How to Start an LLC in Oregon

Feb 27, 2025

Want to turn your business dreams into reality without worrying about the financials? Oregon’s a great choice! While other states charge hundreds for LLC formation, Oregon keeps it simple with a reasonable $100 filing fee and quick online processing.

If you're looking to launch a food cart in Portland, start a consulting firm in Eugene, or open a retail shop in Salem, we'll walk you through the exact steps you need to know to form your LLC.

Don't let complicated paperwork intimidate you – Oregon makes business formation accessible and efficient. File online and you could have your LLC up and running in just 1-2 business days. Let's break down exactly what you need to know to get started.

Launching an Oregon LLC

Starting an LLC in Oregon comes with plenty of perks. Here's what you need to know:

- Cost-Effective Setup: Basic filing fee is just $100, with no separate state business license requirement. Save time and money by filing online and serving as your own registered agent.

- Quick Processing: Online applications typically process in 1-2 business days, while mail applications take up to 2 weeks. Get your business up and running faster by choosing the online route.

- Essential Requirements: You'll need a unique business name, registered agent with a physical Oregon address, and Articles of Organization. No complex paperwork or hidden requirements.

- Annual Obligations: File annual reports by your LLC's anniversary date ($100 fee) and maintain state tax compliance. Oregon's pass-through taxation means no separate corporate taxes for most LLCs.

- Simple Maintenance: Oregon's requirements are straightforward – maintain a registered agent, file annual reports on time, and stay compliant with state laws. No complicated ongoing paperwork or excessive fees.

Steps to Start Your New LLC in Oregon

Let's walk through the exact steps to get your Oregon LLC up and running without unnecessary complications or wasted money.

Step 1: Choose Your LLC Name

Your business name must include "Limited Liability Company," "LLC," or "L.L.C." (Most choose "LLC" to keep it simple). Before falling in love with a name, check if it's available using Oregon Business Name Search – your name must be distinguishable from other registered businesses.

Pro tip: Skip the $100 name reservation fee if you plan to file your LLC paperwork within a few days. Filing your Articles of Organization automatically secures your name, saving you money for more important business needs.

Step 2: Pick Your Registered Agent

Here's an easy way to save $200-300 annually: serve as your own registered agent. You can be your own agent if you:

- Live in Oregon with a physical street address

- Can be available during business hours

- Are at least 18 years old

- Don't mind your address being public record

While professional registered agent services charge $200-300 per year, they offer privacy and ensure you never miss important legal documents. But for most small business owners, being your own registered agent is a smart way to reduce costs.

Step 3: File Your Articles of Organization

Here's where your LLC becomes official. Filing costs $100 and can be done online or by mail. Save yourself time and get faster processing by filing your Articles of Organization online through the Oregon Secretary of State's website.

You'll need to provide:

- Your LLC's name

- Principal office address

- Registered agent information

- Whether the LLC is member or manager-managed

- Names and addresses of managers (if manager-managed)

- Duration of the LLC (usually "perpetual")

Pro tip: File online for 1-2 day processing instead of the two weeks for mail applications. The online system also checks for errors as you go, reducing the chance of rejection and delays.

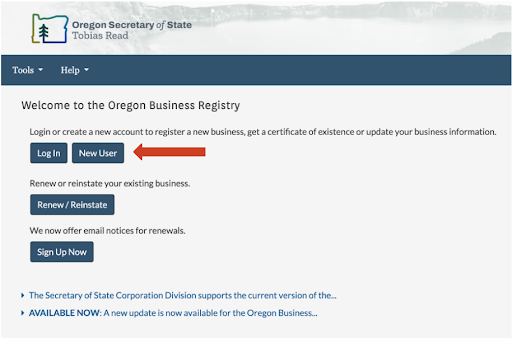

To file online, visit the Oregon Secretary of State. Click “Register a Business Online”

Make an account and click “New User.”

Click “Start.”

Register your name, then in the drop down, click “Domestic LLC.”

This is where the real paper work starts. Once your name is verified, fill out the address, and business information. Here's a list of all the required info.

Submit, pay the fee, and wait until it is approved. You should hear back within 1-2 business days.

Handle Post-Filing Requirements

Once your LLC is approved, complete these essential tasks to keep your business compliant and protected:

Get Your Tax Documents in Order

- Apply for an EIN (free through the IRS website)

- Set up pass-through taxation (default for most LLCs)

- Register for any required local taxes

- Personal income tax rates range from 4.75% to 9.9%

Protect Your Business

- Open a separate business bank account

- Create an operating agreement (not required by law but crucial for protection)

- Consider business insurance options

- Visit Business Xpress to determine specific licensing requirements.

Keep Your LLC Compliant

- File annual reports ($100 fee) by your anniversary date

- Maintain current registered agent information

- Track any local permit renewal deadlines

Launch Your Oregon LLC Today

You're all set to make your Oregon LLC official! Take The next step today and turn your business idea into reality—your Oregon LLC is just a few clicks away. The total cost to form your LLC will be just $100, plus any optional services you choose.

Ready to get started? Head to the Oregon Secretary of State's website and start your online filing – you could have your LLC up and running in just a couple of days.