How to Start an LLC in Washington

Mar 04, 2025

Washington offers a business-friendly environment, making it easier than ever to turn your ideas into a thriving company. With online filing fees of just $180 and processing times as quick as two business days, you can launch your business faster and cheaper than you might think. Plus, with no state income tax and a streamlined formation process, Washington ranks as one of the most business-friendly states in the country.

Don't let unnecessary expenses or complicated paperwork hold you back. Whether you're launching a tech startup in Seattle or opening a shop in Spokane, we'll show you exactly how to form your LLC in Washington without wasting time or money on things you don't need.

Starting Your Washington LLC

Starting an LLC in Washington comes with several advantages that make it an attractive option for new business owners. Here's what you need to know:

- Cost-Effective Formation: Basic filing fees are just $180 by mail or $200 online, with no separate state business license requirement. Save money by filing online and serving as your own registered agent.

- Quick Processing Times: Online applications typically process in 2 business days, while mail applications take up to 6 weeks. Save $100-300 annually by being your own registered agent if you have a Washington address.

- Simple Requirements: You'll need a unique business name, registered agent with a physical Washington address, and Certificate of Formation. The B&O tax registration (1.5% rate) is required before conducting business.

- Annual Obligations: File annual reports ($60 fee) and maintain B&O tax compliance. No complex franchise taxes or hidden fees to worry about.

- Straightforward Maintenance: Washington's requirements are clear – maintain a registered agent, file annual reports on time, and keep up with B&O tax payments. No complicated ongoing paperwork or unexpected costs.

A Complete Guide to Starting Your Washington LLC

Let's walk through the essential steps to form your LLC without unnecessary complications or costs.

Step 1: Choose Your LLC Name

Your LLC name needs to follow specific rules to be accepted. The name must include "Limited Liability Company," "LLC," or "L.L.C." Before getting attached to a name, search the Washington Secretary of State’s Corporation Search to ensure it's available.

Here's a money-saving tip: skip the $30 name reservation fee if you plan to file your LLC formation documents within a few days – filing your Certificate of Formation automatically secures your name.

Step 2: Choose Your Registered Agent

Save $100-300 annually by being your own registered agent. You can serve as your own agent if you:

- Live in Washington with a physical street address

- Can be available during business hours

- Don't mind your address being public record

Step 3: File Your Certificate of Formation

This is where the real work begins. File your Certificate of Formation online at the Washington Secretary of State. Online filing: $200 (2-day processing), Mail filing: $180 (up to 6 weeks)

Required information includes:

- LLC name and address

- Registered agent details

- Management structure

- Duration of LLC

Pro tip: File online for faster processing and to reduce the chance of errors that could delay your application.

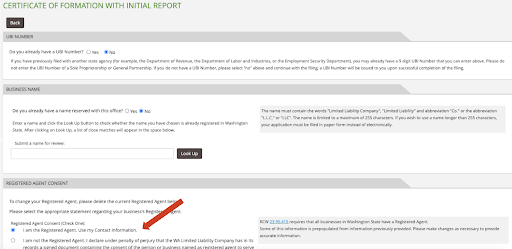

To file online, create an account through the Washington Filing Website.

On the main page, select the “Domestic Limited Liability Company” drop down bar, then click “Yes” to filing your Certificate of Formation online

Create your account or log in.

Once you’re logged in click “Create” or “Register a Business” on the side panel.

Next, fill out all of the basic information about your business. Remember, you can make yourself the registered agent.

Finish filing and go to payment. Review, submit, and wait for approval.

Handle Post-Formation Requirements

Once your LLC is approved, complete these essential tasks to keep your business compliant and protected:

Get Your Tax Documents in Order

- Apply for an EIN (free through the IRS website)

- Register for Business & Occupation (B&O) tax (1.5% rate)

- Set up B&O tax payments through the Department of Revenue

Protect Your Business

- Open a separate business bank account

- Create an operating agreement (not required but crucial for protection)

- Consider business insurance options

- Check local licensing requirements

Keep Your LLC Compliant

- File annual reports ($60 fee), due yearly on the LLC’s anniversary date.

- Maintain current registered agent information

- Keep B&O tax payments up to date

- Track any local permit renewal deadlines

Running Your Washington LLC

- File your annual report on time to avoid penalties

- Keep accurate financial records for B&O tax purposes

- Maintain separation between personal and business finances

- Visit the Washington State Business Licensing Service for tax registration and additional licenses.

Launch Your Washington LLC

Starting your Wyoming LLC is a great strategic move, Wyoming makes it easy to launch and maintain your LLC. Now that you know the steps, it's time to take action—get your business officially registered and start building your future with confidence.The total cost to form your LLC will be between $180-200, plus any optional services you choose.

Ready to make it official? Head to the Secretary of State's website and start your online filing – you could have your LLC up and running in as little as two business days.