How to Start an LLC in Montana

Feb 22, 2025

Montana makes it easy for entrepreneurs to start their own business. With LLC filing fees recently slashed from $70 to $35 and a streamlined online-only process, the Treasure State has become one of the most affordable places to launch your company.

Along with the low filing fee, Montana keeps things extra simple. No state sales tax, minimal paperwork, and processing times of just 5-6 business days, you can focus on launching your LLC instead of getting stuck in hurdles.

Ready to join the over 130,000 small businesses in Montana? Let's walk through exactly how to form your LLC with confidence.

Launching Your Montana LLC

Let's take a look at the essential tips you should know before launching an LLC in Montana:

- Save Money: Montana offers some of the lowest LLC filing fees in the region – just $35 for online filing. That's half of what it cost last year and hundreds less than many other states.

- Quick Processing: Your LLC application typically processes in 5-6 business days through the mandatory online system. No more waiting weeks for paperwork to shuffle through the mail.

- Minimal Requirements: Unlike some states, Montana doesn't require a separate state business license for most companies. You'll just need your Articles of Organization and EIN to get started.

- Simple Maintenance: Annual requirements are straightforward – file your annual report by April 15th each year ($20 fee) and keep your registered agent information current.

- Maximum Flexibility: Montana allows you to be your own registered agent and handle everything online, helping you save both time and money when launching your business.

What It Takes to Form Your Montana LLC

Montana has streamlined the LLC formation process to be entirely online – no paper forms, no in-person visits, no unnecessary complications. The state recently modernized its system, requiring all business filings to be completed through the Secretary of State's online portal. While this might seem restrictive at first, it actually saves you time and money.

Here's exactly what you'll need:

- A unique business name that includes "LLC," "Limited Liability Company," or similar approved designations

- A physical Montana address for your registered agent

- Basic information about your LLC members

- $35 for the filing fee

- About 30 minutes to complete the online application

Pro tip: Skip the name reservation fee ($10) if you're ready to file your LLC paperwork within a few days. Your name gets protected automatically when you submit your Articles of Organization, so there's no need to pay extra unless you're still getting other pieces in place.

Step-by-Step Process for Your Montana LLC

Starting an LLC in Montana is straightforward when you break it into manageable steps. Here's your easy-to-follow guide:

Step 1: Choose and Register Your Name

Finding the right name is your first step, but don't overthink it. Check availability through the Montana Secretary of State's business search tool. Remember, you must include "LLC" or "Limited Liability Company" in your name. Avoid words like "Bank," "Insurance," or "Engineering" unless you have proper licensing.

If your name is taken, brainstorm a different one.

Step 2: Register Your LLC

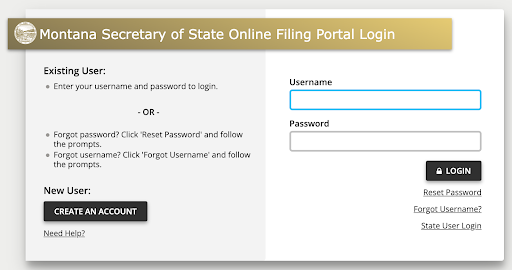

After confirming your desired name is available, return to the Montana Secretary of State portal. Create an account or log in.

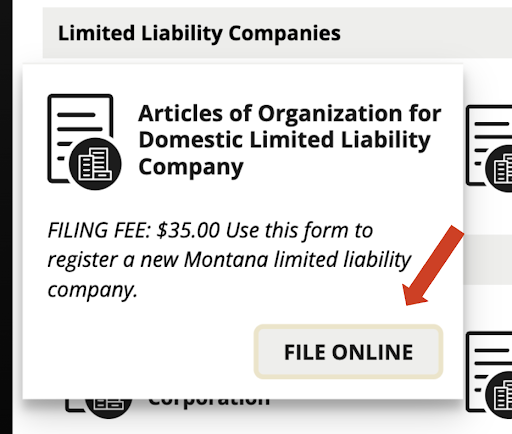

Click Register a Business, under the "Forms" tab select “Articles of Organization for Domestic Limited Liability Company”

Click “File Online.”

Step 3: File Your Articles of Organization Online

The next step is through the Secretary of State's portal, you’ll file the Articles of Organization.

Here's what you'll need to provide:

- Your LLC's name

- Principal office address

- Registered agent information

- Member/manager names

- Effective date (can be up to 90 days in the future)

Follow the online instructions to fill out your LLC details, after completing the form, sign and submit your application online.

Step 4: Handle Post-Filing Requirements

Once your LLC is approved (typically within 5-6 business days), knock out these essential tasks:

- Get your EIN (free from the IRS website)

- Open a business bank account (keep personal and business finances separate)

- Create an operating agreement (not required by law but crucial for protecting your business)

Step 5: Maintain Your LLC

Montana keeps ongoing requirements simple:

- File your annual report by April 15th ($20 fee)

- Update your registered agent information if it changes

- Keep your operating agreement current

- Maintain separate business banking

- Register with Montana’s Department of Revenue

Money-saving tip: Consider being your own registered agent if you have a physical Montana address and don't mind your address being public record. This can save you $100-200 annually in registered agent service fees.

Save Money When Starting Your Montana LLC

Smart entrepreneurs know that every dollar saved is a dollar you can invest back into your business. Here's how to keep more money in your pocket when forming your Montana LLC:

- Be your own registered agent if you have a physical Montana address

- Skip the name reservation fee if you're ready to file within a few days

- File online to save on processing fees and get faster results

- Handle your own EIN registration through the IRS website

- Create a basic operating agreement yourself instead of paying for one

- Use your home address for LLC registration if you don't need a separate office

Launch Your Montana LLC Today

Getting your Montana LLC up and running doesn't have to drain your bank account or overwhelm you with paperwork. The state's streamlined online system and reduced filing fees make it easier than ever to start your business the right way. With just $35 for filing and $20 for your annual report, you can have your LLC formed and running in less than a week.

Don't let overpriced formation services or complicated paperwork hold you back. Head to the Montana Secretary of State's website and start your online filing today. You could have your own business up and running in less than a week.