How to Start a Family Business: The Unsexy Truth About Working With People You Actually Like

Nov 25, 2025

Starting a business is hard. Starting a business with family? That's a whole different beast.

You've probably heard all the warnings. Don't mix business with family. It'll ruin Thanksgiving. Someone's going to steal from the petty cash and blame it on cousin Eddie.

But here's what nobody talks about: family businesses make up over 63% of the U.S. workforce. They're not all disasters. Some of them work incredibly well. The difference? They know what they're getting into before they start.

This guide covers everything you need to know about starting a family business from scratch, the good parts, the messy parts, and the parts where you might want to throw your laptop at your brother's head.

Why Family Businesses Can Actually Work

Before we get into the doom and gloom (and trust me, there's plenty), let's talk about why this might not be the worst idea you've ever had.

You Already Speak the Same Language

When you work with family, you skip years of awkward team-building exercises. You already know how your sister communicates. You understand that when your dad says "we should look into that," he means "do it yesterday."

This shared history means faster decision-making. You're not wasting time explaining context or building trust from zero. You've got 20+ years of shared experiences that translate into efficient communication.

Your brother knows you're direct because that's how you've always been, not because you're being a jerk on Tuesday morning. That context matters when you're trying to move fast.

Built-In Trust (When It Works)

There's already a foundation. You know this person will show up (hopefully). You know their work ethic from watching them mow the lawn for the past decade. You've seen them under pressure during family crises.

This trust can accelerate business decisions. No six-month trial period to see if someone's reliable. You already know if they'll answer the phone at 2 AM when something breaks.

But here's the catch—that same trust can bite you. You might give them too many chances. You might overlook red flags because "they're family." We'll get to that.

Winning Together Feels Better

Making money with strangers is fine. Making money with people you actually care about? That hits different.

When you close a big deal and your brother's sitting across from you, you get to celebrate with someone who knows exactly how much work went into it. When you finally turn a profit after two years of grinding, you're sharing that win with people who matter to you.

It's like running a family activity that happens to generate income. And when you eventually take that vacation with the profits? You're spending it with people you'd want to hang out with anyway.

The Real Talk: Why Most Family Businesses Fail

Now for the part where we talk about why your uncle's landscaping company imploded after six months.

Blurred Boundaries Will Destroy You

The biggest problem with family businesses? You can't clock out.

Dinner conversations turn into strategy sessions. Family gatherings become unofficial board meetings. Your sister texts you about inventory issues at 9 PM on a Saturday. Suddenly, you're always working or always talking about work.

This is how relationships die. You stop being siblings and start being "business partners who happen to share DNA." Every family interaction carries the weight of unresolved business tension.

The fix? Clear boundaries. When you're at home, you're family. When you're at work, you're coworkers. Sounds simple. It's not. But it's necessary.

Skills Don't Transfer From Family Dinners

Your cousin is great at Thanksgiving. He tells funny stories, remembers everyone's birthday, and always helps clean up. That doesn't mean he'll be good at sales.

Here's the trap: You assume because someone is reliable in family situations, they'll be reliable in business situations. These are completely different skill sets.

Just because someone will help you move doesn't mean they'll close deals. Just because they're trustworthy with family secrets doesn't mean they can manage finances. These are separate competencies.

The biggest mistake? Bringing someone into the business because you like them, not because they have skills that complement yours.

Favoritism Kills Companies

This one sneaks up on you.

You start noticing that one family member is crushing it. They're bringing in clients, solving problems, staying late. The other one? Lots of talk, minimal results.

Suddenly, you're doing everything for the productive one and resenting every request from the other. Even good ideas from the underperformer get dismissed because you've lost faith in their execution.

This creates a toxic dynamic. The underperformer feels attacked. The overperformer feels overworked. You're stuck in the middle trying to maintain family peace while running a business.

The "I'll Just Do It Myself" Death Spiral

When family members don't deliver, you have two options: have an uncomfortable conversation or just do it yourself.

Most people choose option two.

So you start covering. Your brother was supposed to handle invoicing, but he's "busy," so you do it. Your sister was going to update the website, but she's "learning," so you figure it out.

Before you know it, you're doing everything while other people collect paychecks. This builds resentment faster than anything else.

The problem? You volunteered for this. The second you say "I'll just handle it," you become the person who handles it. Forever.

