How to Start an LLC in Nebraska

Feb 22, 2025

Starting an LLC in Nebraska is a straightforward and affordable process, offering entrepreneurs a smooth path to business ownership, with basic filing fees of just $100 online. While the state does have a unique newspaper publication requirement that adds to your startup costs, the actual formation process is pretty straightforward.

Whether you're launching a local retail shop, starting a consulting business, or diving into property management, we'll walk you through the exact steps to form your Nebraska LLC without unnecessary fees.

Don't let the legal requirements intimidate you–you can have your LLC up and running in about 3-5 business days when filing online.

Starting Your Nebraska LLC

Here's a breakdown of some benefits you should know before starting your LLC in Nebraska:

- Cost-Effective Setup: Basic filing fee is just $100 when you file online ($110 by mail). Save money by being your own registered agent instead of paying $100-300 annually for a service.

- Quick Processing: Online applications typically process in 3-5 business days, while mail applications take 5-7 business days. Plan ahead for the required newspaper publication that takes 3 weeks.

- Essential Requirements: You'll need a unique business name, registered agent with a physical Nebraska address, and Certificate of Organization. Plus, you must publish a notice in a local newspaper for three consecutive weeks.

- Simple Maintenance: File biennial reports by April 1st of odd-numbered years ($25 online, $30 by mail). No complex franchise taxes or expensive annual fees to worry about.

- Straightforward Compliance: Nebraska's requirements are clear-cut – maintain your registered agent, file biennial reports on time, and keep up with basic tax obligations. No hidden requirements or complicated ongoing paperwork.

Complete Guide to Forming Your Nebraska LLC

Forming your LLC in Nebraska is straightforward when you know the steps. Here's exactly what you need to do:

Step 1: Choose Your LLC Name

Start by picking a name that's both legal and available. Here's how to do it right without wasting time or money:

- Your name must include "Limited Liability Company," "LLC," or "L.L.C."

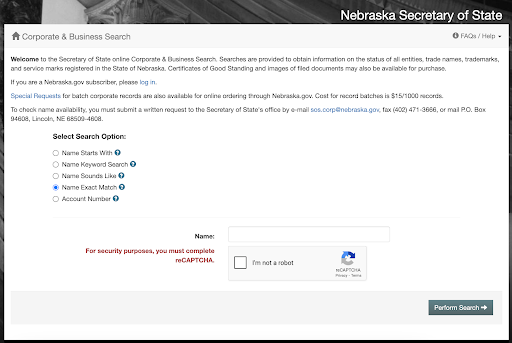

- Check availability using Nebraska Secretary of State Business Search

- Don't waste $30 on name reservation if you're filing your LLC within a few days – the name is automatically reserved when you file

- Avoid restricted words like "bank," "insurance," or "engineering" unless you have the proper licenses

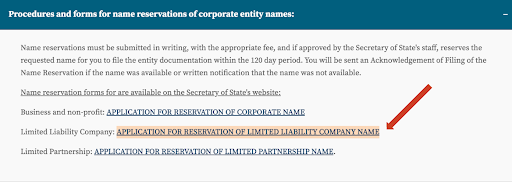

Once your name is approved, visit the Application for Reservation of Limited Liability Company Name.

Fill out the information accordingly.

Step 2: Set Up Your Registered Agent

If you want an easy way to save money, you can be your own registered agent if you:

- Have a physical Nebraska address (no P.O. boxes)

- Can be available during business hours

- Don't mind your address being public record

Professional registered agent services run $100-300 per year. While they offer privacy and convenience, being your own agent is a smart way to reduce costs when starting out.

Step 3: File Your Certificate of Organization

Once you have a name, you’ll need to File Certificates of Organization with the Nebraska Secretary of State.

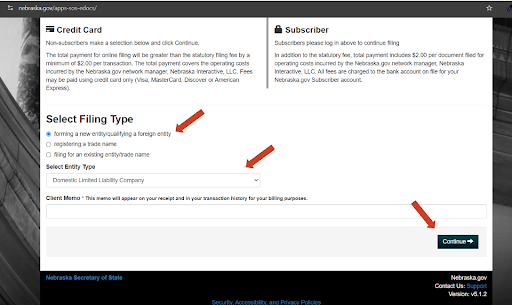

- Go to the Nebraska Secretary of State Online Filing System.

- Create an account or log in to file your Certificate of Organization.

- File online to save $10 (online fee is $100, mail-in is $110)

- Provide your LLC name, address, and registered agent information

- Choose faster 3-5 day processing by filing online instead of 5-7 days by mail

Once you’re on the home page, fill out your business account number, and submit. You can find this on the Nebraska Department of Labor’s website.

Select “Forming a New Entity,” “Domestic Limited Liability Company,” and continue.

Pay the filing fee (currently $100 for online filings; confirm the fee in case it has changed).

Once you have moved on, go through the forms and submit your application.

Check the Secretary of State’s website for current processing times.

Post-Filing Requirements You Can't Skip

The newspaper publication requirement is unique to Nebraska and can't be avoided. Nebraska requires you to publish a notice about your LLC formation in a local newspaper for three consecutive weeks.

Here's how to handle it efficiently:

- Choose a legal newspaper in your LLC's county

- Publish your notice for three consecutive weeks

- Expect to pay $70-100 for the publication

- Submit proof of publication to the Secretary of State ($25 online, $30 by mail)

Next Steps to Launch Your Business:

- Get your free EIN (tax ID) from the IRS website

- Open a separate business bank account

- Create a basic operating agreement (not required by law but crucial for protection)

- Register for state taxes if needed

- Visit Nebraska's Business Licensing Information System to find what’s needed for your industry.

Keeping Your LLC Compliant

Nebraska makes ongoing compliance straightforward:

- File biennial reports every odd year by April 1st

- Keep your registered agent information current

- Maintain separate business and personal finances

- Track any local permit renewal deadlines

- Stay current with tax obligations

Launch Your Nebraska LLC Today

Don't let the legal requirements intimidate you – you can have your Nebraska LLC up and running for around $200 total (including filing and publication fees). Focus on following the steps in order, and you'll avoid unnecessary costs and delays.

Looking to make it official? Head to the Nebraska Secretary of State's website and start your online filing – you could have your LLC formed within a week.