How to Start an LLC in Oklahoma

Feb 27, 2025

Starting an LLC in Oklahoma is fast, affordable, and hassle-free. With a filing fee of just $100 and online applications processed in as little as 1-2 business days, you can get your business up and running in no time. No long waits, no excessive costs—just a straightforward path to legal protection and financial flexibility. If you're ready to make your business official, Oklahoma makes it easy.

Looking to you're launch a local retail shop, start a consulting business, or open a service company? No worries, we'll walk you through the exact steps to form your LLC without unnecessary complications or excessive costs.

Don't let fancy business formation services fool you – you can handle this yourself and save hundreds.

Starting an Oklahoma LLC

Forming an LLC in Oklahoma offers numerous benefits, making it an attractive choice for entrepreneurs. Here’s what you need to know to get started:

- Cost-Effective Setup: Basic filing fee is just $100 ($95 online), with no separate state business license requirement. Save money by filing online and serving as your own registered agent.

- Quick Processing: Online applications typically process in 1-2 business days, while mail applications take 3-5 business days. No need for expensive expedited service.

- Essential Requirements: You'll need a unique business name, registered agent with a physical Oklahoma address, and Articles of Organization. That's it – no complicated paperwork.

- Annual Obligations: File annual certificates by your LLC's anniversary date ($25 fee) and maintain tax compliance. No complex franchise taxes or costly annual fees.

- Simple Maintenance: Oklahoma's requirements are straightforward – maintain a registered agent, file annual reports on time, and keep up with tax payments. No hidden complications or excessive fees.

A Step-by Step Guide to Starting Your Oklahoma LLC

Starting an LLC in Oklahoma is a simple process that will set your business on the path to success. Let’s walk through the 3 major steps.

Step 1: Choosing Your LLC Name

In Oklahoma, picking your LLC name isn't just about creativity – you need to follow specific rules to avoid rejection and save time. Your LLC name must include "Limited Liability Company," "LLC," or "L.L.C." (Most businesses use "LLC" to keep it simple).

Before falling in love with a name, check if it's available using the Oklahoma Business Entity Search – your name must be unique from other registered businesses.

Here's a money-saving tip: skip the $10 name reservation fee if you plan to file your LLC formation documents within a few days, since filing your Articles of Organization automatically secures your name.

Step 2: Choosing Your Registered Agent

Save money by serving as your own registered agent. While registered agent services run $100-300 per year, being your own agent is a smart way to reduce costs if you:

- Live in Oklahoma with a physical street address

- Can be available during business hours

- Don't mind your address being public record

Step 3: Filing Your Articles of Organization

The real work begins with filing your Articles of Organization with the Oklahoma Secretary of State. Save yourself $5 and get faster processing by filing online – it costs $95 online versus $100 by mail. You'll need to provide:

- Your LLC's name

- Principal office address

- Registered agent information

- Email address for annual report reminders

- Term of existence (usually "perpetual")

Pro tip: File online for 1-2 day processing instead of the 3-5 days for mail applications. The online system also checks for errors as you go, reducing the chance of rejection and delays.

To file online, go to the Oklahoma Secretary of State and fill out your contact information.

Begin your work ID, click “Start New”.

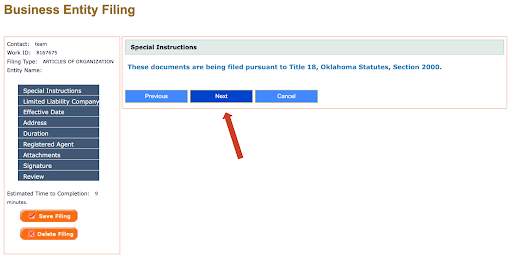

Click the blue “Next” button.

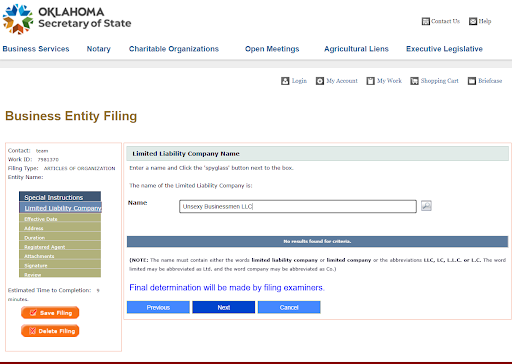

Enter the name of your company followed by LLC.

Fill out your business address and the information on the left side bar.

Submit your file and wait for it to be processed.

Post-Filing Requirements

Once your LLC is approved, complete these essential tasks to keep your business compliant and protected:

Get Your Tax Documents in Order

- Apply for an EIN (free through the IRS website)

- Register for Oklahoma sales tax if selling products (4.5% state rate)

- Set up tax payments through Oklahoma Tax Commission

Protect Your Business

- Open a separate business bank account

- Create an operating agreement (not required by law but crucial for protection)

- Consider business insurance options

- Visit OK.gov Business Services to check required licenses or permits.

Keeping Your LLC Compliant

Being your own boss doesn't mean drowning in paperwork. Oklahoma makes ongoing compliance straightforward and affordable. Your main obligations include:

- Annual Certificate Filing: Due on your LLC's anniversary date with a modest $25 fee

- Records Maintenance: Keep a registered agent and maintain basic business records

- Tax Compliance: Stay current with state tax obligations, including sales tax if applicable

- Operating Agreement Updates: While not required, keep this document current as your business grows

Remember to set calendar reminders for your annual certificate filing date to avoid late fees or potential LLC dissolution.

Launch Your Oklahoma LLC Today

The total cost to form your LLC will be between $95-$100, plus any optional services you choose.

Ready to make it official? Head to the Oklahoma Secretary of State's website and start your online filing – you could have your LLC up and running in less than a week.