How to Start an LLC in Texas

Mar 02, 2025

Want to launch your business dreams in the Lone Star State? Starting an LLC in Texas is straightforward and won't drain your startup budget. While other states might charge hefty fees or create endless paperwork hurdles, Texas keeps things relatively simple with a reasonable $300 filing fee and streamlined online process. There’s a reason over 3.1 million small businesses call this state home.

Plus, you don't even need a general business license to get started. We'll walk you through the exact steps to form your Texas LLC Let's cut through the red tape and get your business up and running.

Starting Your Texas LLC: Key Points to Know

Here's why forming an LLC in Texas is a smart choice for your business:

- Cost-Effective Setup: Basic filing fee is just $300 ($310 online), with no separate state business license required. Save money by filing online and serving as your own registered agent.

- Quick Processing: Online applications typically process in 2-3 business days, while mail applications take 5-7 business days. Get your business running faster with online filing.

- Essential Requirements: You'll need a unique business name, registered agent with a Texas address, and Certificate of Formation. Plus, Texas doesn't require you to file an operating agreement (though we recommend having one).

- Annual Obligations: File franchise tax reports only if revenue exceeds $2.47 million (most small businesses are exempt). No complicated franchise taxes or costly annual fees for most startups.

- Simple Maintenance: Texas keeps it straightforward – maintain a registered agent, file your annual franchise tax report, and keep good records. No complex ongoing paperwork or hidden fees.

How to Start Your Texas LLC

Let's walk through the exact steps to form your LLC in Texas without wasting time or money. Here's what you need to do:

Step 1: Choose Your LLC Name

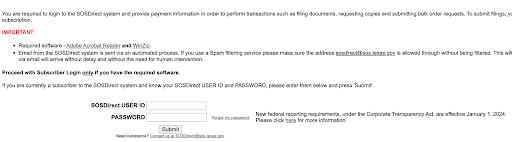

Before you start with anything, create an account with Texas Secretary of State's SOSDirect system.

Pick a name that's unique and follows Texas naming rules. Your business name must include "Limited Liability Company," "LLC," or "L.L.C." Run a quick search on the Texas Secretary of State's website to check availability, It costs $1 to search your business name.

Step 2: Choosing Your Registered Agent

Texas makes LLC formation straightforward, but you need to know a few key requirements. Save $100-200 annually by being your own registered agent instead of hiring a service – just make sure you're comfortable with your address being public record.

To be your own registered agent, you must:

- Be at least 18 years of age

- Have a physical Texas address (no P.O. boxes)

- Be available during business hours

Step 3: File Your Certificate of Formation

File the Certificate of Formation online through the Texas Secretary of State's SOSDirect system for $310 (or $300 by mail). Online filing gets you faster processing and fewer rejections.

You'll need:

- Your LLC's name

- Registered agent information

- Management structure (member or manager-managed)

- Business address

- Organizer information

Create an account with SOSDirect.

Download “Adobe Acrobat Reader” to fill out the Certificate of Formation.

You’ll also need to download Winzip.

Once you’ve logged in, use Adobe Acrobat to edit the Certificate of formation, download it as a PDF.

Review, submit, and wait for approval.

Post-Filing Requirements

Grab your free EIN from the IRS website, open a business bank account, and consider creating an operating agreement. While Texas doesn't require an operating agreement, having one prevents headaches later and helps establish your LLC's legitimacy with banks and vendors.

Essential Texas LLC Requirements

For your Certificate of Formation, you'll need to specify whether your LLC is member-managed (owners run the business) or manager-managed (hired managers handle operations). Choose member-managed if you plan to run the business yourself – it's simpler and saves money on management fees.

Money-Saving Tips

Skip the unnecessary expenses that many "business formation experts" try to sell you:

Serve as your own registered agent instead of paying for a service

- File your Certificate of Formation online to save $10 and get faster processing

- Create your own operating agreement using free templates

- Get your EIN directly from the IRS instead of paying a third party

- Open a business bank account at a local Texas bank that offers free business checking

- Visit the Texas Business Permits Office to determine licensing needs.

Remember to keep your business compliant by marking May 15th on your calendar – that's when your franchise tax report is due.

Launch Your Texas LLC Today

Don't let overpriced formation services or complicated paperwork stop you from starting your business. Texas makes LLC formation accessible with reasonable fees and straightforward requirements. File your Certificate of Formation online, serve as your own registered agent, and you could have your LLC up and running in just a few days for around $300.

Ready to make it official? Head to the Texas Secretary of State's SOSDirect system and start your online filing. Your unsexy but profitable Texas business awaits.