How to Start an LLC in Kentucky

Feb 17, 2025

Kentucky's business-friendly environment makes it an attractive state for forming an LLC. Entrepreneurs are drawn to its low costs, including one of the nation’s most affordable filing fees at just $40, along with a streamlined registration process. The flat 4% tax rate adds to the appeal by simplifying financial planning for business owners.

Whether you’re starting a small business or planning for growth, the Bluegrass State provides a supportive landscape for success. Our guide will walk you through exactly how to form your Kentucky LLC, from choosing a name to handling annual requirements.

Starting Your Kentucky LLC

- Save Money: The filing fee is just $40, making Kentucky one of the more affordable states for setting up an LLC.

- Quick Processing: Online filings are processed the same day, while mail-in applications take up to 1 week.

- Minimal Requirements: Kentucky doesn’t require a state business license for most companies. Articles of Organization and an EIN are often all you need.

- Simple Maintenance: Annual reports are due by the 15th day of the fourth month after your tax closing month, with a $15 filing fee (online).

- Maximum Flexibility: You can be your own registered agent and handle everything online, saving time and additional costs.

Steps to Launch Your Kentucky LLC

Starting your LLC in Kentucky doesn’t have to be complicated—just follow these clear and simple steps to get your business off the ground.

Step 1: Choose Your LLC Name

Your Kentucky LLC name must follow specific state rules to be approved. The name must include "Limited Liability Company," "LLC," or "LC" (or "Professional Limited Liability Company"/"PLLC" for professional services).

Before filing, search the Kentucky Business Entity Search to ensure your name is available. If you find the perfect name but aren't ready to file, you can reserve it for 120 days by paying a $15 fee. Keep in mind that Kentucky's name requirements are strict:

- Must be distinguishable from other registered businesses

- Cannot include words that make it sound like a different type of entity (like "Inc." or "Corp.")

- Professional LLCs must include "PLLC" or "Professional Limited Liability Company"

- Cannot include words that require special licensing without proper authorization

Step 2: Select a Registered Agent

Kentucky requires every LLC to have a registered agent—this is the person or company authorized to receive legal documents and official state mail for your business. Your agent must have a physical street address in Kentucky (no P.O. boxes) and be available during regular business hours.

You can serve as your own registered agent if you have a Kentucky address (highly recommended), or you can appoint another person or a professional service. Many business owners choose a professional service to:

- Maintain privacy (avoid receiving legal papers at your business location)

- Ensure you never miss important documents

- Keep your address off public records

- Have guaranteed availability during business hours

While serving as your own agent is free, consider whether saving the $100-300 annual fee for a professional service is worth the added responsibilities and privacy concerns.

Step 3: File Your Articles of Organization

This is where you officially create your LLC by filing Articles of Organization with the Kentucky Secretary of State. The filing fee is $40—one of the lowest in the country. Kentucky makes this process straightforward through their Business One Stop Portal.

Your Articles of Organization must include:

- Your LLC's name

- Principal office address

- Registered agent information

- Whether the LLC is veteran-owned

- Management structure (member-managed or manager-managed)

- Organizer's signature

- Registered agent's signature

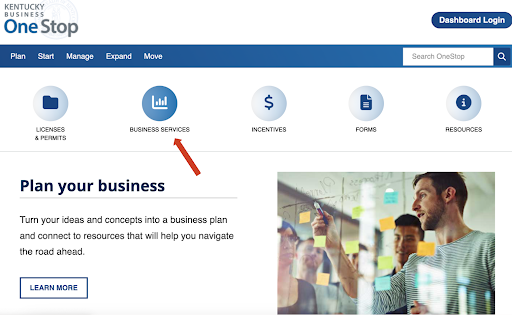

The first step to filing online is to click “Business Services.”

Click “Start.”

Click the “Registration with the Secretary of State and Department of Revenue” link.

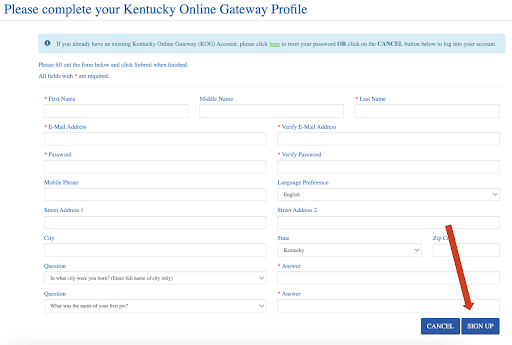

Create an account.

After you’re logged in, you’ll file your Articles of Organization.

If you're forming a professional LLC (PLLC), you'll need to use a special version of the Articles and include your professional service type. Once approved, the state will send your formation certificate—keep this document safe as banks and other institutions will request it.

Step 4: Create an Operating Agreement

While Kentucky doesn't legally require an operating agreement, skipping this step is like running a business without insurance—risky. This document outlines how your LLC will handle everything from profit sharing to member disputes, and it strengthens your liability protection.

Your operating agreement should cover:

- Ownership percentages and voting rights

- Member responsibilities and powers

- How profits and losses are distributed

- Procedures for adding or removing members

- Steps for dissolving the LLC

- Management structure details

Step 5: Handle Kentucky Tax Requirements

Start by getting your federal Employer Identification Number (EIN) from the IRS—it's free and can be done online in minutes. Kentucky also requires a Commonwealth Business Identifier (CBI) for state tax purposes.

Your Kentucky LLC will need to register for:

- Limited Liability Entity Tax (LLET)

- Sales and use tax (6%) if selling tangible goods

- Employer withholding tax if you have employees

- Local occupational taxes (varies by city/county)

- Special industry taxes if applicable

Post-Filing Requirements for Kentucky LLCs

Once your LLC is approved, take care of these critical next steps:

- Open a Business Bank Account to separate your business and personal finances to maintain legal protection.

- Create an Operating Agreement, while not required by Kentucky, it’s strongly recommended to outline how your LLC will operate.

- Register with the Kentucky Department of Revenue

- Visit Kentucky One Stop Business Portal for any additional licensing needs.

Kentucky keeps annual requirements simple but missing them can dissolve your LLC. File your annual report between January 1 and June 30 each year ($15 fee). Set a reminder—your first report is due the year after formation.

Making It Official

Now that you've formed your Kentucky LLC, maintain separate business accounts, keep good records, and stay on top of annual requirements. With Kentucky's business-friendly environment and low costs, you're well-positioned for success. Just remember that while starting an LLC is straightforward, running it properly requires ongoing attention to detail and compliance.

Looking to start today? Head to the Kentucky Secretary of State's website and start your online filing. Your LLC could be up and running in just one business day.