How to Start an LLC in Vermont

Mar 03, 2025

Starting an LLC in Vermont is a smart move for entrepreneurs looking for a business-friendly environment with straightforward filing requirements. The Green Mountain State makes it simple to form an LLC, with online processing in just one business day and a reasonable $125 filing fee. While other states might charge upwards of $500 or make you wait weeks for approval, Vermont keeps things practical.

It won’t matter if you're launching a maple syrup operation, starting a tech company in Burlington, or opening a ski lodge in Stowe, we'll walk you through the exact steps to form your LLC without unnecessary complications or excessive costs.

No fancy consulting fees or complex legalities – just straightforward guidance to get your business up and running in Vermont.

Starting Your Vermont LLC

Before getting started, here's what you should know about forming an LLC in Vermont:

- Fast Processing Time: Get your LLC approved in just one business day with online filing – no need to wait weeks like in other states.

- Budget-Friendly Setup: Basic filing fee is $125 ($20 extra for name reservation if needed). Save money by being your own registered agent instead of paying $100-300 annually for a service.

- Simple Annual Requirements: Just one annual report due within three months after your fiscal year ends, with a modest $35 filing fee.

- DIY-Friendly State: Vermont's straightforward process means you can handle most formation steps yourself, saving on lawyer and service fees.

- Online Everything: From name searches to annual reports, Vermont's online system makes compliance easy and efficient.

- Flexible Management: Choose between member-managed or manager-managed structure with no extra paperwork or fees.

Steps to Form Your Vermont LLC

Ready to make your business official? Here's exactly how to form your LLC in Vermont without overpaying or getting lost in red tape.

1. Choose Your LLC Name

Before anything else, pick a name that follows Vermont's rules and stands out to customers. Your name must end with "Limited Liability Company," "LLC," or "L.L.C." Search Vermont's Business Entity Search to make sure your name is available.

If you're not ready to file yet but love your name, reserve it for 120 days by paying $20 – but skip this fee if you're filing your LLC paperwork within a few days.

2. Select a Registered Agent

Here's an easy way to save $200+ annually: be your own registered agent. While registered agent services charge $100-300 per year, serving as your own agent is free if you:

- Live in Vermont with a physical address

- Can be available during business hours

- Don't mind your address being public record

3. File Your Articles of Organization

The real work begins with filing your Articles of Organization with Vermont's Secretary of State. File online to save time and $5 – the fee is $125 by mail or $120 online. Processing takes just one business day online versus 7-10 days by mail. Include basic information like:

- Your LLC's name

- Principal office address

- Registered agent information

- Management structure

- Member/manager details

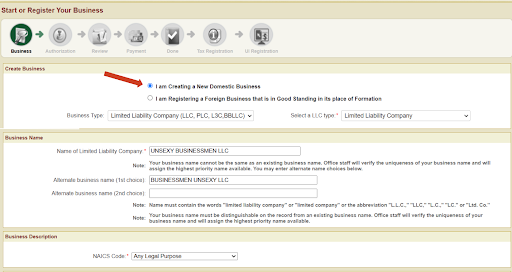

To start on the filing process. Visit Vermont VTBIZ Filings, and create an account.

Fill out the name of your business and make sure to put it as an LLC. Add your address on this page as well.

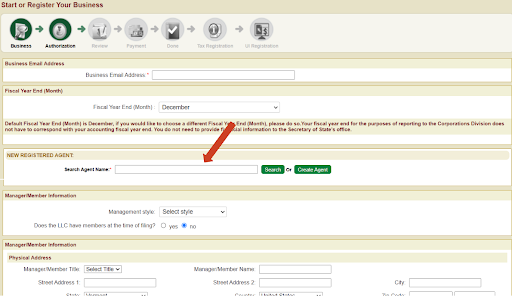

Create and add yourself as the registered agent (optional but highly recommended).

Fill out all the other information about your business.

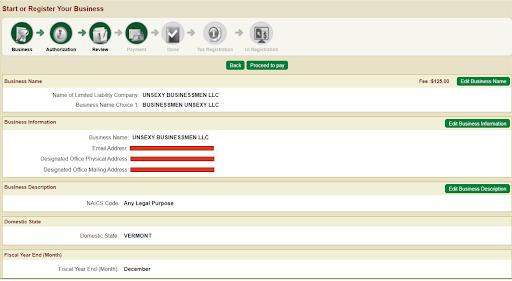

Pay, submit your filing, and wait 1-3 business days to get approved.

Handle Post-Formation Requirements

Once your LLC is approved, complete these essential tasks to keep your business compliant and protected:

Get Your Tax Documents in Order

- Apply for an EIN (free through the IRS website)

- Register for Vermont state taxes if applicable

- Set up business tax payments through Vermont's online portal

Open a Business Bank Account

- Keep personal and business finances separate

- Use your EIN and Articles of Organization to open the account

- Shop around local Vermont banks for free business checking options

Create an Operating Agreement

Vermont doesn't require an operating agreement, but skipping this step is like driving without insurance. This document:

- Outlines ownership percentages and voting rights

- Details how profits and losses are shared

- Protects your personal assets

- Prevents future disputes between members

Stay Compliant in Vermont

- File your annual report ($35) within three months after your fiscal year ends

- Keep your registered agent information current

- Maintain required licenses and permits

- Track tax payment deadlines

- Visit the Vermont Department of Taxes or the Business Portal for licensing and tax requirements.

Time to Launch Your Vermont LLC

With Vermont’s simple filing process and the option to submit everything online, you can quickly establish your business while keeping costs low. Just follow these steps to get your LLC up and running without unnecessary stress or expenses.The total cost to form your LLC will be between $120-125, plus any optional services you choose.

Ready to get the ball rolling? Head to Vermont’s VTBIZ Filings and start your online filing – you could have your LLC up and running by tomorrow.