How to Start an LLC in Massachusetts

Feb 19, 2025

Looking to start an LLC in Massachusetts? Let's address the elephant in the room—that $500 filing fee is one of the highest in the nation. But don't let that scare you away from business ownership. While you can't dodge the state's filing costs, there are plenty of ways to save money throughout the LLC formation process without cutting corners or compromising your business's legal foundation.

Massachusetts actually makes it pretty straightforward to handle your LLC filing yourself. No fancy services required, no excessive fees beyond the basics, and no unnecessary complications.

Let's walk through the process of forming your Massachusetts LLC while keeping more money in your pocket for actually running your business.

Launching a Massachusetts LLC

Here’s some key points you should know before jumping into the details of starting an LLC in Massachusetts:

- Filing Fees: The $500 Certificate of Organization fee is non-negotiable, but you can skip the optional $30 name reservation fee by filing your LLC paperwork right away.

- Quick Processing: Online filings typically process within 2-3 business days, while mail filings take 5-7 business days. Want it faster? Skip the extra expedited fees—online filing is quick enough.

- DIY Savings: Save $100-300 annually by being your own registered agent. Most Massachusetts business owners qualify and can handle this role themselves.

- Simple Maintenance: Plan for the $500 annual report fee, but dodge unnecessary expenses like third-party services or "compliance packages" you don't need.

- Maximum Flexibility: Massachusetts doesn't require a state business license for most companies, and you can file everything online without professional help.

A Full Guide to Starting Your LLC in Massachusetts

Starting an LLC in Massachusetts doesn’t have to be complicated. We’ll take you through every step of the process, and help your business start off smoothly.

Step 1: Choose Your LLC Name

First up, pick your business name—but don't overthink it. Massachusetts has some basic rules to follow:

- Must include "Limited Liability Company," "LLC," or "L.L.C." (Just use "LLC"—it's shorter and works just fine)

- Has to be unique in Massachusetts, check the Massachusetts Business Entity Search first

- Can't use restricted words like "Bank," "Insurance," or "Engineering" unless you have proper licensing

Pro tip: Skip the $30 name reservation fee if you're ready to file your LLC paperwork within a few days. Your name gets protected automatically when you submit your Certificate of Organization.

Step 2: Choose Your Registered Agent

Looking for an easy way to save $100-200 annually? In Massachusetts, it’s perfectly legal to be your own registered agent. You qualify if you:

- Are at least 18 years old

- Have a physical Massachusetts address (no P.O. boxes)

- Can be available during business hours

Just remember—your address becomes public record. If privacy matters more than savings, professional registered agent services run about $100-200 per year, but most small business owners can handle this role themselves.

Step 3: File Your Certificate of Organization

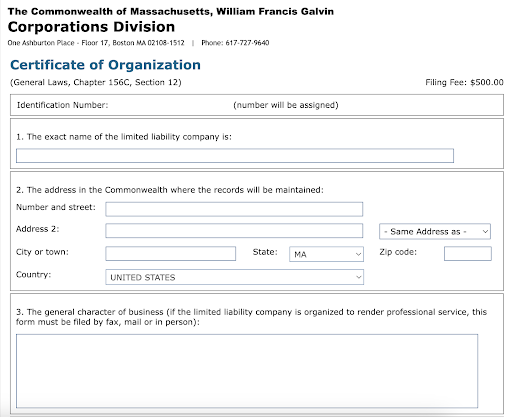

Here's where you'll face that $500 filing fee—but let's make sure you get it right the first time to avoid paying twice. You'll file your Certificate of Organization with the Secretary of the Commonwealth's office. Here's what you need to provide:

- Your LLC's name

- Principal office address

- Registered agent information

- The general character of your business

- Names and addresses of managers (if any)

- Name of person filing and their signature

- Optional: Effective date (can be up to 90 days in the future)

