How to Start an LLC in Iowa

Feb 16, 2025

Ready to kickstart your Iowa business without getting buried in red tape? You're in good company – an impressive 99% of new businesses in the Hawkeye State are small businesses, and there's a good reason why. Iowa makes it simple and affordable to form an LLC, with online filing costs of just $50 and processing times as quick as 1-2 business days. Plus, you'll only need to file reports every two years instead of annually like most states.

Looking to join Iowa's thriving business community? Let's walk through exactly how to form your LLC without the usual headaches and hefty price tags.

Starting Your Iowa LLC

Before jumping into the details, here’s what makes Iowa a solid choice for forming your LLC:

- Save Money on Filing: Iowa's $50 online filing fee is among the lowest in the Midwest. Skip the legal middlemen – the state's straightforward process means you can handle everything yourself.

- Quick Processing Time: While other states keep you waiting weeks, Iowa typically processes online LLC applications within 1-2 business days. Mail filings take 7-10 business days.

- Minimal Ongoing Requirements: Iowa only requires biennial (every two years) reporting, saving you time and money compared to states with annual requirements. Plus, there's no separate state business license needed for most companies.

- Tax Advantages: Iowa is transitioning to a single flat tax rate of 3.9% by 2026, making it easier to predict and manage your tax obligations. Single-member LLCs can report business income directly on personal tax returns.

- Maximum Flexibility: You can be your own registered agent and handle all filings online, potentially saving hundreds in service fees annually.

How to Form Your Iowa LLC

Forming an LLC in Iowa boils down to filing a Certificate of Organization with the Secretary of State. While other states pile on complex requirements, Iowa keeps things simple. Online filing costs $50, and you'll typically get approval within 1-2 business days.

The entire process can be completed online in under an hour if you're prepared. No need for expensive legal services or formation companies – Iowa's system is designed for direct filing by business owners like you.

Step 1: Choose Your LLC Name

Your business name needs "Limited Liability Company," "LLC," or "L.L.C." in the title – most owners just use "LLC" to keep things simple. Before getting attached to a name, search the Iowa Secretary of State's Business Entities Search to make sure it's available.

Want to lock down a name while you get your paperwork together? Reserve it for 120 days by paying $10 – but here's a money-saving tip: if you're ready to file within a few days, skip the reservation fee since your name gets protected automatically when you file your Certificate of Organization.

Step 2: Select Your Registered Agent

Here's an easy way to save $100-300 annually: be your own registered agent. You qualify if you:

- Are at least 18 years old

- Have a physical Iowa address (no P.O. boxes)

- Can be available during business hours to receive legal papers

Just keep in mind that your address becomes public record. If privacy matters more than the savings, professional registered agent services run about $100-300 per year. But for most small business owners, handling this role yourself is a smart way to cut costs.

Step 3: File Your Certificate of Organization

This is where your LLC becomes official. Iowa's online filing system makes it surprisingly straightforward. Here’s the steps for filling out your Certificate of Organization through Fast Track Filing:

- Provide your LLC name

- List your registered agent details

- Include your principal office address

- Pay the $50 filing fee

- Submit and typically receive approval within 1-2 business days

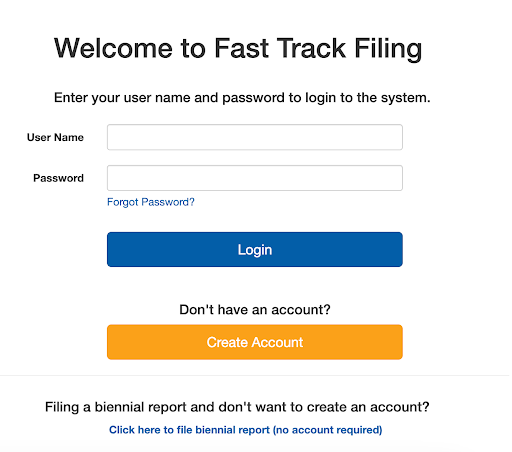

The first step to filing your paperwork is to create an account with Fast Track Filing.

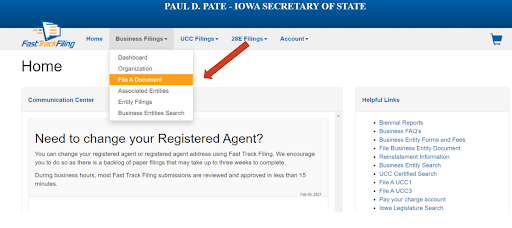

Once you’re logged in, head to the home page and click “Business Filings.”

Click “File a Document” in the drop down bar.

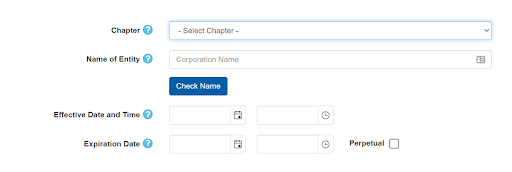

Next, click “Form an Iowa Limited Liability Company”

You’ll be brought to the Certificate of Organization page. Select “Domestic LLC” and fill out the information accordingly, and submit as a PDF.

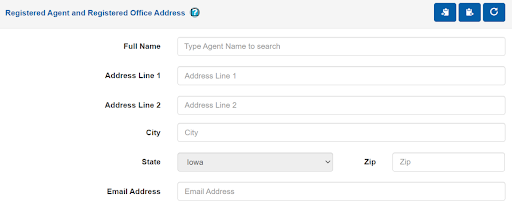

Fill out the registered agent information, remember, you can use yourself.

Fill out the remaining information, review, and submit.

After Filing: Keep Your LLC Running Smoothly

Once your LLC is approved, knock out these essential tasks:

- Get your EIN from the IRS website (free and usually instant online)

- Open a business bank account (crucial for maintaining liability protection)

- Register with the Iowa Department of Revenue if you'll collect sales tax

- Check local permit requirements with your city or county

Tax advantages make Iowa LLCs particularly attractive:

- Single-member LLCs report business income on personal returns

- Multi-member LLCs file as partnerships by default

- Take advantage of Iowa's new 3.9% flat tax rate (coming in 2026)

- Consider S-corporation status if your profits exceed $40,000 annually

Money-Saving Tips for Iowa LLC Owners:

- Handle your own registered agent duties to save $100-300 annually

- File everything online to save on fees and processing time

- Use free resources from the Iowa Small Business Development Center

- Set a reminder for your biennial report due every odd-numbered year

- Visit IASourceLink for permit requirements.

Time to Break Free from the 9-to-5

Iowa has created one of the most easy, straightforward, and affordable paths to LLC formation in the country. No degree necessary, no hefty fees, just a clear and simple path forward. Just follow these steps, save your money for actually running your business, and finally become the independent business owner you dreamed of.

Let’s make it happen! Head to the Iowa Secretary of State's website and start your online filing. Your LLC could be up and running in less than 48 hours.