Starting a Business for Dummies: The Real Guide

Oct 28, 2025

You don't need an MBA or substantial capital to build a profitable business. You need two things: a viable business model and the discipline to execute without overthinking.

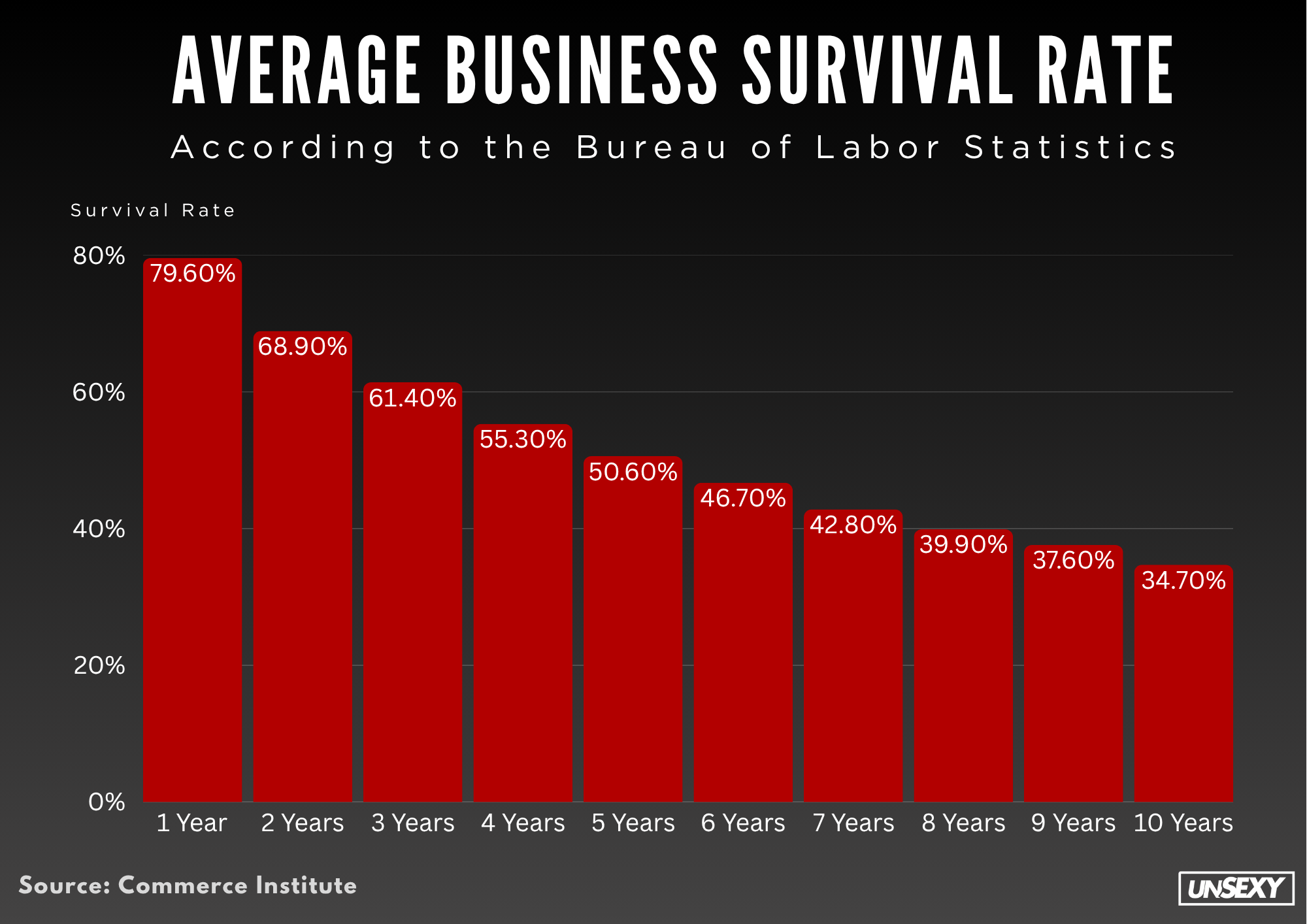

The internet overflows with startup advice from founders who raised millions and failed within two years. In fact, approximately 20.4% of businesses fail within their first year, 49.4% fail in their first 5 years, and 65.3% fail in their first 10 years.

