How to Start an LLC in Alabama

Feb 05, 2025

Eager to start your business in Alabama while keeping costs low? Despite what you might have heard, forming an LLC in the Yellowhammer State doesn't require deep pockets or a law degree. With a basic filing fee of $200 and processing times of just 3-5 business days, Alabama makes it surprisingly simple to establish your business presence.

It doesn’t matter if you're launching a local construction company, starting a consulting firm, or opening a retail shop, we're here to help you set up your LLC keeping it easy, smooth and budget-friendly.

Don't let misconceptions hold you back – you can have your Alabama LLC up and running in less than a week.

Forming Your Alabama LLC

Starting an LLC in Alabama comes with several advantages and straightforward requirements. Here's what you need to know:

- Cost-Effective Setup: Basic filing fee is just $200, with no separate state business license requirement. Save money by filing online and serving as your own registered agent.

- Quick Processing: Online applications typically process in 3-5 business days, while mail applications take 5-7 business days. No need to pay for expensive expedited service.

- Essential Requirements: You'll need a unique business name, registered agent with a physical Alabama address, and Certificate of Formation. Plus, you must file an Initial Business Privilege Tax Return within 2.5 months of formation.

- Annual Obligations: File your Business Privilege Tax Return by April 15th each year. Minimum tax is typically $100, but businesses owing $100 or less in 2024 are exempt from filing.

- Simple Maintenance: Alabama's requirements are straightforward – maintain a registered agent, file annual tax returns, and keep up with any required local business licenses. No complex ongoing paperwork or hidden fees.

A Complete Guide to Starting an LLC in Alabama

Let's walk through the essential steps to form your LLC in Alabama without unnecessary complications or expenses. The first step is to visit Alabama’s Secretary of State.

Step 1: Choose Your LLC Name

Picking your LLC name isn't just about creativity – in Alabama, you need to follow specific rules to avoid rejection. Your name must include "Limited Liability Company," "LLC," or "L.L.C." (Most businesses use "LLC" to keep it simple).

Some requirements to follow:

- Must include "Limited Liability Company," "LLC," "L.L.C.," or similar approved variations

- Cannot be identical to existing Wyoming businesses

- Restricted words like "Bank" or "Insurance" require additional licensing

- Name reservations available for $60 if you're not ready to file

Before falling in love with a name, check if it's available using Alabama's Business Entity Search – your name must be distinguishable from other registered businesses.

Here's a money-saving tip: While you can reserve your name for 120 days for $25, skip this fee if you plan to file your LLC formation documents within a few days, since filing your Certificate of Formation automatically secures your name.

Step 2: Choose Your Registered Agent

You can be your own registered agent, giving you oversight of your business correspondence while saving on fees for professional services. Here's how to do it:

What You Need to Qualify as Your Own Registered Agent:

- Age Requirement: You must be at least 18 years old.

- Physical Address: You need a street address in Alabama (P.O. Boxes don’t count).

- Availability: Be available during business hours to receive notices and legal documents.

Benefits of Being Your Own Agent:

- Avoid paying for third-party registered agent services.

- Stay informed about legal and government matters affecting your LLC.

- No need to involve an intermediary—documents come straight to you.

Taking the reins as your own registered agent is a smart move to save money and stay hands-on with your LLC's operations.

Step 3: Filing Online

The real work begins with filing your Certificate of Formation with Alabama's Secretary of State. This step costs $200 by mail or online, Including a copy of the Name Reservation Certificate. You'll need to provide:

- Your LLC's name

- Principal office address

- Registered agent information

- Whether the LLC is member or manager-managed

- Names and addresses of managers (if manager-managed)

- Signature of the organizer

Pro tip: File online for fastest processing (3-5 business days versus 5-7 days for mail). The online system also checks for errors as you go, reducing the chance of rejection and delays.

