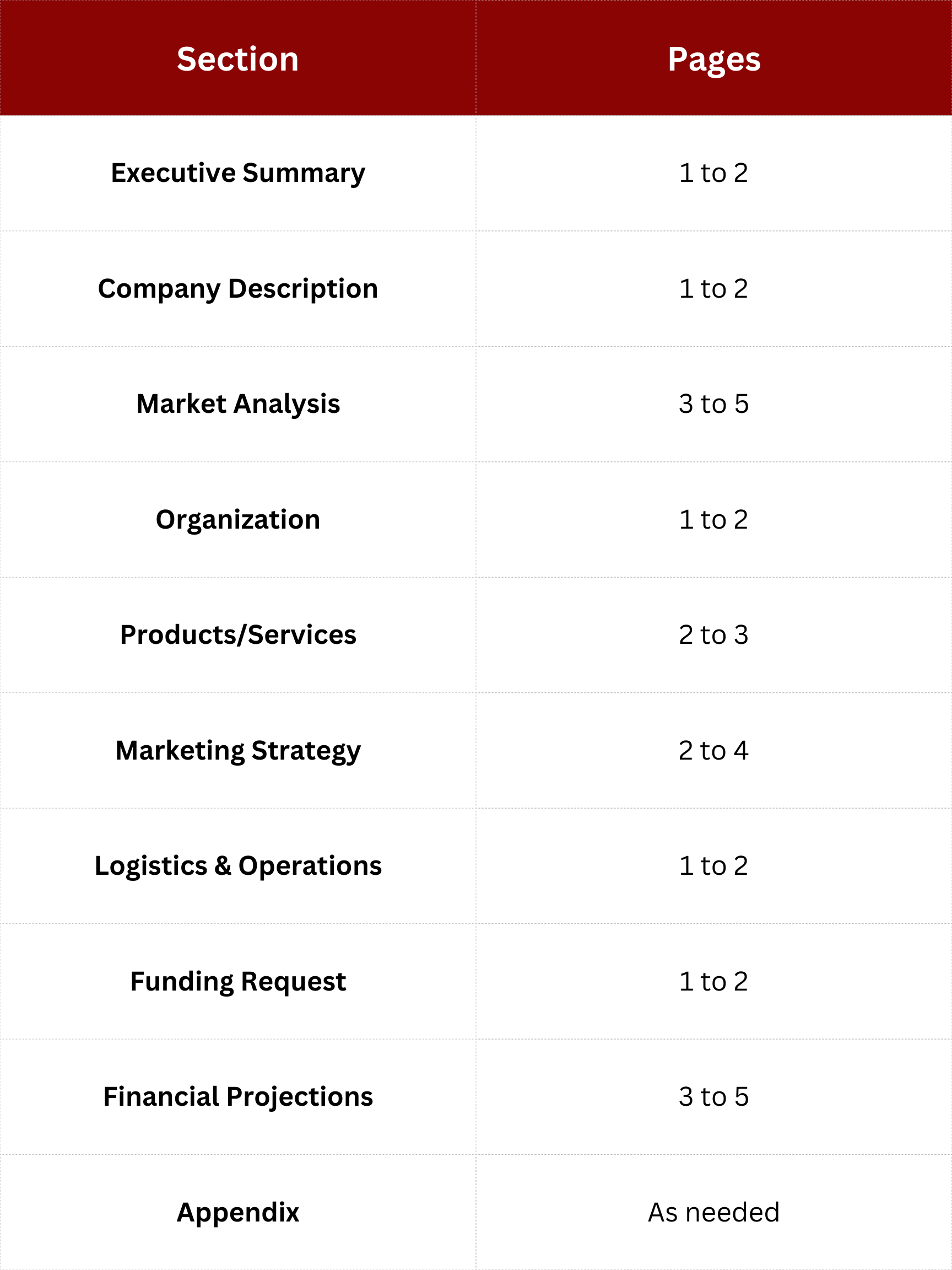

The 9 Sections of a Traditional Business Plan

1. Executive Summary

A 1-2 page overview of your entire plan, written last, placed first. Think of it as an elevator pitch in written form. If a busy investor reads nothing else, they should understand your business from this section.

