How to Start an LLC in North Dakota

Feb 26, 2025

Looking to start a business in North Dakota without overspending? With a straightforward $135 filing fee and quick 3-5 day processing time, forming an LLC in North Dakota is more accessible than you might think. The Peace Garden State has streamlined its business formation process, making it possible for entrepreneurs to get their LLC up and running without unnecessary complications or excessive costs.

If you're looking to launch a local service business in Fargo or start an online venture from Bismarck, we'll walk you through the exact steps to form your North Dakota LLC efficiently and affordably. No fancy consultants or overpriced services required – just practical, actionable steps to get your business officially registered.

Establishing Your North Dakota LLC

Here's a quick overview of what you need to know before forming your North Dakota LLC:

- Cost-Effective Setup: Basic filing fee is just $135, with no separate state business license requirement. Save $5 by filing online ($130) and act as your own registered agent to avoid service fees.

- Quick Processing: Online applications typically process in 3-5 business days. Mail applications take longer at 5-7 business days. Skip expedited service fees by filing online.

- Core Requirements: You'll need a unique business name, registered agent with a North Dakota address, and Articles of Organization. No initial publication requirements or complex paperwork.

- Annual Obligations: File annual reports ($50 fee) by the corporate anniversary date and maintain compliance with state tax requirements.

- Simple Maintenance: North Dakota keeps it straightforward – maintain a registered agent, file annual reports on time, and stay current with tax obligations. No complicated ongoing paperwork or hidden fees.

Starting Your North Dakota LLC in 3 Steps

Starting your North Dakota LLC is easier than you might think—just follow these three straightforward steps to get your business up and running.

Step 1: Choose Your LLC Name

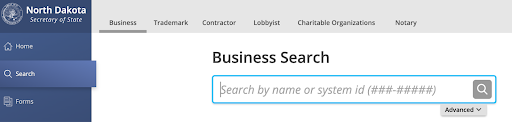

Start by selecting a unique business name that includes "Limited Liability Company," "LLC," or "L.L.C." Check availability through North Dakota Business Entity Search. Avoid restricted words like "bank," "insurance," or "engineering" unless you have the required licenses

If you find a name you like but aren't ready to file, you can reserve it for 120 days for $10 – though we recommend skipping this fee if you plan to file your LLC paperwork within a few days.

Step 2: Designate Your Registered Agent

Here's an easy way to save $100-300 annually: serve as your own registered agent. Register through North Dakota’s Secretary of State.

You can be your own agent if you:

- have a physical North Dakota address (no P.O. boxes)

- can be available during business hours

- Don't mind your address being public record

Remember, if privacy is a concern, a professional service might be worth the investment.

Step 3: File Your Articles of Organization

File your Articles of Organization with the North Dakota FirstStop. Filing online costs $130 (versus $135 by mail) and processes faster (3-5 days versus 5-7 days). You'll need to provide:

- Your LLC's name

- Principal office address

- Registered agent information

- Name and address of each organizer

- Duration of the LLC (usually "perpetual")

Pro tip: Save time and money by filing online, the system checks for errors as you go, reducing the chance of rejection and delays.

To start your online filing, on FirstStop, select “Forms” on the right tab.

Click the “Business Limited Liability” button.

Click “File Online.”

Create your account.

Fill out the required information, and they will walk you through the rest. Submit your finalized paperwork and wait for it to be reviewed.

Handle Post-Filing Requirements

Once your LLC is approved, complete these essential tasks to keep your business compliant and protected:

Set Up Your Tax Structure

- Apply for an EIN (free through the IRS website)

- Register for state tax purposes

- Set up a business bank account to separate personal and business finances

- North Dakota's tax rates range from 1.95% to 2.5% for individuals and 1.41% to 4.31% for corporations – understand your tax obligations before starting operations

Maintain Compliance

- File annual reports ($50 fee) by your LLC's anniversary date

- Keep registered agent information current

- Stay up-to-date with tax payments

- Track any local permit renewal deadlines

- Submit beneficial ownership information to FinCEN (new requirement as of 2024)

Keep Costs Low and Protection High

- Create an operating agreement (not required by law but crucial for protection)

- Consider basic business insurance

- Check local licensing requirements

- Maintain accurate financial records

- Check the North Dakota Business Services Portal to identify any industry-specific requirements.

Launch Your North Dakota LLC Today

Now you’ve got the steps, starting your LLC is smooth sailing from here. The total cost to form your LLC will be between $130-$135, plus any optional services you choose.

Focus your resources on growing your business rather than paying unnecessary fees or expensive formation services. With North Dakota's straightforward process and reasonable fees, you can have your LLC up and running in less than a week.

Ready to make it official? Head to North Dakota FirstStop and start your online filing now.