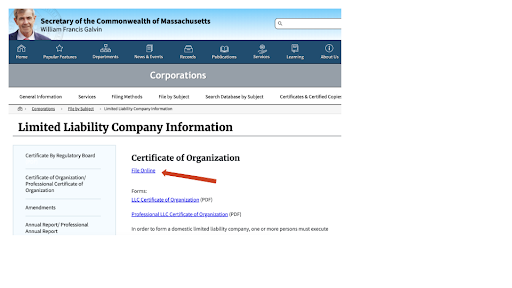

We’ve linked a shortcut, but to find the certificate on your own, visit the Secretary of the Commonwealth’s Limited Liability page. Click “File Online”

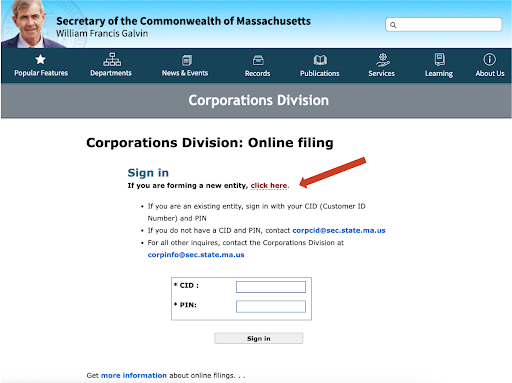

This will take you to the login page. You’re forming a new entity, click “Click Here”

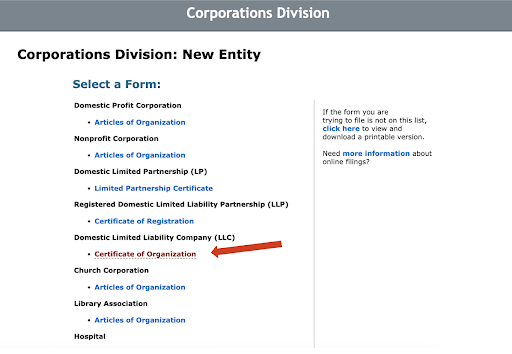

Under Domestic Limited Liability Company (LLC), select “Certificate of Organization”

This is where you’ll start filing.

Fill out all of the required information, submit, and wait for approval.

Money-saving tip: File online instead of by mail. Not only do you save time with faster processing (2-3 days versus 5-7 for mail), but the online system checks for errors as you go, reducing the chance of rejection and costly refiling. Plus, you can pay with a credit card instead of dealing with checks or money orders.

Keeping Your LLC Running Smoothly

The hardest part is done, but there are a few unsexy (but important) details to handle each year to keep your LLC in good standing:

Annual Report: Mark your calendar—your $500 annual report is due by your LLC's anniversary date. Missing this deadline means costly penalties and potential dissolution of your LLC. File online through the Secretary of the Commonwealth's website and set a reminder for next year.

Post-Filing Requirements

After your LLC is approved, tackle these essential tasks:

- Get your EIN (free from the IRS website)

- Open a business bank account (keeps your personal finances separate)

- Create an operating agreement (not required by law but crucial for protecting your business)

- Register with the Department of Revenue for state taxes if needed

Remember, Massachusetts keeps things relatively simple—there's no separate state business license required for most companies. However, you might need local permits depending on your city and type of business.

Tax Classification Options:

- Single-member LLCs: Report business income on your personal tax return

- Multi-member LLCs: File as a partnership by default

- Want more options? You can elect S-corporation status within 75 days of formation to potentially save on self-employment taxes if your profits exceed $40,000 annually

Money-Saving Tips for Massachusetts LLC Owners:

- Handle your own registered agent duties to save $100-200 annually

- File everything online to save time and reduce errors

- Skip the name reservation if you're ready to file your LLC paperwork

- Use free resources from the Massachusetts Small Business Development Center

- Consider an S-corp election if your profits exceed $40,000 annually

Time to Start Your Massachusetts LLC

You've got the blueprint—now it's time to build your business. While Massachusetts isn't the cheapest state for LLC formation, you can still save money by handling the process yourself.. Use our guide, and save your money for actually running your business, and join the entrepreneurs of Massachusetts.

Ready to get started? Head to the Massachusetts Secretary of the Commonwealth's website and start your online filing. Your LLC could be up and running in less than a week.