How to Start an LLC in Colorado in 2026

Feb 10, 2025

Want to start a business in Colorado? Smart Move! with one of the most straightforward filing processes in the country, immediate online processing, and a modest $50 filing fee, Colorado makes it surprisingly simple to launch your company.

While other states pile on complex requirements and hefty fees, Colorado keeps things refreshingly simple with no general state business license requirement and a straightforward 4.25% flat tax rate. Whether you're looking to protect your personal assets or take advantage of tax benefits, we'll show you exactly how to form your Colorado LLC without the usual headaches and unnecessary expenses.

Why Form an LLC in Colorado?

An LLC protects your personal stuff from your business problems. If someone sues your company or your business racks up debt, they can only go after business assets, not your house, car, or personal savings. That's the whole point of "limited liability."

Here's what else you get:

- Tax flexibility: Choose to be taxed as a sole proprietorship, partnership, S corporation, or C corporation. Most small businesses stick with pass-through taxation (where profits flow to your personal tax return), but you have options if your situation changes.

- Fewer headaches than a corporation: No board meetings, no corporate minutes, no complex stockholder requirements. Just run your business.

- Credibility boost: "Smith Consulting LLC" looks more professional than "Bob Smith, Guy Who Does Consulting." Clients, vendors, and banks take you more seriously.

If you're doing anything more than casual freelance work, this protection is worth it.

Starting Your Colorado LLC

Let’s break down what you really need to know about forming an LLC in Colorado:

- Save Money: Colorado charges just $50 for online LLC filing - one of the lowest rates nationwide. Plus, you can be your own registered agent to save $100-300 annually.

- Fast Processing: When you file online, your LLC is typically processed immediately. No waiting weeks or paying extra for expedited service.

- Simple Maintenance: Annual requirements are minimal - just file a periodic report each year ($10 fee) and maintain your registered agent information.

- Tax Benefits: Colorado offers a straightforward 4.25% flat tax rate and pass-through taxation, making tax season less complicated and potentially more affordable.

- Maximum Flexibility: You can file everything online, manage your own paperwork, and even operate as a single-member LLC - giving you complete control over your business with minimal red tape.

How to Form Your Colorado LLC: Step-by-Step Guide

1. Choose Your LLC Name

Your first task is picking a name that's both available and compliant with state rules. Colorado requires your name to include "Limited Liability Company," "LLC," or "L.L.C." Skip the $25 name reservation fee if you're ready to file - your name is automatically protected when you submit your formation documents.

Quick tip: Use the free Colorado Secretary of State business database to check availability before spending a dime.

2. Select a Registered Agent

Here's an easy way to save $100-300 per year: be your own registered agent. You qualify if you have a physical Colorado address and can be available during business hours. Just remember, your address becomes public record - if privacy matters more than savings, professional registered agent services run about $100-200 annually. Visit the Secretary of State LLC page to start filing.

3. File Your Articles of Organization

This is where you officially create your LLC, and Colorado makes it surprisingly affordable. The filing fee is just $50 online ($45 if you file by mail), and your articles are processed immediately when filed online. You'll need:

- Your LLC's name and principal address

- Registered agent information

- Management structure (member or manager-managed)

- Name and address of the person forming the LLC

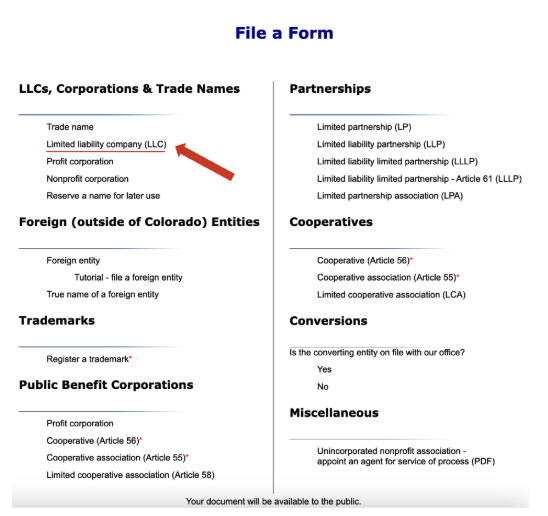

To Start your LLC after visiting the website, click the “Limited Liability Company” link.

