The No-Nonsense Guide to Business License Costs: What You'll Really Pay

Nov 08, 2024

Starting a business? You’re going to need a business license, and figuring out the cost can be confusing. Let’s break it down simply and straightforwardly so you know what to expect.

Key Takeaways

- Business license costs vary widely: Typical ranges from $50 - $500+

- Factors affecting costs: Location, business type, and government level

- Additional permits or licenses may be needed, increasing overall expenses

- Budget for renewal fees and ongoing compliance costs

- Some businesses require multiple licenses at different government levels

Typical Costs: What to Expect

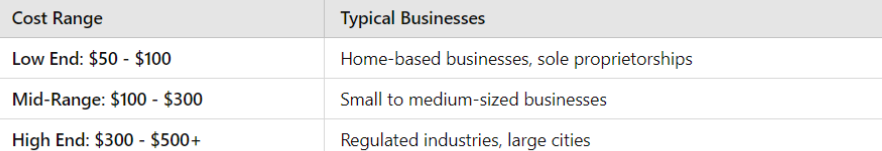

Most small businesses can expect to pay between $50 and $200 for a basic business license. However, costs can exceed $500 in certain industries or locations. Here’s a quick breakdown:

Factors Influencing Your Business License Cost

1. Location, Location, Location

- City fees: Vary dramatically (e.g., $15 in small towns, $400+ in major cities)

- County fees: Additional costs may apply

- State fees: Range from $0 to $300+. (Find your LLC Costs here)

2. Business Type and Size

- Home-based: Generally lower fees

- Retail and restaurants: Typically higher costs

- Regulated industries: (e.g., liquor stores, cannabis dispensaries) incur steeper fees

3. Government Level

- Local licenses: Often required

- State licenses: Necessary for certain professions

- Federal licenses: Required for specific industries (e.g., firearms, broadcasting)

Hidden Costs to Watch Out For

Be aware of potential additional expenses:

Industry-Specific License Costs

Some industries face higher licensing costs due to increased regulation:

Renewal Fees: The Gift That Keeps on Giving

Most business licenses aren’t a one-time expense. Make sure you budget for the following renewal fees.

- Typical renewal frequency: Annually or bi-annually

- Renewal costs: Similar to initial fees, sometimes slightly less

- Late renewal penalties: Often 50% or more of the regular fee

How to Estimate Your Total Licensing Costs

- Research local requirements: Check city and county websites for fee schedules

- Identify state-level needs: Visit your state’s business licensing department online

- Consider your industry: Look up specific licensing requirements

- Add up potential fees: Include initial license, permits, and first-year renewals

- Budget for the unexpected: Add a 20% buffer for unforeseen costs

Money-Saving Tips for Budget-Conscious Entrepreneurs

- Start home-based: Lower licensing fees

- File independently: Save on service fees if straightforward

- Apply early: Avoid expedited fees by planning ahead

- Check for discounts: Some areas offer reduced fees for veterans or low-income applicants

- Bundle permits: Look for package deals for multiple permits

The True Cost of Skipping Your Business License

Operating without a license can lead to serious consequences:

LLCs typically enjoy pass-through taxation. Parent LLCs report subsidiary profits on their tax returns, but it’s essential to understand all associated fees. Learn what you'll really pay here.

- Fines: Typically $500 to $5,000 for first-time offenses

- Back taxes and penalties: You’ll owe unpaid taxes plus interest

- Forced closure: Business may be shut down until compliance is met

- Legal fees: Fighting citations can be expensive

- Damaged reputation: Loss of trust from customers and partners

Ready to Tackle Your Business Licensing?

Navigating business licenses and permits may seem daunting, but it’s a crucial step in establishing your business. At Unsexy Businessmen, we help entrepreneurs cut through the finish line and ensure compliance.

Whether you’re launching an HVAC company, opening a laundromat, or turning a side hustle into a full-time gig, we’re here to assist. Visit unsexybusinessmen.com to learn how we can help you navigate the licensing landscape efficiently.

In the business world, it’s not about flash; it’s about building a solid foundation. Let’s get your business licensed and ready to thrive!