This isn't that article. This focuses on businesses that generate consistent, reliable revenue, no unicorns, no hockey stick projections. Just profit.

Most beginner business guides recommend following your passion and thinking big. Here's what actually works: identify what people need, charge appropriately for it, and maintain low overhead. Everything else is implementation.

Why Most Business Advice Falls Short

The problem with most startup guides is they're written by people who either never launched a business or pursued the wrong model.

They recommend writing 40-page business plans before generating your first dollar. They push pitch decks and investor meetings. They insist every business requires a revolutionary idea.

That advice serves tech startups burning venture capital. If you're reading this, you're likely not raising a Series A. You need revenue next month, not in three years.

The businesses that work for most entrepreneurs are the ones rarely featured in business publications: car washes, pressure washing, window cleaning, HVAC repair, laundromats. These aren't glamorous, but they're highly profitable and don't require advanced degrees.

Step 1: Choose a Viable Business (Not Your Passion Project)

Stop waiting for the perfect idea. The best businesses solve practical problems that people pay to fix.

Here's what defines a strong first business:

- Regular customer need (recurring revenue, not one-time)

- Low startup costs (ideally under $5,000)

- Local service area (customers within 20 miles)

- Fast path to profitability (weeks, not years)

- Minimal specialized credentials required

Examples: Pressure washing services can launch for under $1,000. Window cleaning requires $300 in supplies. Lawn care needs a mower and trailer. None require business loans or investor pitches.

Your passion can remain a hobby. Your business must generate income.

Step 2: Conduct Market Research (Without Analysis Paralysis)

Market research sounds complex. It's not. Answer three questions:

- Are people already paying for this? (If there's no market, there's no business)

- Who are your competitors? (Research their pricing and reviews)

- Can you deliver better, faster, or more affordably? (Ideally, two of three)

Don't spend months on this. Spend one week. Interview ten potential customers. Identify their frustrations with current options. That's your competitive advantage.

The best market research is securing your first customer. If you can't get one person to pay before registering your LLC, you don't have a validated business yet.

Critical point: If you spend more than two weeks on research without making a sale, you're procrastinating. Start asking for business.

Step 3: Complete Legal Requirements (It's Straightforward)

You need to register your business. It provides legal protection and establishes credibility.

Choose your business structure:

Sole Proprietorship: Simplest option. You and the business are legally identical. Drawback: personal assets are exposed to liability.

LLC (Limited Liability Company): Protects personal assets. Costs $50-$500 depending on your state. Setup takes approximately one hour. This is the recommended option for most. We have a guide for starting an LLC for each state in the U.S., take a look.

Corporation: Unnecessary for most beginners. Only consider if raising significant capital or planning an eventual sale.

Register online through your state's website or services like ZenBusiness or Incfile. The process takes 30 minutes.

Obtain your EIN (Employer Identification Number): Free from the IRS website. Takes five minutes. Required for business banking and tax filing.

Permits and licenses: Requirements vary by business type and location. Check city and state websites. Most service businesses need a general business license. Some require specialty permits (food service, contracting, etc.).

Don’t be one of the businesses that fail because they skipped this step. The survival rate of businesses should put it into perspective.

Step 4: Manage Startup Financing (Without Overextending)

Calculate your actual startup costs honestly. What do you genuinely need to launch?

For most service businesses: equipment, basic marketing materials, possibly a website, business registration, and insurance. You don't need office space. You don't need employees initially. You don't need premium business cards.

Funding options:

Bootstrapping: Self-fund with personal savings. No debt, no equity dilution. This is the most sustainable approach if feasible.

Small business loan: Consider if you need equipment or inventory. SBA loans offer competitive rates but lengthy processing. Local banks typically move faster.

Business credit card: Useful for managing cash flow, but don't rely on it as primary funding. This leads to financial trouble.

Friends and family: Can work, but document everything in writing. Financial arrangements damage relationships quickly.

Skip venture capital and angel investors. Those are for tech companies, not service businesses generating immediate revenue.

Price appropriately: Don't compete on price alone. Low pricing attracts difficult customers. Position yourself in the middle to upper range. Compete on quality and reliability.

Grab our Business Pro Starter Pack, for all of the legal forms and papers you’ll need.

Step 5: The Business Plan Reality Check

Do you need a formal business plan? For most, no.

