How to Start an LLC in Indiana

Feb 16, 2025

If you’re looking for somewhere that provides a cost-effective and hassle-free way to establish your LLC. Indiana could be your ticket to independence. With online filing fees of just $95 (or $100 by mail) and processing times as quick as 24 hours, Indiana makes it surprisingly simple to establish your company.

Indiana is an excellent choice to start an LLC thanks to its low startup costs and business-friendly tax policies. In Indiana, operating agreements aren't mandatory, most businesses don't need special state licenses, and the state's INBiz portal lets you handle everything online.

Plus, with Indiana's relatively low 3.05% individual tax rate, you can keep more of what you earn. Let's walk through exactly how to form your Indiana LLC without any unnecessary complications or expenses.

Building Your Indiana LLC

Before getting into the specifics, let’s break down the information you need to know before starting an LLC in Indiana:

- Quick Processing: File online and your LLC could be approved within 24 hours. Even mail filings typically process in just 5-7 business days, faster than many other states.

- Save Money: Indiana's filing fees are lower than most states at $95 for online filing ($100 by mail). Skip the business license fees too – Indiana doesn't require a general state business license for most companies.

- Minimal Paperwork: Operating agreements aren't legally required, and you can handle most filings through Indiana's streamlined INBiz portal, saving you time and hassle.

- Simple Maintenance: Just file a business entity report every two years (not annually like most states) and stay current with your registered agent information. The biennial report only costs $32 online.

- Maximum Flexibility: Choose your tax structure (S-corp or C-corp options available), be your own registered agent to save money, and enjoy Indiana's relatively low 3.05% individual tax rate.

Step-by-Step: How to Form Your Indiana LLC

Let's cut through the red tape and get straight to what you need to do to make your Indiana LLC official:

1. Choose Your LLC Name

First, pick a name that includes "LLC," "L.L.C.," or "Limited Liability Company." Search the Indiana Secretary of State's business database to ensure it's available. Skip the $20 name reservation fee if you're ready to file – your name gets protected automatically when you submit your Articles of Organization.

2. File Your Articles of Organization

This is where your LLC becomes official. Submit online through INBiz for $95 (or mail in for $100). You'll need:

- Your LLC's name and address

- Your registered agent's information

- Management structure (member-managed or manager-managed)

- Business purpose

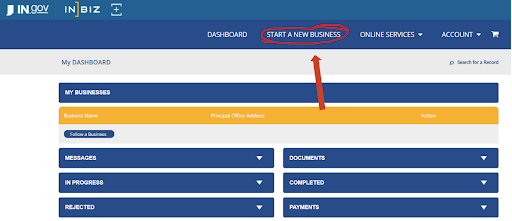

The first step to forming your LLC begins on the homepage. Click “Start a New Business”.

Create an account.

Once your account is made, it will take you to your portal. Click Start a Business.

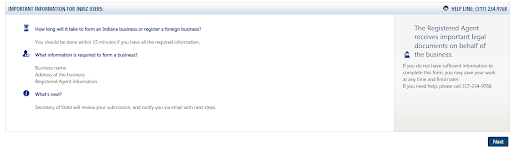

It will take you to this page and give you the information you need to start your LLC.

The next page will guide through the process of starting an LLC.

Decide on your business name, and be sure to add LLC to the end. If it’s available, you’ll move on.

The rest is pretty straightforward. Fill out your business and email address. We’ll walk through the registered agent.

3. Handle the Post-Filing Requirements

Once approved, get your free EIN from the IRS website, set up a business bank account, and register with the Indiana Department of Revenue if you'll have employees or collect sales tax. Most businesses don't need additional state licenses, but check your local requirements.

Saving Money While Starting Your Indiana LLC

Here's where many entrepreneurs waste money – but you don't have to. Indiana offers several ways to keep your startup costs low while still getting all the LLC benefits:

Registered Agent Savings

Save $100-200 annually by being your own registered agent instead of hiring a service. You qualify if you:

- Are at least 18 years old

- Have a physical Indiana address (no P.O. boxes)

- Can be available during business hours

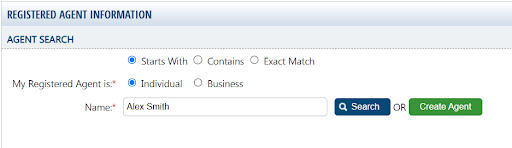

Once you reach the Registered Agent Information section, click the Create Agent button, and make yourself the registered agent. (Optional but highly recommended)

You’ll then fill out the remaining information. That's all it takes!

Just remember – your address becomes public record, and you'll need to be available to receive legal papers in person. If privacy is worth more to you than the savings, professional registered agent services run about $100-200 annually.

Smart Filing Choices

- File online instead of by mail to save $5 and get faster processing

- Skip the name reservation fee if you're ready to file your LLC paperwork

- Handle your own operating agreement instead of paying a lawyer (templates are readily available)

- Get your EIN for free directly from the IRS website

- Use the free resources from Indiana's Small Business Development Center for business advice

Keeping Your LLC Compliant

Once your LLC is up and running, Indiana makes ongoing maintenance surprisingly simple. Unlike most states that require annual filings, Indiana only needs a business entity report every two years. Mark your calendar for your LLC's anniversary month and budget $32 for online filing ($50 by mail).

Tax requirements stay straightforward too:

- Single-member LLCs: Report business income on your personal tax return

- Multi-member LLCs: File as a partnership by default

- Want more options? You can elect S-corporation status within 75 days of formation to potentially save on self-employment taxes

Time to Break Free

You've got the blueprint – now it's time to build your business. Indiana has created one of the most simple, affordable paths to LLC formation in the country. Straightforward and easy, without the need for fancy credentials or extra costs Just follow these steps, save your money for actually running your business, and become an independent business owner.

Ready to make it official? Head to the Indiana INBiz portal and start your online filing. Your LLC could be up and running in less than a day.