How to Start an LLC in Ohio

Feb 26, 2025

Starting an LLC in Ohio is easier than you think—low fees, simple filing, and a business-friendly environment make it the perfect place to launch. While other states charge hundreds in filing fees, Ohio keeps costs low with a $99 filing fee and processing times of just 3-7 business days for standard applications.

It doesn’t matter if you're launching a local retail shop, starting a consulting firm, or opening an online business, we can walk you through the exact steps to form your LLC without any unnecessary complications

Don't let confusion about paperwork hold you back – Ohio makes business formation accessible. From choosing your business name to filing your Articles of Organization, we'll show you how to get your LLC up and running efficiently and economically.

Forming Your Ohio LLC

Starting an LLC in Ohio comes with several advantages. Here's what you need to know:

- Cost-Effective Setup: Basic filing fee is just $99, with no separate state business license requirement. Save money by filing online and serving as your own registered agent to avoid service fees of $100-300 annually.

- Quick Processing: Standard processing takes 3-7 business days. Expedited service is available for additional fees ($100 for 2-day service or $300 for 4-hour service), but most businesses don't need this extra expense.

- Essential Requirements: You'll need a unique business name, registered agent with a physical Ohio address, EIN, and Articles of Organization. You must also register for state tax purposes.

- Annual Obligations: Unlike other states, Ohio LLCs don't need to file annual reports, saving you time and money. Just maintain tax compliance and any necessary business licenses.

- Simple Maintenance: Ohio's requirements are straightforward – maintain a registered agent, stay compliant with tax obligations, and keep your business records current. No complex ongoing paperwork or hidden fees.

How to Start an LLC in Ohio

Let's walk through the essential steps to establish your Ohio LLC and save money along the way.

Step 1: Choose Your LLC Name

Your business name must follow specific Ohio rules to avoid rejection and costly refiling. The name must include "Limited Liability Company," "LLC," or "L.L.C." (Most businesses use "LLC" to keep it simple). Before getting attached to a name, check its availability using Ohio Secretary of State Business Search – your name must be unique from other registered businesses.

Money-saving tip: Skip the $39 name reservation fee if you plan to file your LLC formation documents within a few days, since filing your Articles automatically secures your name.

Step 2: Choose Your Registered Agent

Here's an easy way to save $100-300 annually: serve as your own registered agent.

You can be your own agent if you:

- Live in Ohio with a physical street address

- Can be available during business hours

- Don't mind your address being public record

While professional registered agent services charge $100-300 per year, they offer privacy and ensure you never miss important legal documents. For most small business owners, being your own registered agent is a smart way to reduce costs.

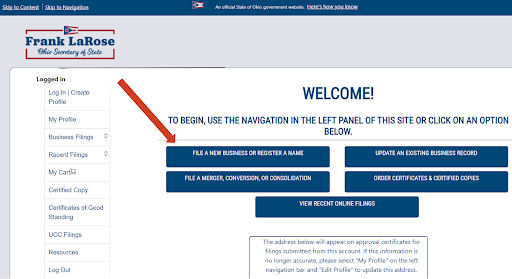

Register through the Ohio Business Filings Portal. Click “Submit a Business Filing” and create an account.

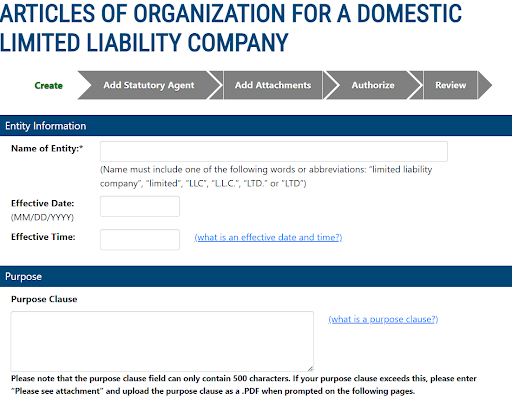

Step 3: File Your Articles of Organization

The real work begins with filing your Articles of Organization with Ohio's Secretary of State. This step costs $99 and includes essential company information. You'll need to provide:

- Your LLC's name

- Principal office address

- Registered agent information

- Whether the LLC is member or manager-managed

- Names and addresses of managers (if manager-managed)

- Duration of the LLC (usually "perpetual")

Pro tip: File online for standard 3-7 day processing instead of mailing your documents. The online system also checks for errors as you go, reducing the chance of rejection and delays.

Once you’ve created an account, you’ll land on this page. Click “File a New Business or Register a Name.”

Select “LLC in State” and choose your desired delivery method.

It will have you verify your business name availability. Once that is done, click “Begin Filing” and start the process.

The forms will walk you through the rest.

Submit your LLC and wait for it to be reviewed, don’t forget to fill yourself out as the registered agent!

Handle Post-Filing Requirements

Once your LLC is approved, complete these essential tasks to keep your business compliant and protected:

Get Your Tax Documents in Order

- Apply for an EIN (free through the IRS website)

- Register for Ohio sales tax if selling goods

- Set up tax payments through the Ohio Business Gateway

Protect Your Business

- Open a separate business bank account

- Create an operating agreement (not required by law but crucial for protection)

- Consider business insurance options

- Visit Ohio Business Gateway to find information on required permits or licenses

Launch Your Ohio Business Today

You're now equipped with everything you need to start your Ohio LLC, by following these steps and taking advantage of online filing, you can save money for your business. The total cost to form your LLC will be just $99, plus any optional services you choose.

Ready to take the next step? Head to the Ohio Secretary of State's website and start your online filing – you could have your LLC up and running in less than a week.