How to Start an LLC in Florida

Feb 13, 2025

Looking to start a business with budget-friendly policies and a simple process? Florida might be your perfect launching pad. With some of the lowest filing fees in the region ($125), quick processing times (5-7 business days), and zero state income tax, the Sunshine State makes it surprisingly simple to form an LLC.

While other states pile on complex requirements and hefty fees, Florida keeps things refreshingly straightforward. You won't face endless forms or sky-high costs—just a clear-cut process that gets your business up and running quickly.

Whether you're launching a side hustle or going all-in on your entrepreneurial dreams, we’ll walk you through exactly how to form your Florida LLC quickly and efficiently.

Benefits for Starting Your LLC in Florida

Let’s talk about what you really need to know about forming an LLC in Florida:

- Save Money: Florida's filing fee is just $125, with online filing available. No separate state business license required for most businesses.

- Quick Setup: Online filings typically process in 5-7 business days. Mail-in applications take longer and cost more ($50 extra).

- Tax Benefits: Florida has no state income tax, and LLCs can choose how they want to be taxed (pass-through entity, S-corp, or C-corp).

- Annual Requirements: File a report by May 1st each year ($138.75 fee). Late filings trigger a $400 penalty, so mark your calendar.

- Minimal Red Tape: Just appoint a registered agent, file your Articles of Organization, and get your EIN. No excessive paperwork or complex requirements.

5 Steps to Form Your Florida LLC

Starting your Florida LLC is easy when you follow these 5 essential steps to get your business up and running smoothly. Let’s walk through it.

Step 1: Choose Your LLC Name

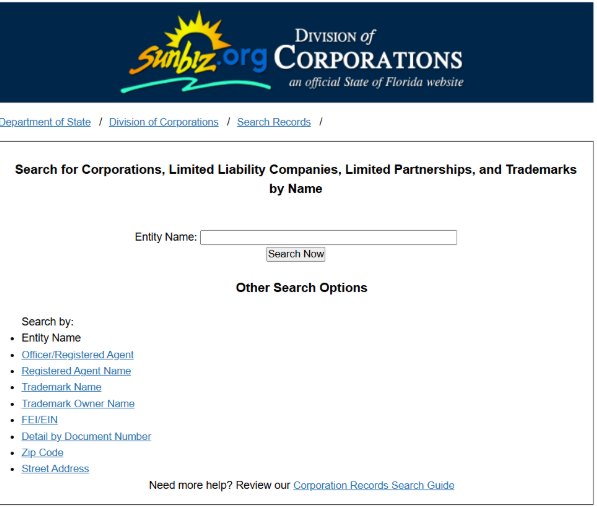

Your business name must include "Limited Liability Company," "LLC," or "L.L.C." and be unique in Florida. Search the state's business database to check availability. Don't waste $25 on name reservation if you're ready to file—your name gets protected automatically when you submit your Articles of Organization.

Quick tip: Check with the Florida Divisions of Corporations Record Search to find verify availability.

Step 2: Pick a Registered Agent

Every Florida LLC needs a registered agent to accept legal documents. Save $100-200 annually by being your own agent if you have a Florida address and can be available during business hours. Just remember—your address goes on public record. If privacy matters more than savings, professional services run about $100-125 per year.

Once you have clicked the Start new filing button the rest is very simple.

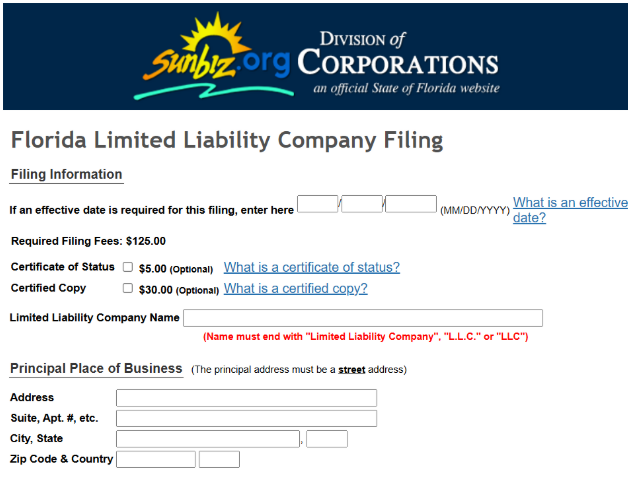

Step 3: File Articles of Organization

This is where you officially create your LLC. File online to save money ($125 vs $170 for mail-in) and get faster processing (5-7 business days vs 10-15). You'll need:

- LLC name and address

- Registered agent information

- Member/manager details

- Effective date (can be up to 90 days after filing)

You’ll be brought to this page. Click “Start New Filing”

Once you have clicked the filing button the rest is very simple.

Step 4: Create an Operating Agreement

While Florida doesn't require an operating agreement, skip this step and you're asking for trouble. This document outlines ownership percentages, voting rights, and how profits get distributed. It's crucial for preventing disputes and protecting your LLC status.

Step 5: Get Your EIN

Think of this as your business's social security number—you'll need it for taxes, bank accounts, and hiring employees. Apply online with the IRS for free and get your number instantly. Skip the third-party services trying to charge you for this.

Why Choose to Start an LLC in Florida?

A Florida LLC combines the liability protection of a corporation with the tax flexibility of a partnership. Your personal assets (like your home and savings) stay protected if your business faces legal issues or debt. Plus, you get to choose how your business is taxed—most owners opt for pass-through taxation to avoid double taxation and take advantage of Florida's zero state income tax.

With a Florida LLC, you're not just getting basic liability protection. You're setting up a legitimate business structure that banks, clients, and vendors take seriously, all while maintaining the flexibility to run your business how you see fit. No complex corporate requirements or excessive paperwork—just practical protection for your growing business.

Keep Your Florida LLC Compliant

After formation, handle these key tasks to keep your LLC running smoothly:

- Get a business bank account to maintain liability protection

- Register for state tax accounts if you'll collect sales tax

- File your annual report by May 1st ($138.75 fee, $400 penalty if late)

- Check local licensing requirements—while Florida doesn't require a state business license, your city or county might

- Register with the Department of Revenue if you'll have employees

- Visit the Florida Department of Business & Professional Regulation for information.

Save Money and Time Going Forward

- File everything online—it's cheaper and faster

- Set calendar reminders for annual report deadlines to avoid penalties

- Consider S-corp tax status if you'll make over $40,000 annually

- Be your own registered agent if privacy isn't a major concern

- Use free resources from Florida's Division of Corporations instead of paying for forms

Time to Launch Your Business

You've got the blueprint—now it's time to build. Florida offers one of the most straightforward paths to LLC formation in the country. Get started without the need for complex requirements, hidden fees, or complicated steps.

Grab your EIN, file those Articles of Organization, and join the ranks of independent business owners who've become their own boss. Your LLC could be up and running in less than a week.