How to Start an LLC in Arizona in 2026

Feb 05, 2025

Ready to turn your business idea into reality and start your LLC in Arizona? While traditional advice might suggest you need thousands of dollars and complex legal help, starting an LLC in Arizona is straightforward and affordable. With just a $50 filing fee and about two weeks of processing time, you can establish your business presence in the Grand Canyon State.

Whether you're launching a local service company, starting a consulting firm, or opening a retail shop, we'll walk you through the exact steps to form your LLC without unnecessary complications or excessive costs.

Don't let outdated advice hold you back – Arizona makes it simple to take control of your future.

Launching Your Arizona LLC

Starting an LLC in Arizona comes with plenty of benefits for entrepreneurs looking to build something of their own. Here's what you need to know about forming your Arizona LLC:

- Cost-Effective Setup: Basic filing fee is just $50, with no separate state business license requirement. Save money by filing online and serving as your own statutory agent to avoid service fees of $50-300 annually.

- Quick Processing: Standard processing takes 13-15 business days, or 4-6 business days with expedited service ($35 extra). Online filing is recommended for fastest results.

- Essential Requirements: You'll need a unique business name, statutory agent with an Arizona address, and Articles of Organization. Plus, most counties require newspaper publication of your LLC formation.

- Annual Obligations: Unlike many states, Arizona doesn't require annual reports or have franchise taxes. Just maintain your statutory agent and handle any required business tax filings.

- Simple Maintenance: Arizona's requirements are straightforward – maintain a statutory agent, meet publication requirements, and keep up with any necessary tax payments. No complex ongoing paperwork or hidden fees.

A Complete Guide to Starting Your Arizona LLC

Starting an LLC in Arizona is a straightforward process that can set you on the path to business independence. The Arizona Corporation Commission (ACC) handles all LLC formations, and you can complete most steps online to save time and money.

Step 1: Name Your LLC

When selecting a name for your LLC, Arizona law requires adherence to specific guidelines, Your business name must:

- Include an indicator such as “Limited Liability Company,” “LLC,” or “L.L.C.”

- Avoid misleading terms like “corporation” or “incorporated” that imply it is a different type of business entity.

- Be unique among businesses already registered in Arizona.

To check if your desired name is available, use the Arizona Business Entity Search.

Here's a money-saving tip: If you’re not quite ready to file, you can reserve your chosen name for 120 days by submitting an Application to Reserve Limited Liability Company Name and paying a $10 fee.

Professional LLCs Have Different Name Rules

Running a professional service like legal, medical, accounting, or architectural work? Arizona requires different naming conventions for your LLC:

Professional LLCs must use:

- "Professional Limited Liability Company" (full phrase), OR

- "PLC," "P.L.C.," "PLLC," or "P.L.L.C." (abbreviations)

Regular "LLC" or "L.L.C." won't cut it for professional services. You'll also need to describe your services in your Articles of Organization. Check with your professional licensing board before forming a PLLC. Some professions have additional requirements or restrictions.

Want to operate under a different name? You can register a DBA (Doing Business As), referred to in Arizona as a “Trade Name,” through the Arizona Secretary of State's office. Trade Name registration costs $10.

Step 2: Select a Statutory Agent

Every LLC in Arizona is required to appoint a statutory agent (also known as a registered agent). This individual or entity is responsible for receiving legal and state correspondence on behalf of your business. Choosing to act as your own statutory agent can simplify your business operations while saving money.

Requirements for a Statutory Agent in Arizona:

- Physical Address: The statutory agent has to have a physical street address in Arizona (P.O. boxes aren’t allowed).

- Availability: They must be available during regular business hours to accept legal documents and correspondence.

- Eligibility: The statutory agent can be:

- You or another member of your LLC.

- An individual who resides in Arizona.

- A professional statutory agent service.

Benefits of Acting as Your Own Statutory Agent:

- Save Money: Avoid paying fees to professional agent services, which can add up over time.

- Maintain Control: Receive important legal and state documents directly without relying on a third party.

- Simplicity: Streamline your LLC operations by managing correspondence personally.

While serving as your own statutory agent requires your address to be part of the public record and availability during business hours, this is manageable for many business owners.

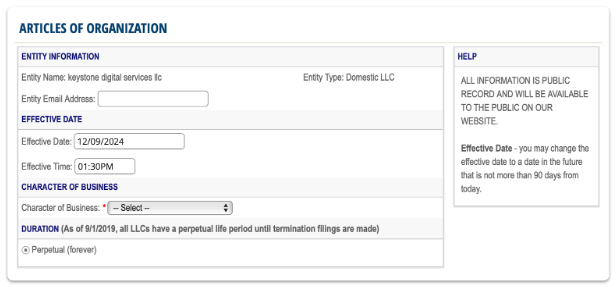

Step 3: File the Articles of Organization

To establish your LLC in Arizona, file the Articles of Organization with the Arizona Corporation Commission. The filing fee is $50, and you can file online, by mail, or in person.

Information Required in the Articles of Organization:

- LLC Name: Include “LLC” or a similar indicator.

- Statutory Agent Details: Provide the name and address of your statutory agent.

- Management Structure: Indicate whether the LLC is managed by its members or by managers.

- Known Place of Business: This is your LLC’s Arizona business address, which may differ from the statutory agent’s address.

- Organizer’s Information: The name of the person or entity completing and signing the form.

Where to File:

- Online: Through the Arizona Corporation Commission’s eCorp portal

- By Mail:

Arizona Corporation Commission

Corporations Division

1300 W. Washington St.

Phoenix, AZ 85007 - In Person: Visit the above address.

