How to Start an LLC in Idaho

Feb 15, 2025

If you’re looking to start an LLC, Idaho could be your golden ticket to business ownership. With reasonable filing fees of just $100 for online filing and straightforward processing times of 2-3 business days, Idaho makes it surprisingly simple to launch your own company.

While other states pile on complex requirements and hefty fees, Idaho keeps things refreshing simple. In fact, by the end of 2023, new business applications in Idaho were up over 10% compared to 2022. Ready to join the ranks of successful Idaho entrepreneurs? Let's walk through exactly how to form your LLC.

Starting an LLC in Idaho

Before we get ahead of ourselves, here's what you really need to know about starting an LLC in Idaho:

- Save Money: Idaho offers competitive LLC filing fees - just $100 for online filing and $120 for mail-in applications. Filing online saves you both time and money.

- Quick Processing: Your LLC application typically processes in 2-3 business days when filed online. Mail-in applications take 7-10 business days.

- Minimal Requirements: Idaho doesn't require a separate state business license for most companies. You'll just need your Certificate of Organization and EIN to get started.

- Simple Maintenance: Annual requirements are straightforward – file your annual report by the end of your LLC's anniversary month and keep your registered agent information current.

- Maximum Flexibility: Idaho allows you to be your own registered agent and file everything online, helping you save both time and money when launching your business.

A Guide to Starting an LLC in Idaho

Guide made to walk you through everything you need to get your business officially established in the Gem State

Choose Your LLC Name

First things first – let's nail down your business name. Idaho has some specific rules you'll need to follow:

- Your name must include "Limited Liability Company," "LLC," or "L.L.C." (Save yourself some paperwork and business card space – most owners just use "LLC")