Include:

- Business name, location, and what you sell

- Problem you solve and for whom

- Your competitive advantage in one sentence

- Target market summary

- Revenue projections (current and forecasted)

- Funding request and intended use of funds

- Management team highlights

Length: 1-2 pages

Common mistake: Writing this first. You'll rewrite it anyway once you've completed your research. Finish the other sections, then summarize.

2. Company Description

Background on your business—the full story behind the executive summary.

Include:

- Legal structure (LLC, S-corp, sole proprietor, partnership)

- Business model (service, product, subscription, B2B, B2C)

- Mission statement (2-3 sentences maximum)

- Short-term goals (next 12 months)

- Long-term vision (3-5 years)

- Location and facilities

- Competitive advantages

Your company description should answer: "So what exactly do you do?" Be specific about advantages: "same-day response to all service calls" beats "great customer service."

3. Market Analysis

Proof that customers exist and will pay for what you're selling. This section requires real research, not guesses.

Include:

- Industry description and outlook

- Target market definition (demographics, behaviors, pain points)

- Total addressable market (TAM) with sources

- Serviceable market (SAM)—the realistic portion you can reach

- Competitor analysis (direct and indirect)

- SWOT analysis (strengths, weaknesses, opportunities, threats)

- Your competitive positioning

Research sources: Census Bureau data (free), industry association reports, IBISWorld or Statista (often available through libraries), local economic development offices, competitor websites, and reviews.

Common mistakes: Claiming "everyone" is your customer or saying you have "no competitors." Both signals you haven't done the research. Narrow markets are easier to dominate.

4. Organization and Management

Investors often bet on the team more than the idea. A talented team can pivot a struggling concept; a weak team will fail even with a great one.

Include:

- Ownership structure and percentages

- Management team bios with relevant experience

- Organizational chart (even if it's just you)

- Board of advisors or mentors

- Key hires needed in years 1-3

- Gaps in expertise and how you'll address them

- Outside consultants you'll use (accountant, attorney, etc.)

For solo operators, acknowledge gaps honestly. Explain how you'll compensate, partnering with experienced people, hiring consultants, or outsourcing specific functions like bookkeeping or marketing.

5. Products or Services

What you sell and why customers will buy it. Go beyond features to explain benefits.

Include:

- Product/service descriptions in plain language

- Benefits to customers (not just features)

- How your offering differs from competitors

- Pricing structure and rationale

- Product lifecycle or service delivery process

- Intellectual property (patents, trademarks, copyrights)

- Supplier relationships

- Future products planned

Include specific pricing. "$2,500 per project" is stronger than "competitive pricing." Specific numbers show you've done the math.

