How to Start an LLC in Delaware

Feb 13, 2025

Why Choose Delaware for Your LLC? Starting a business in Delaware could be your smartest move yet. While other states charge hefty fees and drown you in paperwork, Delaware offers some of the lowest filing fees around ($90) plus unmatched privacy protections and tax benefits that have attracted over 1.8 million businesses to incorporate here.

Whether you're a solo entrepreneur or small business owner, Delaware's streamlined process, business-friendly courts, and lack of state corporate income tax on out-of-state income make it an unsexy but savvy choice for your LLC. Let's walk through exactly how to form your Delaware LLC without the usual hassles and headaches.

Benefits of Starting an LLC in Delaware

Before getting into the details, let’s break down what you should know about forming an LLC in Delaware:

- Cost Advantage: Delaware's $90 filing fee beats most states' rates. Plus, there's no state corporate income tax on out-of-state income, making it ideal for online businesses.

- Quick Processing: Standard filing takes 10-15 business days, but 24-hour processing is available for an extra $50 if you need to launch fast.

- Privacy Protection: Unlike many states, Delaware doesn't require member/manager names on public records. Only your registered agent's information becomes public.

- Simple Maintenance: No annual report required—just pay your $300 annual franchise tax by June 1st each year and keep your registered agent information current.

- Maximum Flexibility: Delaware allows single-member LLCs and doesn't require an operating agreement (though we strongly recommend having one).

Why Choose Delaware for Your LLC?

Delaware isn't just for Fortune 500 companies. The state offers unique advantages that make it a smart choice for businesses of any size. First, Delaware's specialized business court system (the Court of Chancery) handles business disputes faster and more predictably than regular courts, potentially saving you thousands in legal fees if issues arise.

More importantly, Delaware shields your privacy and your wallet. You won't pay state corporate income tax on out-of-state income, making it perfect for online businesses or those serving customers outside Delaware.

The state also keeps your personal information private – only your registered agent's details appear on public records, not your name or address. Add in some of the strongest asset protection laws in the country, and you've got an incredibly practical home for your business.

Step-by-Step Formation Process

1. Choose Your LLC Name

Your business name must include "Limited Liability Company," "LLC," or "L.L.C." Check availability through Delaware's business entity search portal before proceeding.

Want to reserve a name while you get your paperwork together? It's $75 for 120 days – but save that money if you're ready to file now, since your name gets protected automatically when you submit your Certificate of Formation.

2. Select a Registered Agent

Every Delaware LLC needs a registered agent with a physical Delaware address. You have two options:

- DIY Approach: Be your own agent if you have a Delaware address and can be available during business hours. Cost: $0

- Professional Service: Hire a registered agent service for around $100-300 annually. They'll handle your legal documents and protect your privacy.

3. File Your Certificate of Formation

Here's where you make it official. File your Certificate of Formation by mail with the Delaware Division of Corporations Forms by Entity Type page. You'll need:

- Your LLC name

- Registered agent information

- Filing fee ($90 for standard processing, +$50 for 24-hour service)

- Effective date (can be up to 90 days in future)

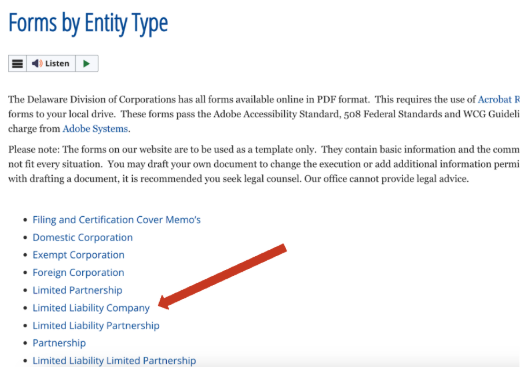

To start your filing, visit the Forms by Entity Type page.

In Delaware, you can’t file your Certificate of Formation online. It must be done by mail. This requires you to download an Adobe system. Click the blue “Adobe Reader” link to download.

Click “Download Acrobat Reader”

Once you’re back to the Forms page, click the “Limited Liability Company” form.

From there, click the “Certificate of Formation” filing form.

This is what your form should look like. Fill out the required information, send it in the mail, and wait for approval.

Mailing address in Delaware:

401 Federal Street,

Suite 4,

Dover, DE 19901

Remember, include a check for the $90 filing fee.

4. Handle Post-Filing Requirements

Once approved:

- Get your EIN (free from IRS website)

- Open a business bank account

- Create an operating agreement (not required but strongly recommended)

- Register for state taxes if needed

- Check local licensing requirements.

- Visit the Delaware Business First Steps page for additional information.

Launch Your Delaware Business Today

Getting your Delaware LLC up and running is simpler than you might think. Total upfront costs run about $90-140 depending on filing speed, plus your registered agent fees if you choose a professional service. Most LLCs are approved within 10-15 business days (or next day with expedited service).

Remember to mark June 1st on your calendar – that's when your $300 annual franchise tax is due. Miss it, and you'll face a $200 penalty. But otherwise, Delaware keeps things refreshingly simple. No annual reports, no complex compliance rules, just straightforward business ownership.

Ready to join over 1.8 million businesses that call Delaware home? Head to the Delaware Division of Corporations website and start your filing today. Your business could be up and running before your next paycheck hits.