How to Start an LLC in Virginia

Mar 04, 2025

Want to start a business in Virginia without worrying about draining your savings? Forming a Virginia LLC is refreshingly affordable, with a $100 filing fee that drops to $95 if you file online. Unlike many states, Virginia doesn't require an annual report, and you'll only pay a $50 annual registration fee—making it one of the most cost-effective states for maintaining an LLC.

But saving money shouldn't mean cutting corners. Whether you're launching a consulting firm in Richmond, opening a retail shop in Norfolk, or starting a tech company in Northern Virginia, we'll walk you through the exact steps to form your LLC properly without unnecessary expenses or hassle.

Let's get your business up and running the smart way.

Starting an LLC in Virginia

Before getting ahead of ourselves, here's what makes Virginia one of the most business-friendly states for LLC formation:

- Simple Filing Process: Virginia's State Corporation Commission makes LLC formation straightforward, with a $95 filing fee for online submissions ($100 by mail). Most applications are processed within 5-10 business days, with no extra expedited fees needed for standard processing.

- Minimal Ongoing Requirements: Unlike other states, Virginia doesn't require annual reports. You'll only need to pay a $50 annual registration fee, saving you time and money on paperwork and compliance costs.

- Smart Cost-Saving Options: You can serve as your own registered agent instead of paying $100-300 annually for a service, and you can skip the $10 name reservation fee by filing your LLC paperwork directly if your name is available.

- Basic Compliance Structure: Virginia keeps things simple—file your formation documents, maintain a registered agent, pay your annual fee, and handle any industry-specific permits. No complex franchise taxes or hidden fees to worry about.

Step-by-Step Process to Form Your Virginia LLC

Follow this step-by-step guide to navigate the process smoothly and get your business up and running in no time.

Step 1: Choose Your Business Name

Virginia's name requirements are straightforward. Your name must include "Limited Liability Company," "LLC," or "L.L.C." Before spending money on branding, check if your name is available through Virginia's Business Entity Search.

Skip the $10 name reservation fee if you're ready to file your LLC paperwork—filing your Articles of Organization automatically secures your name.

Step 2: Choose Your Registered Agent

Here's a money-saving tip: be your own registered agent. While professional services charge $100-300 annually, you can handle this role yourself if you:

- Live in Virginia with a physical street address

- Can be available during business hours

- Don't mind your address being public record

If you travel frequently or want privacy, a professional service might be worth the investment. But for most small business owners, being your own registered agent is a smart way to reduce costs.

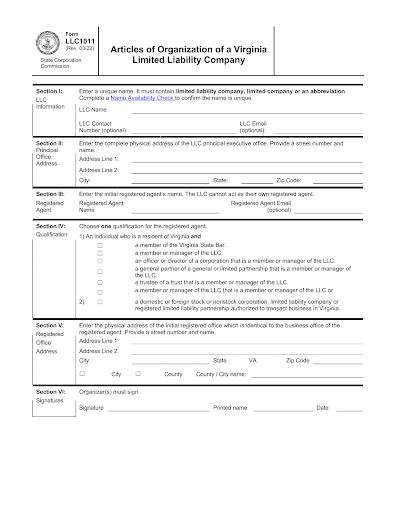

Step 3: File Your Articles of Organization

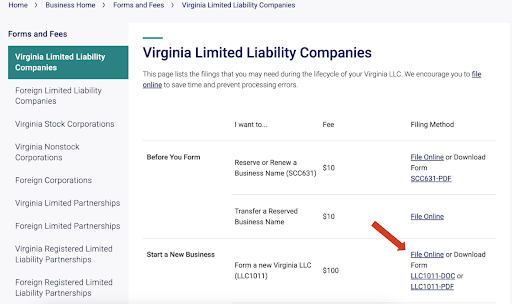

File your Articles of Organization online through Virginia's SCC Limited Liability Companies page for $95 (instead of $100 by mail) and faster processing. You'll need:

- Your LLC's name

- Principal office address

- Registered agent information

- Whether the LLC is member or manager-managed

Once you’re on the LLC page, make an account. After that is done, return to the LLC page, and click “File Online” in the “Start a New Business” section.

You’ll be brought to this page, fill out your business name and click “Search."

Once you are logged in, it will guide you to filing your Articles of Organization.

Fill out required information, submit, and wait for approval.

Handle Essential Post-Filing Tasks

Once your LLC is approved, complete these key steps without overspending:

Tax Requirements:

- Get your free EIN from the IRS website

- Register for Virginia state tax accounts

- Set up online tax payment systems

- Note: Virginia's standard sales tax rate is 5.3% if you'll be selling goods

Protect Your Business:

- Open a separate business bank account (many banks offer free business checking)

- Create an operating agreement (not required by law but crucial for protection)

- Visit the Virginia Business One Stop for specific licensing and tax requirements.

Stay Compliant:

- Mark your calendar for the $50 annual registration fee

- Keep registered agent information current

- Track any local permit renewal deadlines

Launch Your Virginia LLC the Smart Way

Getting your Virginia LLC up and running doesn't have to be complicated or expensive. With a total formation cost of just $95-100, plus an annual $50 registration fee, Virginia makes it affordable to start and maintain your LLC. Skip unnecessary services, file online for faster processing, and focus your resources on growing your business rather than paying excessive fees.

Ready to make it official? Head to the Virginia's State Corporation Commission website and start your online filing—you could have your LLC up and running in less than two weeks.