How to Start an LLC in Illinois

Feb 15, 2025

Looking to escape the corporate routine and start your own business in Illinois? You're not alone. Over 70% of U.S. business partnerships choose LLCs, and for good reason. With reasonable filing fees ($150 online), quick processing times (5-10 business days), and straightforward requirements, Illinois makes it easy to launch your own company.

While other entrepreneurs get tangled up in complex legal structures or waste money on unnecessary services, you can form an Illinois LLC yourself by following a few clear steps.

Ready to join the ranks of independent business owners? Let's walk through exactly how to form your LLC.

Forming an LLC in Illinois

Before we get into the specifics, here’s the key information you need to understand about starting an LLC in Illinois:

- Save Money: File online for $150 instead of using expensive formation services. That's hundreds less than what many services charge for the same paperwork.

- Quick Processing: Standard processing takes 5-10 business days online. Need it faster? Expedited 24-hour service is available for an extra $100.

- Minimal Requirements: No separate state business license needed for most companies. You'll just need your Articles of Organization and EIN to get started.

- Simple Maintenance: Annual reports are due before your LLC's anniversary month each year ($75 fee), and you'll need to maintain a registered agent.

- Maximum Flexibility: Illinois allows you to be your own registered agent and file everything online, helping you save both time and money when launching your business.

What is an Illinois LLC?

An LLC (Limited Liability Company) protects your personal assets while giving you flexibility in how you run and tax your business. It's the sweet spot between a simple sole proprietorship and a complex corporation – giving you legal protection without the corporate red tape.

Think of an LLC as a shield between your business and personal finances. If your business faces legal issues or debt, your personal savings, house, and other assets are typically protected.

Plus, Illinois LLCs offer tax flexibility – you can choose to be taxed as a sole proprietorship (for single-member LLCs) or partnership (for multi-member LLCs), avoiding the double taxation that corporations face.

Your Step-by-Step Guide to Forming an LLC in Illinois

This guide will walk you through everything you need to know to get your business up and running in the Land of Lincoln.

Step 1: Choose Your LLC Name

First things first – let's nail down your business name. Illinois has some specific rules you'll need to follow:

- Your name must include "Limited Liability Company," "LLC," or "L.L.C." (Save yourself some paperwork and business card space – most owners just use "LLC")

- It needs to be unique in Illinois – search the Secretary of State's business database first to avoid wasting time and money on a name that's already taken

- Stay away from restricted words like "Bank," "Insurance," or "Engineering" unless you have the proper licensing

Want to lock down a name while you get your paperwork together? You can reserve it for 90 days by paying $25. But here's a money-saving tip: if you're ready to file your LLC paperwork within a few days, skip the reservation fee – your name gets protected automatically when you file your Articles of Organization.

Step 2: Pick Your Registered Agent

Here's an easy way to save $100-200 per year: be your own registered agent. You qualify if you:

- Are at least 18 years old

- Have a physical Illinois address (no P.O. boxes)

- Can be available during business hours

To start your online filing, visit Illinois Secretary of State LLC Instruction page, and click “File.”

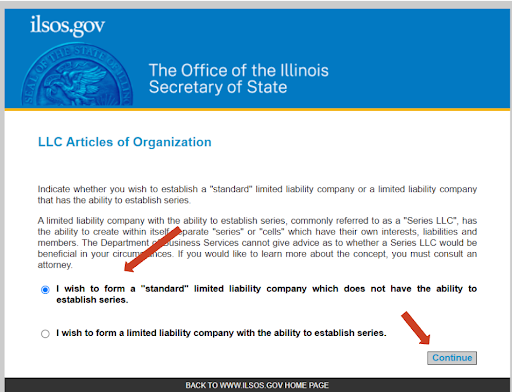

Remember, you are forming a normal business, not establishing a series. Select that option, and “Continue.”

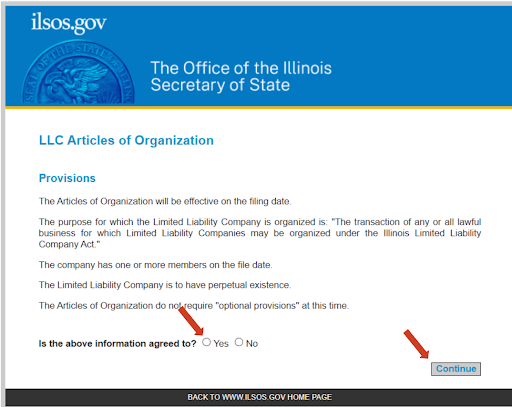

On the next page, click “Yes” and “Continue.”

It will ask for your business name. Make sure you add LLC and click “Continue.”

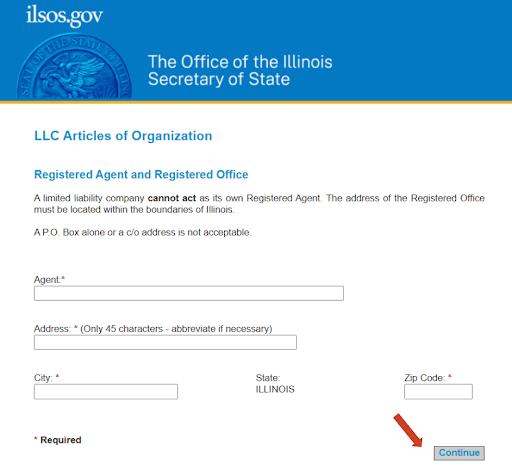

Fill out the address and move forward. Fill yourself out as the registered agent. (Optional but highly recommended)

Fill out and confirm all the information. Make sure to double check that everything is correct, then proceed with the payment.

Just keep in mind that your address becomes public record, and you'll need to be available to receive legal papers in person if needed. If privacy is worth more to you than the savings, professional registered agent services run about $100-200 annually.

Step 3: File Your Articles of Organization

Here's where you officially create your LLC. File your Articles of Organization with the Secretary of State's office online ($150) or by mail ($154). Required information includes:

- Your LLC's name

- Principal office address

- Registered agent information

- Manager or member information

- Effective date (can be up to 60 days in the future)

Pro tip: File online instead of by mail. Not only do you save $4, but you'll get faster processing (5-10 business days versus 7-14 for mail-in applications) and can pay with a credit card.

Step 4: Additional Requirements

After your LLC is approved, knock out these essential tasks:

- Get your EIN (free from the IRS website)

- Open a business bank account (keep your personal finances separate)

- Create an operating agreement (not required by law but crucial for protecting your business)

- Register with the Illinois Department of Revenue for state taxes

- Check local requirements for any needed permits or licenses

Keeping Your LLC Compliant

Mark your calendar for these important deadlines:

- Annual Report: Due before your LLC's anniversary month each year ($75 fee)

- Sales Tax Returns: File either monthly or quarterly if you sell products

- Income Tax: Pay the 4.95% Illinois income tax rate on your share of LLC profits

Visit the Illinois Department of Commerce and Economic Opportunity for any additional information.

Time to Take Action

You've got the blueprint – now it's time to build your business. Illinois has created one of the most straightforward paths to LLC formation in the Midwest. No need for high-level qualifications, no hidden fees, and no complicated processes. Just follow these steps, save your money for actually running your business, and become an independent business owner.

Ready to make it official? Head to the Illinois Secretary of State's website and start your online filing. Your LLC could be up and running in less than two weeks.