How to Start an LLC in Pennsylvania

Feb 28, 2025

Starting a business doesn’t have to be expensive or complicated. Pennsylvania makes LLC formation both affordable and straightforward, with a $125 filing fee and some of the lowest ongoing costs in the country—just $7 annually to keep your business in good standing. While many states burden business owners with expensive renewals and complex regulations, Pennsylvania keeps their entrepreneurs in mind.

We'll walk you through the exact steps to form your LLC, skip the fancy business coaches and overpriced formation services – here's how to get it done right.

Starting Your Pennsylvania LLC

Starting an LLC in Pennsylvania comes with several practical advantages. Here's what you need to know:

- Cost-Effective Setup: Basic filing fee is $125, and veterans get this fee waived completely. There's no separate state business license requirement, saving you hundreds in additional fees. Save money by serving as your own registered office instead of hiring a service.

- Simple Maintenance: Annual report fees are just $7 – among the lowest in the nation. No complicated franchise taxes or hidden state fees to worry about. Just file your report by September 30th each year to stay compliant.

- Quick Processing: Standard processing takes about 15 business days when you file online through the PENN File system. Mail filings typically take 5-7 days longer, so stick with online filing to save time and $5 on the fee.

- Essential Requirements: You'll need a unique business name, registered office with a physical Pennsylvania address, and Certificate of Organization. No unnecessary paperwork or complex requirements – just the basics to get your business up and running.

- Straightforward Protection: Pennsylvania LLCs provide strong liability protection without the complex requirements of a corporation. Keep your personal assets separate by following basic guidelines like maintaining a separate business bank account and filing annual reports on time.

Ho to Start Your Pennsylvania LLC

Step 1: Choose Your LLC Name

Your business name isn't just about creativity – Pennsylvania has specific rules you need to follow. Include "Limited Liability Company," "LLC," or "L.L.C." in your name (most businesses use "LLC" to keep it simple). Before getting attached to a name, check if it's available using Pennsylvania's Business Entity Search.

Save yourself the $70 name reservation fee by skipping it if you plan to file your LLC formation documents within a few days – filing your Certificate of Organization automatically secures your name.

Step 2: Set Up Your Registered Office

Here's an easy way to save $200-300 annually: serve as your own registered office. Pennsylvania requires a registered office (not a registered agent) with a physical street address in the state.

You can be your own registered office if you:

- Live in Pennsylvania with a physical address (no P.O. boxes)

- Can receive legal documents during business hours

- Don't mind your address being public record

Step 3: File Your Certificate of Organization

Now for the main event – filing your Certificate of Organization with the Department of State. This costs $125 ($0 for veterans) and can be done entirely online through PA Business One-Stop Hub. You'll need:

- Your LLC name

- Registered office address

- Organizer information

- Simple docketing statement with basic business details

Pro tip: File online for 15-day processing instead of the 20+ days for mail applications. The online system also checks for errors as you go, reducing the chance of rejection and delays.

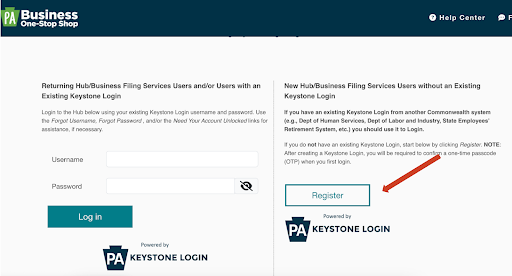

The first step to filing online is to click “Register” and “Make an Account.”

Once you are logged into your account, click “Register a Business.”

Pennsylvania has made a video to guide you through the process.

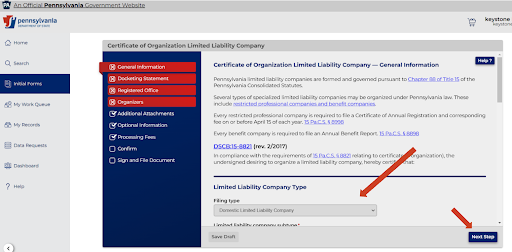

Scroll to the bottom and get straight into the paperwork. Click “Limited Liability Company (LLC)” and start the process.

Fill out all of your business information.

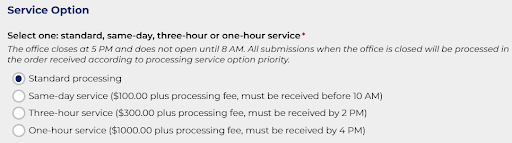

Choose a processing option, this will add on top of the $125 filing fee.

Sign, submit, and wait until it is approved!

Handle These Essential Post-Filing Tasks

Once your LLC is approved, complete these crucial steps to keep your business protected and compliant:

Get Your Tax Documents in Order

- Apply for an EIN (free through IRS website)

- Register for state tax accounts through PA-100 form

- Set up sales tax if you're selling taxable items

- Consider hiring an accountant to handle ongoing taxes

Protect Your Business

- Open a separate business bank account (prevents personal liability issues)

- Create an operating agreement (banks require this; we have a free template)

- Consider general liability insurance if working with customers

- Visit PA Business One-Stop Hub to research licensing requirements specific to your business type.

Keep Your LLC Compliant

- File annual reports ($7 fee) by September 30th

- Maintain accurate registered office information

- Stay current on state tax obligations

- Track any local permit renewal deadlines

Time to Get Started

The total cost to form your LLC will be between $125-195, plus any optional services you choose.

Ready to launch your LLC? Head to PA Business One-Stop Hub and start your online filing – you could have your LLC up and running in just over two weeks.