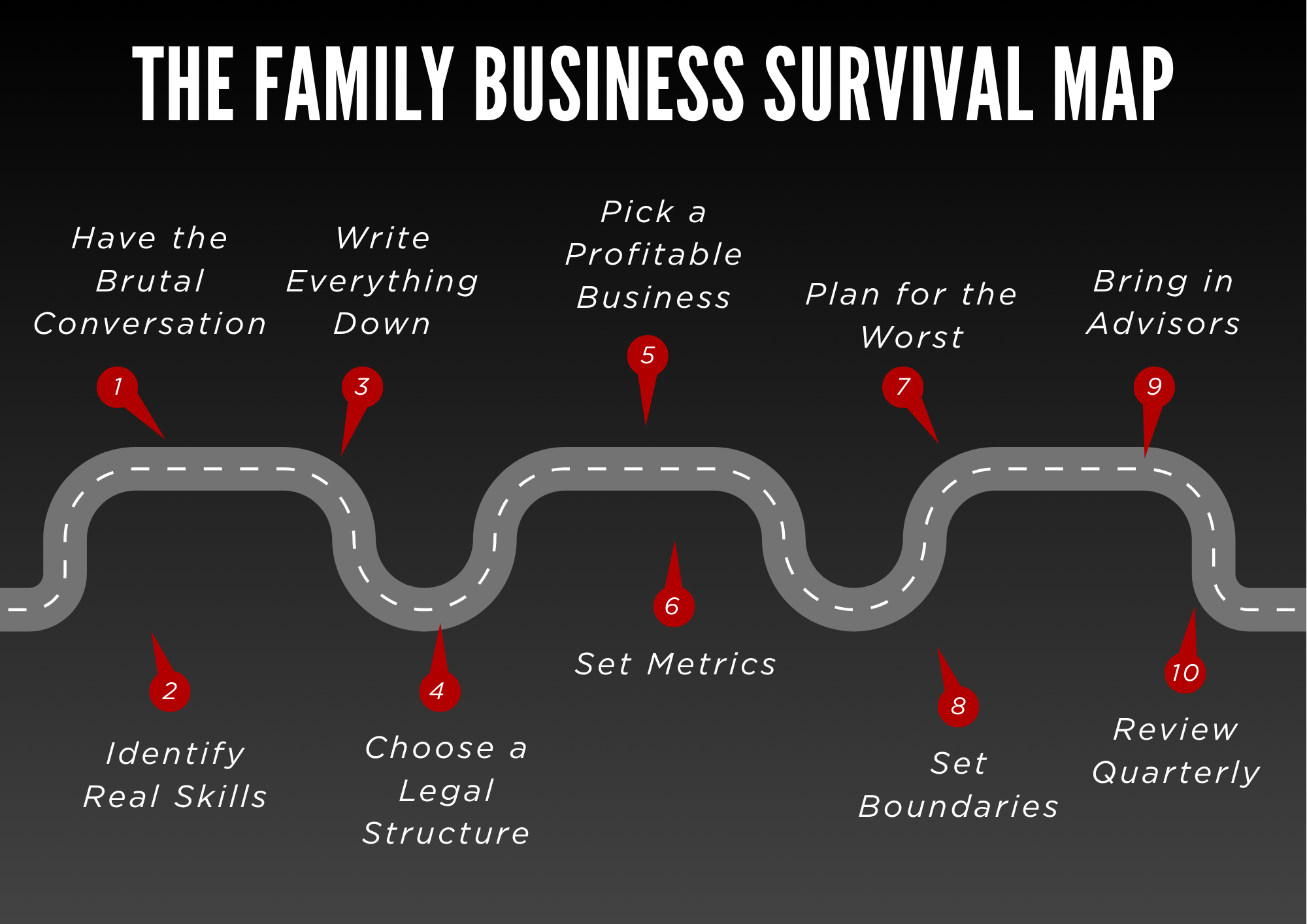

How to Actually Start a Family Business (Without Ruining Thanksgiving)

Let's get practical. Here's how you do this without creating a multi-generational blood feud.

Step 1: Have the Brutal Conversation First

Before you file a single piece of paperwork, sit down and ask the hard questions:

Can I fire this person if it doesn't work out?

If the answer is no, don't start the business. Period. You need to be comfortable with the possibility of terminating this relationship.

Will I be okay losing this relationship if the business fails?

Most businesses fail. That's just statistics. If you're not willing to risk the relationship, find a different business partner.

What happens if we have a major disagreement?

Talk through scenarios now. What if you want to reinvest profits and they want to take distributions? What if you want to expand and they want to stay small? How do you resolve deadlocks?

These conversations suck. Have them anyway.

Step 2: Identify Actual Skills (Not Just Good Intentions)

Make a brutally honest list of what each person brings to the table.

Not "I'm a people person" or "I'm good with ideas." Real, tangible skills:

- Can you close sales?

- Can you build websites?

- Can you manage finances?

- Can you write contracts?

- Can you manage inventory?

- Can you handle customer service?

If someone's best quality is "they're really nice," that's not a skill that builds a business. Nice doesn't pay the rent.

Your skills should complement each other. If you're both "idea people," you're both useless. You need someone who executes while someone else strategizes. You need someone who sells while someone else fulfills.