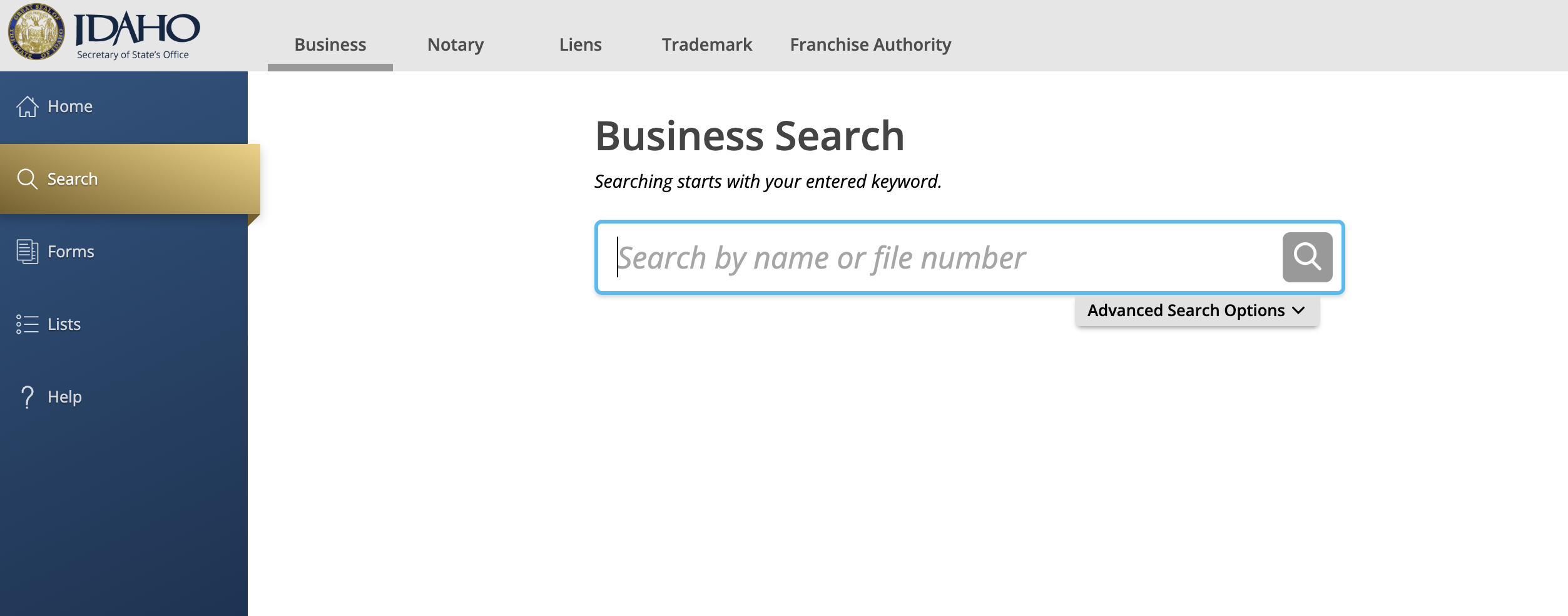

- It needs to be unique in Idaho. Search the Secretary of State's business database first to avoid wasting time and money on a name that's already taken.

- Stay away from restricted words like Bank, Insurance, or Engineering unless you have the proper licensing.

Want to lock down a name while you get your paperwork together? You can reserve it for 120 days by paying $20. But here's a money-saving tip: if you're ready to file your LLC paperwork within a few days, skip the reservation fee – your name gets protected automatically when you file your Certificate of Organization.

Register Your LLC

Here's where you officially create your LLC, and Idaho makes it surprisingly affordable. You'll file your Certificate of Organization with the Secretary of State's office. The best part? It only costs $100 online or $120 by mail – that's about the cost of a decent dinner out.

What you'll need to provide:

- Legal business name

- Principal office address

- Registered agent information

- Organizer's name and signature

- Effective date (can be up to 90 days in the future)

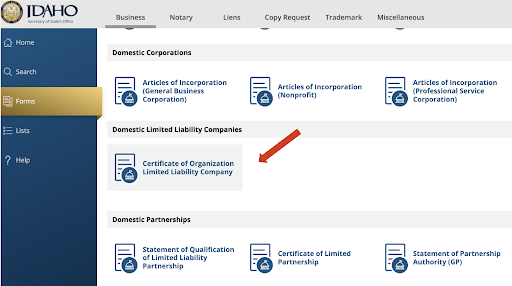

After you have made an account click the “Click Here” box

On the next page, click “Certificate of Organization Limited Liability Company.”

Once that is done, you’ll decide how fast you want your LLC processed.

When you input your name be sure to add LLC.

Pro tip: File online instead of by mail. Not only do you save $20, but you'll get faster processing (2-3 business days versus 7-10 for mail-in applications) and can pay with a credit card. The online system also checks for errors as you go, reducing the chance of rejection and delays.

After your LLC is approved, knock out these essential tasks:

- Get your EIN (free from the IRS website)

- Open a business bank account (keep your personal finances separate)

- Create an operating agreement (not required by law but crucial for protecting your business)

- Register with the Idaho State Tax Commission if needed

- Check local requirements for any necessary permits or licenses

Keeping Your Idaho LLC Running Smoothly

The hardest part is done, but there are a few unsexy (but important) details to handle each year to keep your LLC in good standing:

Annual Report Requirements:

- Due by the end of your LLC's anniversary month

- File online through the Secretary of State's website

- No filing fee required - Idaho is one of the few states with free annual reports

- Missing the deadline could result in your LLC being dissolved

Tax Classification Options:

- Single-member LLCs: Report business income on your personal tax return

- Multi-member LLCs: File as a partnership by default

- Want more options? You can elect S-corporation status within 75 days of formation to potentially save on self-employment taxes

BOI Reporting Update:

New federal requirements mean you'll need to file a Beneficial Ownership Information (BOI) report. While currently under review, be prepared to file within 90 days of formation.

Money-Saving Tips for Idaho LLC Owners:

- Handle your own registered agent duties to save $100-200 annually

- File everything online to save on fees and processing time

- Skip the name reservation if you're ready to file your LLC paperwork

- Use free resources from the Idaho Small Business Development Center

- Consider an S-corp election if your profits exceed $40,000 annually

Time to Break Free

You've got the blueprint – now it's time to build your business. Idaho has created one of the most straightforward paths to LLC formation in the country. No advanced degrees required, no surprise costs, and no confusing paperwork. Just follow these steps, save your money for actually running your business, and join the ranks of independent business owners.

Ready to get started? Head to the Idaho Secretary of State's website and start your online filing. Your LLC could be up and running in just a few days.