You need a business plan if seeking loans or investors. Otherwise, you need strategic clarity, not formatted documentation.

Answer these questions:

- What are you selling?

- Who's buying it?

- What are your delivery costs?

- What are you charging?

- How will you acquire customers?

- When do you reach profitability?

Document these answers. That's your business plan. You can formalize it later if needed.

The goal is generating revenue, not winning business plan competitions.

Step 6: Acquire Your First Customers (The Critical Step)

This is where most fail—not because they can't deliver, but because they won't initiate sales conversations.

Stop building. Stop planning. Start selling.

How to acquire your first ten customers:

- Leverage your network: Announce your business. Post on social media. Contact your network directly. Most people support new ventures.

- Join local communities: Nextdoor, local Facebook groups, business networks. Introduce yourself. Offer introductory discounts.

- Direct outreach: Door-to-door for home services. Direct business visits for B2B. Traditional methods still work.

- Establish online presence: Create a Google Business Profile (free, appears in local searches). Launch a basic website using Wix or Squarespace.

- Request referrals: After every job. "If you're satisfied with my work, could you recommend anyone else who might need this service?"

Your first customers come from direct effort, not marketing campaigns.

One final point: deliver excellent work and request reviews. Online reviews are your most valuable marketing asset.

Step 7: Maintain Financial Discipline (Avoid Tax Issues)

Open a dedicated business bank account. Never mix business and personal finances.

Track all transactions. Use QuickBooks, Wave, or spreadsheets. Consistent tracking is essential.

Save for taxes: Set aside 25-30% of profit. The IRS requires their portion. Be prepared.

Purchase business insurance: General liability minimum. Annual cost: $300-$1,000. One lawsuit without coverage can destroy your business.

Consider hiring a bookkeeper or accountant once you're generating consistent revenue. They cost less than resolving tax problems.

Step 8: Scale Strategically (Avoid Premature Growth)

Acquiring customers is one challenge. Retention and growth is another.

Common growth mistakes:

- Premature hiring: Employees are expensive. Can you outsource or automate first?

- Unnecessary office space: Most customers don't care about your location. Work from home as long as practical.

- Chasing every opportunity: Focus on what's working. Do more of that before diversifying.

- Ignoring cash flow: Paper profit means nothing if you can't pay bills. Monitor cash constantly.

Growth should increase profit, not just revenue. Don't grow for status. Grow because it makes financial sense.

The best growth strategy: Deliver such excellent work that customers become advocates. Everything else is secondary.

Why Practical Businesses Succeed

Shaquille O'Neal is worth $400 million. His investment focus? Car washes.

Not cryptocurrency. Not tech startups. Car washes, laundromats, storage facilities, and other practical businesses that generate consistent returns while others chase trends.

The most successful businesses are rarely conversation topics. They're simple. They solve real problems. They generate revenue reliably.

Examples of practical, profitable businesses:

- Pressure washing (low startup cost, recurring customers)

- Window cleaning (similar economics)

- HVAC maintenance (constant demand)

- Junk removal (universal need)

- Lawn care (ongoing service)

- Storage facilities (passive income potential)

- Vending machines (location-dependent but potentially profitable)

None are exciting. All generate revenue. Most have low overhead. Some offer automation potential.

Stop seeking disruptive innovation. Identify services people need regularly that they prefer to outsource.

Stop Reading, Start Executing

You have the information you need. Identify a genuine need. Maintain low costs. Secure your first customer before investing in extras. Complete legal requirements. Track finances. Deliver quality work.

That's the framework.

Most fail because they never start. They research indefinitely. They wait for the perfect idea. They convince themselves they're unprepared. You won't feel completely ready. Start anyway. The market doesn't need another revolutionary app or platform. It needs professionals who show up, deliver quality work, and charge fairly. That can be you. Stop waiting for permission. No one's granting it.

If you want help turning that framework into real action, we’ve got a few ways to get started. You can visit our Unsexy Businessmen Blueprint, a step-by-step walkthrough on building and scaling practical service businesses from scratch. Or, grab our Business Pro Starter Pack, which gives you all of the legal forms and papers you’ll need.

And if you’re serious about launching soon, we can even set up a consultation to map out your first offer and go-to-market plan together. Whatever path you pick, the goal’s the same: stop overthinking and start building.