How to Start an LLC in Wisconsin

Mar 05, 2025

Looking to start your business and make it official with an LLC? Starting an LLC in Wisconsin is a great place to start. They've got online filing fees of just $130 ($170 by mail) and processing times as quick as one business day. While other states pile on extra fees and requirements, Wisconsin keeps it simple with reasonable annual report costs ($25) and no separate state business license requirement.

Even better, qualifying student entrepreneurs can file for free! We'll walk you through the exact steps to form your Wisconsin LLC without unnecessary complications or excessive costs.

Establishing a Wisconsin LLC

Starting an LLC in Wisconsin comes with several practical advantages. Let’s take a look at a few:

- Cost-Effective Setup: Basic filing fee is just $130 for online applications ($170 by mail), with no separate state business license requirement. Save money by filing online and serving as your own registered agent.

- Quick Processing: Online filings typically process within one business day, while mail applications take about five days. Want it faster? Expedited service is available for an extra $25.

- Student Benefits: Currently enrolled college students can form an LLC for free by filing Form 502SE by mail—a unique perk that can save you the entire filing fee.

- Simple Maintenance: Annual reports cost just $25 and are due at the end of your quarter anniversary. No complicated franchise taxes or hidden fees to worry about.

- Essential Requirements: You'll need a unique business name, registered agent with a Wisconsin address, and Articles of Organization. Most entrepreneurs can complete these steps without hiring expensive services.

A Complete Guide to Starting Your Wisconsin LLC

Let's walk through the exact steps to form your LLC in Wisconsin without wasting time or money.

Step 1: Choose Your LLC Name

Your LLC name must include "Limited Liability Company," "LLC," or "L.L.C." Before getting attached to a name, check if it's available using the Wisconsin Department of Financial Institutions (DFI).

Here's a money-saving tip: skip the $15 name reservation fee if you plan to file your LLC formation documents within a few days, since filing your Articles of Organization automatically secures your name.

Step 2: Select Your Registered Agent

Save $100-200 annually by being your own registered agent. In Wisconsin, your registered agent must have a physical street address in the state (no P.O. boxes) and be available during regular business hours. While professional registered agent services charge $100-300 per year, they're only worth considering if you:

- Travel frequently and can't reliably receive mail

- Want to keep your personal address private

- Need someone always available during business hours

Step 3: File Your Articles of Organization

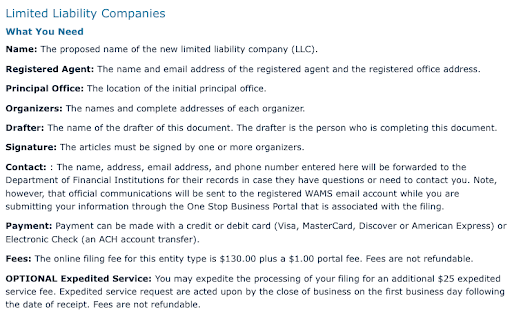

Here's where the real work begins. Register your LLC, and file your Articles of Organization through the Wisconsin Department of Financial Institutions. File online to save $40 and get faster processing. You'll need to provide:

- Your LLC's name

- Principal office address

- Registered agent information

- Whether the LLC is member or manager-managed

- Names and addresses of organizers

To start filing, click the “Domestic Limited Liability Company” link.

Select “Click Here to Start Filing.”

Fill out your business name including LLC and click “Next.”

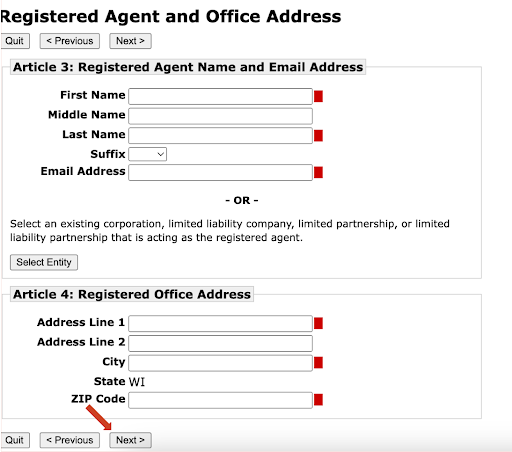

Fill out the registered agent information, remember, you can use yourself.

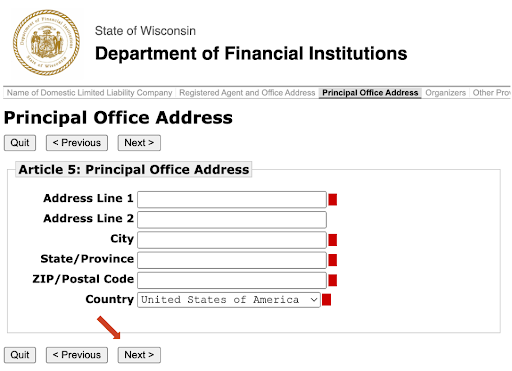

You’ll then fill out your principal office address, and click “Next.”

The rest is easy! Fill out the personal information, review, submit, and wait for approval.

Handle Essential Post-Filing Requirements

Once your LLC is approved, complete these crucial tasks to keep your business compliant and protected:

Get Your Tax Documents in Order

- Apply for an EIN (free through the IRS website)

- Register for Wisconsin tax requirements

- Set up a business bank account to separate personal and business finances

Protect Your Business

- Create an operating agreement (not required by law but crucial for protection)

- Consider basic business insurance options

- Visit the Wisconsin Business Portal for details on tax and licensing requirements.

Keep Your LLC Compliant

- File annual reports ($25 fee) by your quarter anniversary

- Maintain current registered agent information

- Track any local permit renewal deadlines

Smart Money-Saving Strategies

Wisconsin makes it relatively affordable to maintain your LLC, but here are some additional ways to keep costs low:

- File online to save $40 on formation fees

- Serve as your own registered agent to save $100-200 annually

- If you're a student, file Form 502SE by mail for free LLC formation

- Handle annual report filings yourself instead of paying a service

Launch Your Wisconsin LLC

Starting your Wisconsin LLC is a simple process that puts you in control of your business from day one. With clear filing requirements, affordable fees, and ongoing compliance that won’t bog you down, Wisconsin makes it easy to establish and grow your company. The total cost to form your LLC will be between $130-170, plus any optional services you choose.

Ready to become an entrepreneur? Head to Wisconsin's Department of Financial Institutions website and start your online filing – you could have your LLC up and running in just one business day.