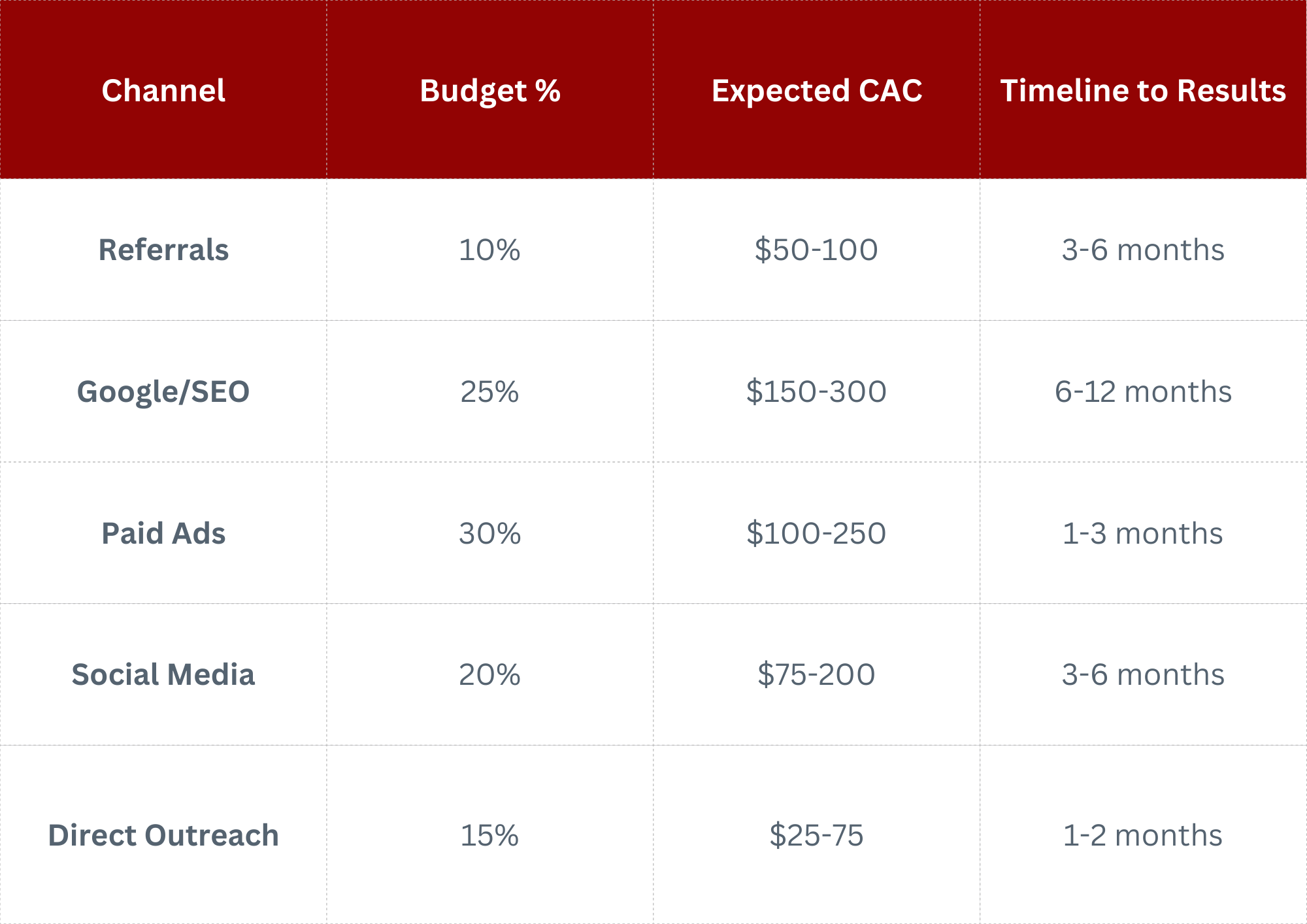

6. Marketing and Sales Strategy

A great product means nothing if no one knows it exists. This section explains how you'll attract customers and convert them into paying clients.

Include:

- Product positioning and value proposition

- Marketing channels ranked by priority

- Customer acquisition cost estimates

- Sales process (steps from lead to close)

- Pricing strategy and positioning

- Promotional tactics for launch

- Customer retention approach

- Marketing goals and how you'll measure them

Your marketing strategy should evolve as you learn what works. The plan documents your starting approach, not a permanent commitment.

7. Logistics and Operations Plan

How you'll actually deliver your product or service day-to-day.

- Suppliers: Where you source products or materials, backup options, import/export considerations, payment terms

- Production: How products are made, facilities and equipment needed, quality control processes

- Fulfillment: Shipping carriers and methods, storage and warehousing, third-party fulfillment partners, returns handling

- Inventory: How much you'll keep on hand, tracking systems, reorder points, and processes

Include contingency plans. What happens if your main supplier goes out of business? What if shipping costs double? Strong logistics planning shows investors you understand the operational side.

8. Funding Request

If seeking financing, specify exactly how much you need and how you'll use it.

Include:

- Total amount requested

- Type of funding sought (loan, equity, line of credit)

- Detailed use of funds breakdown

- Repayment timeline or exit strategy

- Current debt and obligations

- Collateral offered (for loans)

- Your own contribution (shows skin in the game)

Common mistake: Asking for round numbers without justification. "$50,000 for startup costs" raises questions. An itemized breakdown builds credibility.

9. Financial Projections

Show you understand the economics of your business.

Include:

- Income statement (profit and loss) projections

- Cash flow statement projections

- Balance sheet projections

- Break-even analysis

- Sales forecast (monthly for year 1, quarterly for years 2-5)

- Key assumptions documented

- Sensitivity analysis (best case, worst case)

For existing businesses: Also include historical income statements, cash flow statements, and balance sheets for the past three years.

