How to Start an LLC in Utah

Mar 03, 2025

Dreaming of starting a business in Utah but worried about complex paperwork and high costs? Here's some good news: Utah makes LLC formation straightforward and affordable. At just $59 ($54 online), Utah's filing fee is among the lowest in the Mountain West, and you can have your LLC up and running in as little as 2 days with online filing.

Whether you're launching a tech startup in Salt Lake City or opening a ski shop in Park City, we'll show you exactly how to form your Utah LLC without the usual hassle and expense.

No fancy consulting firms needed – just follow our practical, no-nonsense guide to get your business started right.

Forming an LLC in Utah

Before we get into the details, here's a few things you should know about forming an LLC in Utah:

- Cost-Effective Setup: Basic filing fee is just $54 for online applications ($59 by mail). Save money by being your own registered agent and filing online.

- Quick Processing: Online applications typically process in 2 business days, while mail applications take 3-7 days. No need to pay extra for expedited service if you file online.

- Essential Requirements: You'll need a unique business name, registered agent with a Utah address, and Certificate of Organization. Most entrepreneurs can handle this without expensive legal help.

- Annual Obligations: File your annual report ($20 fee) to stay compliant. No separate state business license required for most businesses.

- Simple Maintenance: Keep a registered agent, file annual reports on time, and maintain proper records. No complex franchise taxes or hidden fees to worry about.

The Basic Steps to Starting Your Utah LLC

Before starting the process, the first thing you need to do is Create a Utah ID Account.

Remember, you don't need to pay for expensive formation services – these steps are straightforward enough for most entrepreneurs to handle themselves.

Step 1: Name Your Utah LLC

Forming an LLC in Utah is surprisingly simple. The Utah Division of Corporations handles all LLC registrations, and you can complete the entire process online in just a few steps:

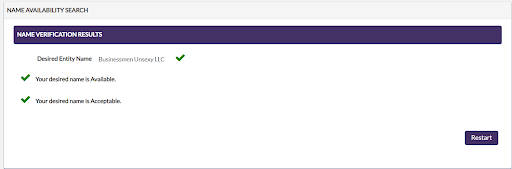

To Select Your LLC Name ($0), use Utah Business Entity Search to ensure your chosen name is available.

Your LLC name sets the foundation for your business. Utah has specific naming rules you'll need to follow:

- Must be unique from other Utah businesses

- Must include "LLC," "L.L.C.," or "Limited Liability Company"

- Can't imply government affiliation or use restricted words like "bank" or "insurance"

Once you are logged into your account, view the “How to File a Formation/Registration tab , click the “Click Here” link, and the business search is right there.

Pro tip: Don't waste $22 on name reservation unless you're months away from filing. Your name is automatically secured when you file your Certificate of Organization.

Step 2: Select Your Registered Agent

While choosing a Registered Agent ($0-$300), save money by being your own registered agent if you have a Utah street address. If privacy or convenience is a concern, professional services run $100-300 annually.

To be your own registered agent, consider these requirements:

- Must have a physical Utah street address (no P.O. boxes)

- Must be available during business hours

- Address becomes public record

Once you have your name picked out, return to the Entity Search and log in with the UTAH ID you created. Click “Domestic Formations” on the side panel. Choose “Domestic LLC” for your business entity type.

You are forming your entity as a “Limited Liability Company.” Once the name availability is verified, you’ll then officially file your business name.

Fill out your purpose statement, and move on to the next section.

Step 3: Certificate of Organization

The next step is to file Your Certificate of Organization ($54 online), and submit this document through the business portal. Include your LLC name, registered agent information, and principal office address. Online filing typically processes within 2 business days.

Step 4: Complete Your Post-Filing Tasks

After your LLC is approved, tackle these essential steps:

- Get your EIN (free through IRS website)

- Open a business bank account (varies by bank, many offer free business checking)

- Create an operating agreement (not required but highly recommended)

- Register for Utah taxes through the Utah State Tax Commission.

- Visit the Utah Department of Commerce to check for licenses or permits.

Smart move: Most banks offer free business checking accounts to new businesses. Shop around and avoid monthly maintenance fees.

Launch Your Utah LLC Today

Don't let complicated legalities or overpriced services stop you from starting your business. Utah's straightforward LLC formation process makes it possible to get your business up and running for less than $60. Skip the fancy consulting firms and expensive formation services – you've got all the information you need to handle this yourself.

Ready to start something of your own? Head to Utah.gov's business portal and start your LLC formation today.

If you need more detailed guides on growing your business or maximizing profits, check out our other resources at Unsexy Businessmen.