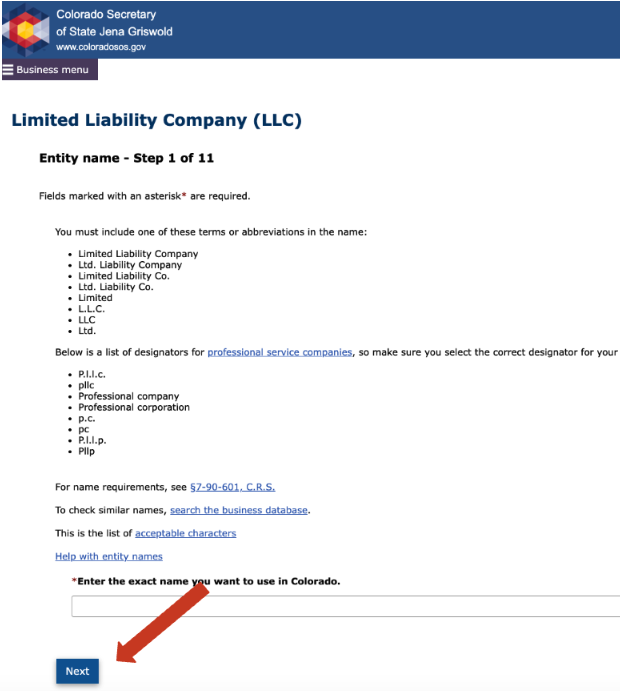

You’ll then click “Next” to officially start your filing.

Colorado has a step-by-step walkthrough to guide you through the rest of your filing.

Fill out all the required information for your Articles of Organization, submit, and wait for approval.

Pro tip: Always file online rather than by mail. You'll get immediate processing instead of waiting 7-10 business days, plus the online system catches common errors that could cause delays.

Essential Post-Filing Steps and Maintenance

Once your LLC is approved, you'll need to handle a few key tasks to get your business running and keep it compliant:

Initial Setup Requirements

- Get your EIN (free through the IRS website) - you'll need this for taxes and banking

- Open a business bank account to keep personal and business finances separate

- Create an operating agreement - while not legally required, it's crucial for protecting your business structure

- Register for state taxes if you'll have employees or collect sales tax

Don't Ignore the BOI Reporting Requirement

Here's a federal requirement that catches most new business owners off guard: Beneficial Ownership Information (BOI) reporting through FinCEN. This became mandatory on January 1, 2024, as part of the Corporate Transparency Act.

You must report:

- Basic company information (name, address, EIN)

- Details about every beneficial owner (anyone who owns 25% or more of your LLC)

- Identification documents for each owner

The deadlines:

- LLCs formed before 2024: Had all of 2024 to file (deadline passed)

- LLCs formed in 2024: 90 days from formation date

- LLCs formed in 2025 or later: 30 days from formation date

The filing is free through the FinCEN website. Do it yourself, it takes about 20 minutes once you have the required information.

Miss the deadline? You're looking at $500 per day in penalties, up to $10,000 total, plus potential criminal charges. The federal government is serious about this.

You'll also need to file updates within 30 days whenever ownership changes, an owner's information changes, or your business address changes. Set a calendar reminder.

Get Your Business Licensed (Maybe)

Colorado doesn't require a general statewide business license, but you're not off the hook entirely.

Local licenses:

Most Colorado cities and counties require their own business licenses or permits. Denver, Colorado Springs, Boulder, they all have different rules. Call your city clerk's office or check their website. Fees typically range from $25-150 per year.

Industry-specific licenses:

Some businesses need specialized state licenses:

- Contractors: State contractor license required

- Food service: Health department permits

- Professional services: Lawyers, doctors, accountants, real estate agents need professional licenses

- Childcare: State licensing through Department of Human Services

- Alcohol sales: Liquor license through local licensing authority

Check the Colorado Secretary of State's website for industry-specific requirements. Don't assume you're exempt, penalties for operating without required licenses add up fast.