Step 3: Write Everything Down (No Handshake Deals)

Get everything in writing before you start. This includes:

Operating Agreement

- Who owns what percentage?

- How are profits distributed?

- What happens if someone wants out?

- How are major decisions made?

Roles and Responsibilities

- Specific tasks each person is responsible for

- Metrics for success in each role

- How often you'll review performance

- What happens if someone doesn't deliver

Compensation Structure

- How much does each person get paid?

- When do salaries increase?

- How are bonuses calculated?

- What happens if the business can't afford salaries?

This isn't about distrust. It's about clarity. When things go sideways (and they will), you need something to reference that isn't clouded by emotion.

Step 4: Choose the Right Business Structure

This is where most people get lost in legal jargon. Let's simplify.

Sole Proprietorship Simple, but dangerous. If the business gets sued, your personal assets are at risk. Also, if the owner dies, the business dies. Not ideal for family succession.

Partnership Multiple owners, but still no liability protection. You're personally liable for business debts. If your brother makes a terrible decision, it can sink your personal finances too.

LLC (Limited Liability Company) This is probably what you want. It protects your personal assets from business liabilities. You can choose how it's taxed (as a partnership or corporation). All members get liability protection.

Most family businesses should start here. It's simple, flexible, and protects everyone involved.

Family Limited Partnership (FLP) More complex, but useful if you're planning long-term wealth transfer. You have general partners (who control decisions) and limited partners (who benefit financially but don't make decisions).

This works well when older family members want to start passing ownership to younger generations while maintaining control.

S-Corporation or C-Corporation More formal structure. Better for businesses planning to bring in outside investors or go public eventually. More paperwork, more regulations, but better for scaling.

For most family businesses starting out? Stick with an LLC. You can always convert later if needed.

Step 5: Pick a Business That Actually Makes Money

Here's where we get unsexy.

You don't need a revolutionary tech startup. You need a business with proven demand that generates cash flow.

Service Businesses That Work:

- Lawn care and landscaping

- Cleaning services (residential or commercial)

- Handyman and repair services

- HVAC or plumbing (if you have the licenses)

- Property management

Home-Based Businesses:

- Bookkeeping and accounting

- Virtual assistant services

- E-commerce (selling products online)

- Consulting in your area of expertise

- Online course creation

Local Businesses:

- Car washes (Shaq's built an empire on these)

- Laundromats

- Vending machine routes

- Mobile detailing

- Pressure washing

Businesses That Use Existing Skills:

- If you're in construction, start a contracting company

- If you're in healthcare, start a home health agency

- If you're in IT, start a managed services provider

- If you're in sales, start a brokerage

The best family business is one where:

- There's proven demand

- Startup costs are manageable

- Cash flow is relatively quick

- Skills are complementary

- Growth potential exists

Step 6: Set Clear Expectations and Metrics

This is where most family businesses fall apart.

Everyone starts with vague ideas about "working hard" and "doing their part." Then three months in, you realize your definitions of "hard work" are completely different.

Create Specific Metrics for Each Role:

If someone's handling sales:

- X number of calls per day

- Y number of meetings per week

- Z dollar amount in closed deals per month

If someone's handling operations:

- Complete X invoices per week

- Respond to customer inquiries within Y hours

- Maintain Z% accuracy on orders

If someone's handling marketing:

- Publish X pieces of content per week

- Generate Y leads per month

- Maintain social media engagement at Z level

These metrics need to be:

- Specific (not "do good work")

- Measurable (numbers, not feelings)

- Time-bound (weekly/monthly, not "eventually")

- Written down (not just verbal agreements)

Review these monthly. If someone's consistently missing their metrics, you have a clear conversation starter that isn't emotional: "You agreed to X, you're delivering Y, what's happening?"

Step 7: Plan for the Worst-Case Scenarios

What happens when things go wrong? Because they will.

Create an Exit Strategy

- How does someone leave the business?

- What happens to their ownership stake?

- Do remaining partners have right of first refusal?

- What's the valuation method?

Define Conflict Resolution

- How do you handle disagreements?

- Is there a neutral third party (lawyer, accountant, advisor)?

- What's the process for major decisions?

- How do you break tie votes?

Establish Termination Procedures

- What are the grounds for removal from the business?

- What's the notice period?

- How is severance calculated?

- How do you handle ownership buyouts?

Protect Against Theft

- Who has access to financial accounts?

- How are expenses approved?

- What's the review process for financials?

- What's your policy on using business resources?

Have a zero-tolerance policy for theft—time theft (claiming hours not worked) or product theft (taking inventory). This isn't negotiable, even for family.

If someone steals $10 worth of cleaning supplies, they're fired. Not because $10 matters, but because that's only the first time you caught them.

Step 8: Set Boundaries Between Family and Business

This is the hill your family relationships will die on if you don't protect it.

