How to Start an LLC in North Carolina

Feb 25, 2025

Ready to turn your business dreams into reality in North Carolina? Starting an LLC doesn't have to be overwhelming. While other states complicate the process with excessive fees and requirements, North Carolina keeps it straightforward with a modest $125 filing fee and processing times of just 3-5 business days for online applications.

Whether you're launching a local retail shop, starting a consulting firm, or opening a service business, we'll walk you through the exact steps to form your LLC without making it intimidating.

Don't let confusing legal requirements hold you back – North Carolina makes it simple to establish your business presence and start building your future on your own terms.

Starting an LLC in North Carolina

Starting an LLC in Oregon offers a number of attractive benefits. Here’s what you need to know to make the process go smoothly:

- Cost-Effective Setup: Basic filing fee is just $125, with no separate state business license requirement. Save money by filing online and serving as your own registered agent.

- Quick Processing: Online applications typically process in 3-5 business days, while mail applications take 5-7 business days. No need to pay for expensive expedited service unless you're in a hurry.

- Essential Requirements: You'll need a unique business name, registered agent with a physical North Carolina address, and Articles of Organization. No complicated additional filings needed to get started.

- Annual Obligations: File annual reports by April 15th ($200 fee) and maintain tax compliance. No complex franchise taxes or hidden fees to worry about.

- Simple Maintenance: North Carolina's requirements are simple – maintain a registered agent, file annual reports on time, and keep up with basic tax payments. No unnecessary paperwork or complex ongoing requirements.

A Guide to Starting Your North Carolina LLC

Let's walk through the essential steps to form your LLC properly and efficiently.

Step 1: Choose Your LLC Name

Picking your LLC name isn't just about creativity – in North Carolina, you need to follow specific rules to get approved. Your LLC name must include "Limited Liability Company," "LLC," or "L.L.C." (Most businesses use "LLC" to keep it simple).

Before settling on a name, check if it's available using North Carolina Business Entity Search – your name must be distinguishable from other registered businesses.

Watch out for:

- Terms like "bank," "insurance," or "engineering" require special licensing or additional paperwork.

- Purely geographic names or those that could mislead the public.

Here's a money-saving tip: skip the $30 name reservation fee if you plan to file your LLC formation documents within a few days, since filing your Articles of Organization automatically secures your name.

Step 2: Register Your LLC

Serving as your own registered agent for your North Carolina LLC is a great way to save money and maintain control over important legal and tax documents. The role requires you to receive official correspondence, such as service of process and state notifications, at a physical address in North Carolina during standard business hours.

To act as your own registered agent, you must:

- Be at least 18 years old and a resident of North Carolina.

- Have a physical street address (P.O. boxes are not allowed).

- Be available during regular business hours to accept legal documents.

While becoming your own registered agent saves you from paying a professional service ($100–$300 per year), it does come with responsibilities. You must stay organized, promptly respond to legal notices, and maintain a consistent business presence. If privacy or availability is a concern, using a registered agent service may be a better option.

Step 3: File Your Articles of Organization

The real work begins with filing your Articles of Organization with the Secretary of State. This step costs $125 – save yourself time and potential headaches by filing online. You'll need to provide:

- Your LLC's name

- Principal office address

- Registered agent information

- Names and addresses of members/organizers

- Duration of the LLC (usually "perpetual")

To register, visit North Carolina’s Secretary of State, and click “Business Registration.”

Click “Register Your Business.”

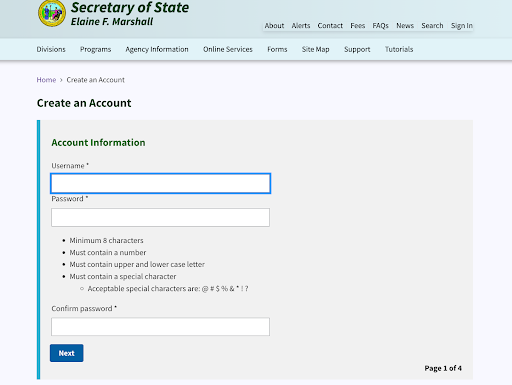

Create your account.

Once you've made your account, file your Articles of Organization. Submit your finalized paperwork for review.

If you need extra help, North Carolina has made a tutorial to help you get your LLC Started.

Pro tip: File online for 3-5 day processing instead of the 5-7 days for mail applications. The online system also checks for errors as you go, reducing the chance of rejection and delays.

Handle Post-Filing Requirements

Once your LLC is approved, complete these essential tasks to keep your business compliant and protected:

Get Your Business Basics in Order

- Apply for an EIN (free through the IRS website)

- Open a separate business bank account (crucial for maintaining liability protection)

- Create an operating agreement (not required by law but important for protecting your interests)

- Consider basic business insurance options

- Visit the North Carolina Business Link to determine if your business requires permits or licenses.

Keep Your LLC Compliant

North Carolina makes ongoing compliance straightforward, but you need to stay on top of a few key requirements. Mark your calendar for the annual report – it's due every April 15th and costs $200 ($203 if filing online). Missing this deadline can result in penalties or even administrative dissolution of your LLC.

Maintain these basics to keep your LLC in good standing:

- File your annual report on time

- Keep your registered agent information current

- Stay up-to-date with state and federal tax obligations

- Track any local permit renewal deadlines

- Maintain clear separation between personal and business finances

Pro tip: Set calendar reminders for all filing deadlines and keep digital copies of all your LLC documentation. This simple organization system helps you avoid missing deadlines and keeps you prepared for any future business needs.

Time to Launch Your LLC

Getting your North Carolina LLC off the ground is simple, by following these steps and taking advantage of online filing, you can save money and time while building a solid foundation for your business. The total cost to form your LLC will be $125, plus any optional services you choose.

Time to make it official! Head to the North Carolina Secretary of State's website and start your online filing – you could have your LLC up and running in less than a week.