Single-Member vs Multi-Member LLCs

Single-member LLCs:

Owned and operated by one person. Colorado allows these, and they're popular with solo entrepreneurs. You get all the liability protection of an LLC with the simplicity of running things yourself.

Tax treatment: File Schedule C with your personal tax return. The IRS treats you like a sole proprietorship for tax purposes unless you elect otherwise.

Multi-member LLCs:

Two or more owners. Requires more planning since you need to split ownership, profits, and decision-making authority.

Tax treatment: File Form 1065 (partnership return). Each member gets a Schedule K-1 showing their share of income/loss.

Both types should:

- Create an operating agreement (even more crucial for multi-member LLCs)

- Get an EIN from the IRS

- Keep business and personal finances completely separate

- Maintain proper records and follow LLC formalities

The single-member LLC is the easiest structure for most solo business owners. Multi-member LLCs work great for partnerships but require more attention to the operating agreement and member relationships.

Your Annual Requirements Are Minimal

Colorado makes ongoing compliance simple compared to most states.

Annual Periodic Report:

File once per year through the Secretary of State's online portal. Costs $10. This updates your business information (address, registered agent, management) and keeps your LLC in good standing.

The filing is available starting 60 days before your anniversary date. Set a calendar reminder so you don't miss it.

That's it.

No annual tax beyond your regular income tax. No franchise tax. No elaborate compliance filings.

Missing your periodic report puts your LLC in "delinquent" status. After continued non-compliance, the state can administratively dissolve your LLC. Just file the $10 report each year and you're good.

Common Questions About Colorado LLCs

Can I be my own registered agent?

Yes, if you have a physical Colorado address and can be available during normal business hours. Your address becomes public record. Most solo entrepreneurs serve as their own agent to save $100-200 per year in professional service fees.

Do I need an EIN if I'm the only member?

Technically no, single-member LLCs can use your Social Security Number. But banks almost always require an EIN to open a business account, and it's free to get one through the IRS website, so just get one. Takes 5 minutes online.

What if I want to do business in another state?

You'll need to register your Colorado LLC as a "foreign entity" in that state. Each state has its own process and fees. Only necessary if you have a physical presence (office, employees) in the other state, occasional sales don't count.

How long does LLC formation take?

File online and your Articles of Organization are processed immediately. You can start operating your business the same day. File by mail and wait 7-10 business days for processing.

Can non-residents form a Colorado LLC?

Absolutely. You don't need to live in Colorado to form a Colorado LLC. You'll need a registered agent with a Colorado address, but you can hire a professional service for that. Useful if you're doing business primarily in Colorado but live elsewhere.

Do I need a lawyer?

Not for a standard LLC formation. The process is straightforward enough to do yourself. Consider a lawyer if you have a complex multi-member structure, unique operating agreement needs, or industry-specific compliance issues. Otherwise, save the $1,500-3,000 in legal fees.

What's the difference between an LLC and a sole proprietorship?

- Sole proprietorship: No separation between you and your business. Someone sues your business, they can take your personal assets.

- LLC: Legal separation between you and your business. Lawsuit targets business assets only. Costs $50 to set up but provides crucial protection.

Can I convert my sole proprietorship to an LLC later?

Yes, but it's easier to start as an LLC from the beginning. Converting means filing new business licenses, getting a new EIN, updating contracts, changing bank accounts, and notifying clients. Just start right the first time.

Time to Launch Your Colorado LLC

Ready to join Colorado's thriving business community? The state has created one of the most straightforward, affordable paths to LLC formation in the country. No complicated requirements, no excessive fees, and no unnecessary red tape. For just $50 and about 30 minutes of your time, you could have your LLC up and running today.

Head to the Colorado Secretary of State's website to start your online filing. With immediate processing and straightforward requirements, you could be building your business empire before dinner.