Step 4: Publish a Notice of Formation

Arizona law requires LLCs formed in most counties (excluding Maricopa and Pima) to publish a Notice of LLC Formation in a newspaper approved by the ACC. This must occur within 60 days of formation and run for three consecutive publications. Contact an approved publication in your county for pricing and details. Publication costs typically range from $60 to $300 depending on the newspaper.

Step 5: Obtain an Arizona Business License

Arizona doesn’t have a statewide general business license, but many cities and towns require local business licenses or permits. Check with your city or town government to determine specific requirements for your LLC.

Some industries (e.g., contractors, health professionals) may also require specialized licenses from state agencies.

Step 6: Register for Your Transaction Privilege Tax License

If your business sells products or taxable services in Arizona, you need a Transaction Privilege Tax (TPT) license. This is Arizona's version of sales tax, though technically it's different.

The cost is $12. Register online through AZTaxes.gov or by visiting a local Arizona Department of Revenue office.

You need this license if you:

- Sell physical products to Arizona customers

- Provide certain services subject to TPT

- Operate a retail location

- Run a restaurant or bar

Not every business needs a TPT license. Service businesses like consulting, coaching, or freelance writing typically don't. When in doubt, check with the Arizona Department of Revenue or ask your accountant.

Once you have your license, you'll file TPT returns monthly, quarterly, or annually depending on your transaction volume. Keep this current, penalties for late filing add up fast.

Get Your Certificate of Good Standing

A Certificate of Good Standing (sometimes called a Certificate of Existence) proves your LLC is legit and current with the state. You'll need this for:

- Opening business bank accounts

- Applying for business loans or lines of credit

- Signing commercial leases

- Bidding on contracts

- Registering to do business in other states

The process is simple: Request one from the Arizona Corporation Commission. It's free, which is unusual, most states charge $10-$30 for this document.

Keep a copy in your business files. Some banks and landlords want to see one that's less than 60-90 days old, so you might need to request fresh copies occasionally.

If You're Bringing an Existing LLC to Arizona

Already have an LLC in another state but want to operate in Arizona? You need to register as a foreign entity. Don't let the name confuse you, "foreign" just means formed outside Arizona.

What you need to do:

- Make sure your LLC name meets Arizona requirements and isn't already taken

- Appoint a statutory agent with an Arizona address

- File an Application for Registration of Foreign Limited Liability Company by mail

- Include a Certificate of Existence from your home state

- Pay the $150 filing fee

Mail everything to:

Arizona Corporation Commission

Corporations Division

1300 W. Washington St.

Phoenix, AZ 85007

Processing takes 2-3 weeks. Once approved, your out-of-state LLC can legally operate in Arizona. You'll maintain your original formation state but comply with Arizona's requirements for doing business her

Get Your Business Operational

Once your LLC is approved and publication requirements are met, complete these essential tasks to keep your business compliant and protected:

Get Your Tax Documents in Order

- Apply for an EIN (free through the IRS website)

- Register for Arizona Transaction Privilege Tax (TPT) if required

- Set up tax payments through AZTaxes.gov

Protect Your Business

- Open a separate business bank account

- Create an operating agreement (not required by law but crucial for protection)

- Consider business insurance options

- Check local licensing requirements

Keep Your LLC Compliant

- Maintain current statutory agent information

- Keep TPT tax payments up to date

- Track any local permit renewal deadlines

Common Questions About Arizona LLCs

Do I need to file annual reports in Arizona?

No. Arizona is one of the few states that doesn't require annual reports or annual statements for LLCs. This saves you $50-$100 every year compared to states like California or Delaware. You just need to keep your statutory agent information current.

Can I change my LLC name after I file?

Yes, but it requires filing an Amendment to Articles of Organization with the Arizona Corporation Commission. There's a filing fee (check current rates), and you'll need to make sure your new name is available and meets naming requirements.

What if I'm the only owner?

Single-member LLCs are completely legal in Arizona. You get all the liability protection of an LLC while keeping operations simple. For tax purposes, the IRS treats you as a sole proprietorship by default (unless you elect corporate taxation). You still need a statutory agent and should still create an operating agreement.

Can I serve as my own statutory agent?

Absolutely. Many business owners serve as their own statutory agent to save the $50-$200 annual fee. The only catch: your address becomes part of the public record, and you need to be available during business hours to receive official documents.

What happens if I miss the publication requirement?

If you're in a county that requires publication (everywhere except Maricopa and Pima) and you don't publish within 60 days, the Arizona Corporation Commission can administratively dissolve your LLC. Don't risk it – the publication costs $60-$300, which is cheap compared to reforming your LLC.

Do I need a business license in Arizona?

Arizona doesn't have a statewide general business license, but your city or town might require one. Phoenix, Tucson, Mesa, and other municipalities each have their own rules. Check with your local city clerk's office. Some professions (contractors, healthcare, real estate) also need specialized state licenses regardless of location.

Start Your Arizona Business Dream

Arizona's straightforward process, including the affordable filing fee and quick approval time, makes it easier than ever to take the leap into entrepreneurship. By following the simple steps outlined, you can have your business up and running quickly. The total cost to form your LLC will be just $45-50 for filing fees, plus any required publication costs if you're outside Maricopa or Pima counties.

Time to take the next step and bring your business to life! Head to the ACC's eCorp website and start your online filing – you could have your LLC up and running in just two weeks.