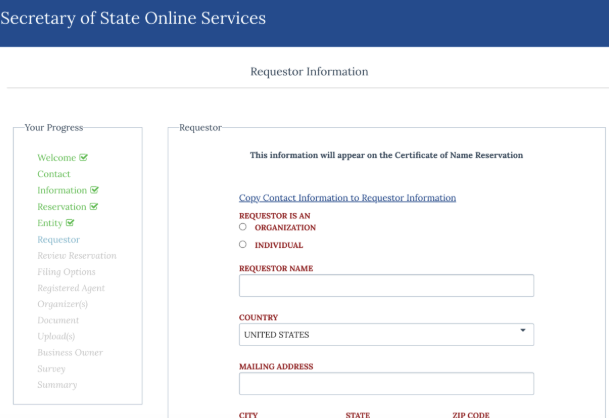

Here’s how to file online:

Use the required certificates for either your Domestic or Foreign Limited Liability Company.

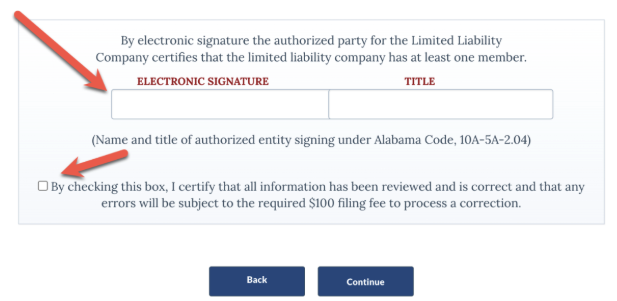

Follow the LLC Wizard: Follow the prompts provided by the Secretary of State’s online wizard.

Review and Sign: Review the company details and the organizer must sign on the bottom of the page.

Pay the Filing Fee: Use the checkout process to pay the filing fee.

- Domestic: $236

- Foreign: $184

Step 4: Choose a Tax Classification

When forming an LLC, you decide how your business will be taxed. LLCs enjoy pass-through taxation, but you can choose a classification that fits your goals.

1. Default LLC Taxation

- Single-Member LLC: Treated as a disregarded entity, meaning the business's profits pass directly to your personal tax return.

- Multi-Member LLC: Taxed as a partnership, with profits distributed among members based on ownership percentages.

2. Electing S-Corporation Tax Status

If you're looking to maximize tax savings, consider filing as an S-Corporation.

- How to Elect: Submit IRS Form 2553 within 75 days of forming your LLC or the start of the tax year.

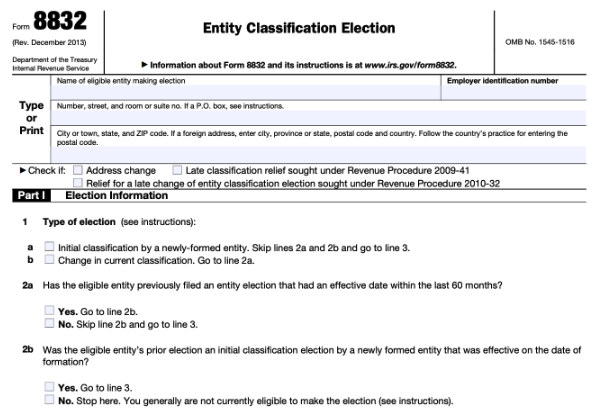

3. Electing C-Corporation Tax Status

For businesses planning to reinvest earnings or attract investors, C-Corporation status can be beneficial.

- How to Elect: File IRS Form 8832 within 75 days of forming your LLC or the start of the tax year.

Handle Post-Filing Requirements

Once your LLC is approved, complete these essential tasks to keep your business compliant and protected:

Get Your Tax Documents in Order

- Apply for an EIN (free through the IRS website)

- File your Initial Business Privilege Tax Return within 2.5 months of formation

- Know your tax rates: $0.25 to $1.75 per $1,000 of net worth

- For 2024, you're exempt from filing if you owe $100 or less

Protect Your Business

- Open a separate business bank account

- Create an operating agreement (not required by law but crucial for protection)

- Consider basic business insurance options

- Check local licensing requirements

Keep Your LLC Compliant

- File Business Privilege Tax Returns by April 15th each year

- Maintain current registered agent information

- Track any local permit renewal deadlines

- Pay attention to industry-specific license requirements

Launch Your Alabama LLC Today

Getting your Alabama LLC up and running doesn't have to be overwhelming or draining. Follow our steps and take advantage of cost-saving opportunities like being your own registered agent, you can save money while building a solid foundation for your business. The total basic cost to form your LLC will be $200, plus any optional services you choose.

Ready to get started? Head to Alabama’s Secretary of State and start filing, you could have your LLC up and running in less than a week.