Document your assumptions: Revenue growth rate, gross margin percentage, operating expense ratios, customer acquisition rate, churn or repeat purchase rate.

Your projections will be wrong—everyone's are. The goal is showing you've thought through the math and identified what must be true for the business to succeed.

Banks reject roughly 80% of small business loan applications. The most common reason? Incomplete or unrealistic financial documentation.

10. Appendix

Supporting documents:

- Team resumes

- Letters of intent from customers

- Lease agreements

- Product photos

- Licenses

- Permits

- Certifications

- Media coverage

- Patents

- Contracts

- Detailed market research data.

How Long Should a Business Plan Be?

A business plan should be long enough to be useful and short enough to be read. Most lenders spend 15-30 minutes reviewing a plan before deciding whether to dig deeper. Front-load the important information.

Common Business Plan Mistakes to Avoid

- Unrealistic financial projections: Claiming 50% market share by year two signals inexperience. Use industry benchmarks.

- No clear revenue model: "We'll figure out monetization later" doesn't work outside Silicon Valley. Show exactly how money flows in.

- Ignoring competition: Claiming "no competitors" suggests you haven't looked. Every business has competitors, even indirect ones.

- Generic market analysis: National statistics mean nothing for a local business. Research your specific market.

- Glossing over management gaps: Pretending you can do everything yourself isn't credible. Acknowledge weaknesses and explain your plan.

- No customer validation: Zero evidence that anyone will pay means you're guessing. Include letters of intent, pre-orders, or interview data.

- Burying the ask: Don't make readers hunt for how much you need. State your funding request clearly and early.

- Sloppy presentation: Typos and inconsistent formatting suggest carelessness. Proofread multiple times.

When to Update Your Business Plan

A business plan isn't a document you write once and forget. Markets change. Your business evolves.

- Quarterly: Review financial projections vs. actual results, adjust marketing tactics, update short-term objectives

- Annually: Full assessment of each section, updated market analysis, revised long-term goals, refreshed SWOT analysis

Immediate updates when: New competitors enter your market, consumer trends shift significantly, supplier costs change dramatically, or regulations change

Free Business Plan Templates and Tools

- SBA Business Plan Tool: Free, guided format from the Small Business Administration

- SCORE Business Plan Templates: Free templates in multiple formats

- SCORE Financial Projections Template: Spreadsheet for building forecasts

- Bank of America Business Plan Workbook: Free, editable PDF

Start with the free SBA template for traditional plans. It covers all sections lenders expect.

Frequently Asked Questions

How long does it take to write a business plan?

Most first-time business owners spend 15-25 hours over 2-4 weeks on a traditional plan. A lean one-page plan takes 1-3 hours. The research phase takes the longest.

Do I need a business plan if I'm not seeking funding?

Not required, but recommended. A basic plan forces you to validate assumptions, identify costs, and set measurable goals before spending money. Many owners discover fatal flaws during planning.

Can I write a business plan myself?

Yes, use free templates from the SBA or SCORE. Hiring a consultant ($2,000-$10,000) makes sense only for significant funding pursuits when you lack time. The downside: you learn less about your own business.

How often should I update my business plan?

Review financial projections quarterly. Update the full plan annually or when major changes occur, new products, market shifts, or significant variance from projections.

What's the most important section?

For lenders, financial projections—they want to know you can repay the loan. For investors, the executive summary and market opportunity. For you, the assumptions underlying your financial model.

Key Takeaways

- A business plan explains what your business does, what you want to achieve, and your strategy to get there

- Choose between traditional plans (15-40 pages, for funding) or lean plans (1 page, for internal use)

- Traditional plans include 9 sections: executive summary, company description, market analysis, organization, products/services, marketing, logistics, funding request, and financials

- Write the executive summary last, it summarizes everything else

- Financial projections matter most for funding; be realistic and document assumptions

- Most owners complete a working plan in 15-25 hours over 2-4 weeks

- Free templates from SBA and SCORE cover most needs

Build Your Business Plan with the Right Tools

Writing a business plan doesn't require starting from scratch. Visit the Unsexy Shop for templates, financial projection spreadsheets, and step-by-step guides built for service business owners who want practical tools—not theory.