How to Start an LLC in Connecticut

Feb 12, 2025

Starting an LLC in Connecticut is a smart way to protect your personal assets while enjoying the flexibility of running your business. Connecticut makes it surprisingly straightforward, with a reasonable $120 filing fee and processing times as quick as 3-7 business days when you file online. While other states pile on complex requirements and hefty charges, Connecticut keeps things refreshingly simple.

You don't need a lawyer or expensive formation service to start your LLC. With clear state guidelines and minimal bureaucracy, you can handle the entire process yourself. Whether you're launching a side hustle or going all-in on your business dreams, we’ll break down exactly how to form your Connecticut LLC with no unnecessary complications, just practical steps to get your business up and running.

Starting an LLC in Connecticut

Before getting too deep into the weeds, here's what you really need to know about forming an LLC in Connecticut:

- Save Money: The filing fee is just $120 online ($125 by mail), making Connecticut one of the more affordable states for LLC formation. Plus, you can be your own registered agent to avoid annual service fees.

- Quick Processing: Online applications typically process in 3-7 business days. Mail-in applications take longer at 7-10 business days. Want it faster? Expedited 24-hour service is available for an extra $50.

- Simple Requirements: Connecticut doesn't require a separate state business license for most companies. Just file your Certificate of Organization, get your EIN, and you're largely ready to operate.

- Clear Timeline: Your first annual report won't be due until the year after formation, giving you time to establish your business. Mark your calendar though—there's an $80 annual filing fee due between January 1 and March 31.

- Maintenance Made Easy: Connecticut's online business portal lets you handle most filings and updates electronically, saving both time and money on paperwork and mailings.

Basics of Forming Your Connecticut LLC

Setting up an LLC in Connecticut takes just four main steps and can be completed entirely online. You'll file your Certificate of Organization with the Secretary of State's office, which establishes your business as a legal entity.

Here's the basic process:

- Choose your LLC name (must be unique and include "LLC" or "Limited Liability Company")

- Appoint a registered agent with a physical Connecticut address

- File your Certificate of Organization ($120 online)

- Get your EIN from the IRS (free)

The entire process can be completed in less than an hour online through Connecticut’s business portal, and your LLC could be approved within a week. Most of your time will be spent gathering information and choosing your business name—the actual filing takes just minutes if you're prepared.

Step-by-Step Guide to Starting Your Connecticut LLC

Step 1: Choose Your LLC Name

Your business name has to be unique in Connecticut and include "LLC," "L.L.C.," or "Limited Liability Company." Save yourself $60 by skipping the name reservation fee—if you're ready to file your LLC paperwork, your name gets protected automatically when you submit your Certificate of Organization.

Use Connecticut's free business name search tool to check availability before filing.

Pick the industry that your business is in for the NAICS CODE.

Everything is very straightforward once that is done. Just fill out the basic information about your business, then submit your files after payment.

Step 2: Select Your Registered Agent

Once your account is created, file with the State of Connecticut online.

Here's an easy way to save $100-300 annually: be your own registered agent. You qualify if you have a physical Connecticut address and are available during business hours. Just remember that your address becomes public record. If privacy matters more than savings, professional registered agent services run about $100-200 per year.

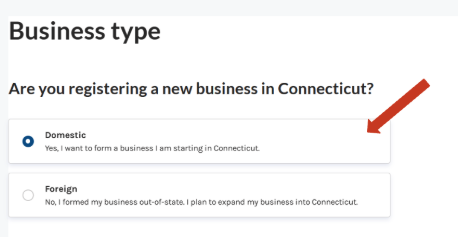

Once you are in the portal and can start filling out your form this is what it should look like.

Click “Domestic”. And “Next.”

Choose the structure of your company next. Hint its LLC. When you pick your name be sure to add LLC after.

Step 3: File Your Certificate of Organization

This is where your LLC officially comes to life. You'll need:

- A unique business name

- Principal office address

- Registered agent information

- At least one member's name and address

- Entity email address

- Organizer's signature

Pro tip: File online instead of by mail. You'll save $5, get faster processing (3-7 days vs. 7-10 days), and the system checks for errors as you go. You can also pay by credit card to avoid dealing with checks or money orders.

Essential Post-Formation Steps

Once your LLC is approved, knock out these crucial tasks:

Get Your EIN

Your EIN (Employer Identification Number) is free from the IRS and essential for opening a business bank account or hiring employees. Get it online for instant processing—just make sure you wait until Connecticut approves your LLC first to avoid complications.

Set Up Your Business Finances

- Keep it simple but professional: Open a separate business bank account (you'll need your Certificate of Organization and EIN)

- Consider creating an operating agreement (not required by law but crucial for protecting your interests)

- Register for state taxes if you'll have employees or collect sales tax (standard rate is 6.35%)

Annual Compliance Made Simple

Your LLC's yearly maintenance is straightforward but important. Mark these dates:

- Annual Report: Due between January 1 and March 31 each year

- Filing Fee: $80 (pay online to avoid processing delays)

- Late Fee: $40 (don't waste money—set a reminder)

Keep Your Business Moving Forward

You've got the blueprint—now it's time to build your business. Connecticut makes it surprisingly affordable to get started ($120 filing fee) and simple to stay compliant ($80 annual report). Skip the expensive formation services and handle the process yourself. Your LLC could be up and running in less than a week, leaving you more time and money to focus on what matters—growing your business and breaking free from the 9-to-5 grind.

Ready to get started? Head to the Connecticut Secretary of State's website and file online. Your future as a business owner is just a few clicks away.