How to Start an LLC in New York

Feb 25, 2025

Looking to join the 2.2 million small businesses thriving in New York by starting your own LLC? While the Empire State has some unique requirements – like the newspaper publication rule that can cost up to $1,200 – the actual process of forming your LLC is relatively straightforward. With a basic filing fee of $200 and standard processing times of 7 business days, you can establish your business presence without unnecessary complications.

Don't let New York's reputation for high costs discourage you. Whether you're launching a consulting firm in Manhattan or opening a retail shop in Buffalo, we'll walk you through the exact steps to form your LLC without the usual expensive service fees and confusing legal jargon.

Forming Your New York LLC

Before jumping into the paperwork, we’ll explain some essential facts of what you need to know about starting an LLC in New York:

- Cost-Effective Filing: The state filing fee is $200, but save $5 by submitting online. You'll get faster processing and can avoid common rejection reasons through the online system's built-in checks.

- Critical Timeline Requirements: Standard processing takes 7 business days. Your LLC must fulfill the publication requirement within 120 days of formation and create an operating agreement within 90 days.

- Publication Costs: Budget between $600-$1,200 for mandatory newspaper publication in your LLC's county. Some counties have significantly lower rates – we'll show you how to handle this requirement efficiently.

- Simple Maintenance: No general business license needed at the state level. Annual state filing fees are based on income, starting at just $25. Keep a registered agent and stay current with tax obligations to maintain good standing.

- Money-Saving Opportunities: Serve as your own registered agent, file online, and handle the formation paperwork yourself to save hundreds in service fees.

Steps to Start an LLC in New York

Starting your New York LLC begins with three essential steps that set up your business foundation. Here's exactly what you need to do:

Step 1: Choose Your LLC Name

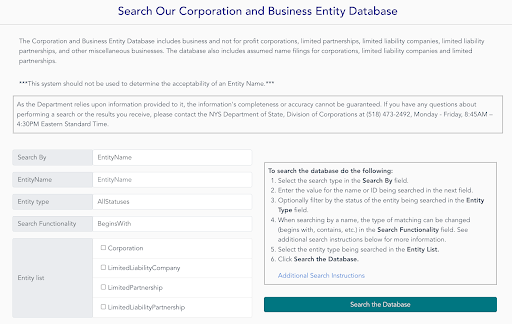

Your LLC name must include "Limited Liability Company," "LLC," or "L.L.C." Before falling in love with a name, check if it's available using the New York Business Entity Database – your name must be distinguishable from other registered businesses.

Watch out for:

- Terms like "bank," "insurance," or "university" require special licensing or additional approval.

- Terms that could imply government affiliation.

Skip the $10 name reservation fee if you plan to file your LLC paperwork within a few days, since filing your Articles of Organization automatically secures your name.

Step 2: Understand Registered Agent Requirements

Here's a money-saving tip unique to New York: The state automatically designates the Secretary of State as your registered agent – no need to pay for this service. While you can appoint an additional registered agent, it's not required. If you do want your own agent, you can save $100-300 annually by serving as your own.

You can be your own agent if you:

- Live in New York with a physical street address

- Can be available during business hours

Step 3: File Your Articles of Organization

File your Articles of Organization online through the NY Department of State website for $200 ($195 online). The form is straightforward.

You'll need to provide:

- LLC name

- County location

- Service of process address

Here’s a walkthrough:

Start at the NY Department of State’s website, click “File Online.”

Next, click “Domestic LLC.”

Scroll down and Click “Apply as an Owner”

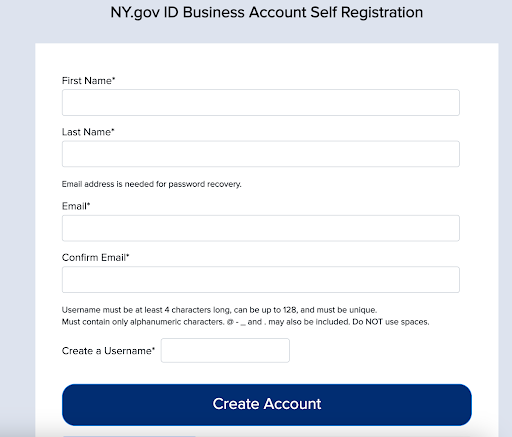

Under “I Need a NY.GOV ID,” click “Register Here.”

Then make an account with a valid New York ID.

These are some fees you should be aware of:

Next, you’ll file your Articles of Organization.

Online filing typically processes within 7 business days, while mail applications can take longer. You can expedite processing for an additional $25-150 if needed.

Handle Post-Filing Requirements

After your LLC is approved, New York has some unique requirements you'll need to address:

Publication Requirement

Within 120 days of forming your LLC, you must publish a notice in two newspapers (one weekly, one daily) for six consecutive weeks. Here's how to minimize costs:

- Contact your county clerk first – they designate which newspapers you can use

- Budget $600-$1,200 for publication fees (costs vary significantly by county)

- Consider forming your LLC in a county with lower publication rates

- Submit your Certificate of Publication ($50 fee) to the state after publication

Essential Tax and Legal Documents

- Get your free EIN from the IRS website – you'll need this for your business bank account

- Create an operating agreement within 90 days (required by NY law)

- Register for state tax obligations through the Department of Taxation and Finance

- Check local licensing requirements with New York Business Services – while NY has no general state business license, your city or county might

Keep Your LLC Compliant

Maintain your LLC's good standing by:

- Filing annual state returns with fees starting at $25

- Keeping your registered agent information current

- Staying up-to-date with tax obligations

- Tracking any local permit renewal deadlines

Smart Money-Saving Strategies

While New York has some fixed costs you can't avoid, there are several ways to save money when forming your LLC:

- Be your own registered agent – save $100-300 annually by using your own address

- File online to save $5 and reduce processing time

- Skip name reservation if filing immediately

- Handle your own operating agreement creation

- Consider a lower-cost county for your LLC address if publication costs are high in your area

- File your own EIN application instead of paying a service

- Submit state filings yourself rather than using a formation service

Time to Start Your New York LLC

Launching your New York LLC doesn't have to be intimidating. By following these steps and taking advantage of online filing, you can save money and time while building a solid foundation for your business. The total cost to form your LLC will be between $850-1,450 (including publication requirements), but you can save hundreds by handling the process yourself.

Ready to start? Head to the New York Department of State website and start your online filing – you could have your LLC up and running in less than a week.