How to Start an LLC in Mississippi

Feb 21, 2025

Mississippi offers a simple, efficient way to form your LLC with minimal fees and straightforward filing processes. By following a few basic steps, you can start your business without the unnecessary difficulties often found in other states. With some of the lowest corporate tax rates in the nation of just 4-5% and low filing fees of $50 by mail and $54 online, the Magnolia State makes it easy to become your own boss.

Other states pile on complex requirements and hefty fees, however, Mississippi likes to keep things easy. They’ve got quick processing times (1-3 business days for online filings), no general state business license requirement, and a clear-cut formation process meaning you can focus on starting your business.

Ready to join the ranks of Mississippi entrepreneurs? Let's walk through exactly how to form your LLC without the headache.

Forming Your Mississippi LLC

Here’s what you need to know about starting an LLC in Mississippi before we get into the specifics:

- Save Money: Mississippi offers some of the lowest LLC filing fees in the nation – just $50 for mail-in applications and $54 for online filing. That's hundreds less than many other states.

- Quick Processing: Your LLC application typically processes in 1-3 business days when filed online. Mail-in applications take 7-10 business days.

- Minimal Requirements: Unlike some states, Mississippi doesn't require a separate state business license for most companies. You'll just need your Certificate of Formation and EIN to get started.

- Simple Maintenance: Annual requirements are straightforward – file your annual report by April 15th each year (with no filing fee) and keep your registered agent information current.

- Maximum Flexibility: Mississippi allows you to be your own registered agent and file everything online, helping you save both time and money when launching your business.

Step-by-Step Guide to Launching Your Mississippi LLC

From filing your formation documents to understanding key requirements, these steps will ensure you’re on the right track to getting your business started.

Step 1: Choose Your LLC Name

Up first, let's pick your business name. Mississippi, like most states, has some specific rules you'll need to follow:

- Your name must include "Limited Liability Company," "LLC," or "L.L.C." (Save yourself some paperwork and business card space – most owners just use "LLC")

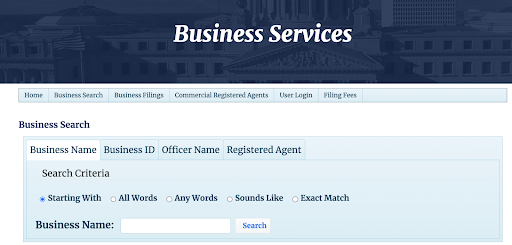

- It needs to be unique in Mississippi. Search the Mississippi Business Entity Search first to avoid wasting time and money on a name that's already taken.

- Stay away from restricted words like "Bank," "Insurance," or "Engineering" unless you have the proper licensing.

Want to lock down a name while you get your paperwork together? Reserve it for 180 days by paying $25 to the Secretary of State. However, if you're ready to file your LLC paperwork within a few days, skip the reservation fee – your name gets protected automatically when you file your Certificate of Formation.

Step 2: Pick Your Registered Agent

Here's an easy way to save $100-200 per year: be your own registered agent. You qualify if you:

- Are at least 18 years old

- Have a physical Mississippi address (no P.O. boxes)

- Can be available during business hours

Just keep in mind that your address becomes public record, and you'll need to be available to receive legal papers in person if needed. If privacy is worth more to you than the savings, professional registered agent services run about $100-200 annually.

Step 3: File Your Certificate of Formation

Here's where you officially create your LLC, and Mississippi makes it affordable. You'll file your Certificate of Formation with the Secretary of State's office. The best part? It only costs $54 online or $50 by mail – that's about the price of a decent dinner out.

What you'll need to provide:

- Your LLC's name

- Principal office address

- Registered agent information

- Organizer's name and signature

- Effective date (can be up to 90 days in the future)

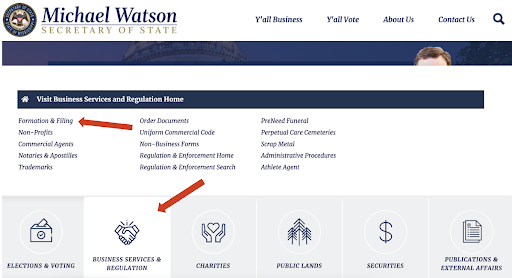

Once you’re on the Secretary of State's website, hover over “Business Services & Regulation,” and click “Formation and Filing”

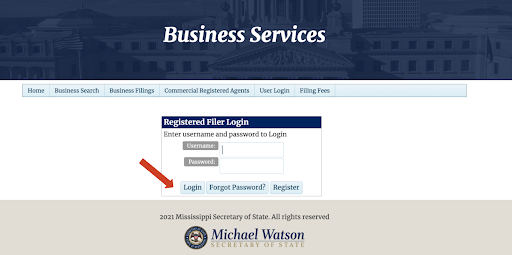

You’ll then create an account or login. They will guide you to the forms.

Your Certificate of Formation should look like this. Fill out the information accordingly.

Once you’re done filing, sign, submit, and wait for approval.

Pro tip: File online instead of by mail. Not only do you save time with 1-3 day processing (versus 7-10 days for mail-in applications), but the online system also checks for errors as you go, reducing the chance of rejection and delays.

Keeping Your LLC Running Smoothly

The hardest part is done, but there are a few unsexy (but important) details to handle each year to keep your LLC in good standing:

Annual Report: Mark April 15th on your calendar – that's when your annual report is due. Unlike most states, Mississippi doesn't charge a filing fee for LLC annual reports. File online through the Secretary of State's website and set a reminder for next year.

Tax Classification Options:

- Single-member LLCs: Report business income on your personal tax return

- Multi-member LLCs: File as a partnership by default

- Want more options? You can elect S-corporation status for potential self-employment tax savings

Money-Saving Tips for Mississippi LLC Owners:

- Handle your own registered agent duties to save $100-200 annually

- File everything online to save time and avoid mail delays

- Skip the name reservation if you're ready to file your LLC paperwork

- Use free resources from the Mississippi Small Business Development Center

- Consider S-corp election if your profits exceed $40,000 annually

Post-Filing Requirements

After your LLC is approved, knock out these essential tasks:

- Get your EIN (free from the IRS website)

- Open a business bank account (keep your personal finances separate)

- Create an operating agreement (not required by law but crucial for protecting your business)

- Register with the Mississippi Department of Revenue if needed

- Check local permit requirements for your city and type of business

Remember, in Mississippi there's no separate state business license required for most companies. You might need local permits depending on your city and type of business.

Time to Start Your LLC

Mississippi is a great option for starting your LLC. The state's process is efficient and won’t give you a financial headache, making it easy for entrepreneurs to establish their businesses. Use our guide to avoid unnecessary costs and focus your resources on growing your business, while confidently joining the ranks of independent business owners.

Ready to take the first step? Head to the Mississippi Secretary of State's website and start your online filing. Your LLC could be up and running in less than a week.