At Work:

- Use professional names, not family nicknames

- Keep conversations business-focused

- Address issues as they arise, don't save them for dinner

- Maintain professional standards even when no one else is around

At Home:

- No business talk after a certain time

- Family events are off-limits for business discussions

- Don't bring work stress into family dynamics

- Give each other permission to be "off duty"

On Communication:

- Use business channels (email, Slack) for business

- Don't text work stuff at midnight unless it's an emergency

- Respect personal time and days off

- Keep work and personal phones separate if possible

This takes discipline. You'll slip up. Your brother will call about inventory during Sunday dinner. Your sister will text about a customer issue during a movie. Call it out and reset the boundary.

Step 9: Bring in Outside Perspective

You need people who aren't emotionally invested in family dynamics.

- Hire an Accountant Not just to do taxes, but to review financials monthly. They'll catch money issues before they become relationship issues.

- Find a Business Lawyer Draft your operating agreement, review contracts, and establish clear legal protections. This isn't optional.

- Get a Business Coach or Advisor Someone who can call out dysfunction without worrying about Thanksgiving dinner. They'll see problems you're too close to notice.

- Create an Advisory Board Even informal, having outside voices in quarterly meetings keeps you honest about business performance versus family loyalty.

Outside advisors do what family can't: tell you hard truths without emotional baggage.

Step 10: Review and Adjust Quarterly

Every three months, have a formal business review. Not a family dinner where you talk shop. A real meeting with an agenda.

Review Each Person's Performance Against Metrics

- Are they hitting their numbers?

- Where are they falling short?

- What support do they need?

- What needs to change?

Assess Financial Health

- Are you profitable?

- Where is money being wasted?

- What investments need to be made?

- Are salaries sustainable?

Discuss Strategic Direction

- Is the current plan working?

- What needs to pivot?

- What opportunities are emerging?

- What threats are on the horizon?

Address Relationship Issues

- What tensions are building?

- Where are boundaries being violated?

- What conversations need to happen?

- How can you improve collaboration?

Document everything. These meetings create a paper trail that protects everyone if things eventually fall apart.

The Types of Family Business Structures That Actually Work

Not all family businesses look the same. Here are the models that tend to succeed:

The Founder-Operator Model

One person owns and runs the business. Other family members are employees with clear roles, not owners.

Pros:

- Clear chain of command

- Easier decision-making

- Less ownership disputes

Cons:

- Employees may resent not having ownership

- Succession planning is more complex

- Power dynamics can create tension

Best for: Parents bringing adult children into an existing business, or one founder hiring family members for specific roles.

The Partnership Model

Two or more family members own and operate together with roughly equal stakes.

Pros:

- Shared financial burden

- Complementary skill sets

- Mutual accountability

Cons:

- Deadlock potential on decisions

- Harder to remove non-performing partners

- Equal ownership doesn't always reflect equal contribution

Best for: Siblings or spouses with complementary skills starting from scratch together.

The Distributed Model

Multiple family members own shares, whether they work in the business or not. Often used in multi-generational businesses.

Pros:

- Keeps wealth in the family

- Easier succession to next generation

- Spreads financial risk

Cons:

- Non-working owners may interfere with operations

- Dividend expectations can drain cash

- Complex governance structure needed

Best for: Established businesses planning long-term family succession across generations.

The Nested Model

Different family members own different parts of the business separately, while sharing some assets jointly.

Pros:

- Allows individual entrepreneurship

- Reduces conflict over specific business decisions

- Easier to separate if needed

Cons:

- Complex legal structure

- Potential for internal competition

- Requires clear boundaries between entities

Best for: Entrepreneurial families where different members have different interests but want some shared infrastructure.

Red Flags That Mean You Shouldn't Start This Business

Sometimes the best business decision is not starting a business. Here are the warning signs:

You Can't Fire Them

If you can't imagine having the conversation that ends with "this isn't working, you need to go," don't start the business.

That unwillingness to have hard conversations will cost you money, time, and eventually the relationship anyway. Might as well save yourself the pain.

They Have No Relevant Skills

"They're a hard worker" isn't a skill. "They're really motivated" isn't a skill.

If the only thing they bring to the table is family connection and good intentions, find a different partner. You need complementary skills, not cheerleaders.

You've Never Worked Together

Just because you're related doesn't mean you work well together. If possible, work on a small project together first before committing to a full business partnership.

Family dynamics at home don't predict business dynamics at work. Test the relationship before you bet your financial future on it.

They're Chronically Unreliable in Personal Life

If your cousin is always late to family events, always has an excuse for why things didn't get done, always has drama that prevents follow-through—they'll be exactly the same in business.

Past behavior is the best predictor of future behavior. Don't convince yourself business will be different.

You Need Them More Than They Need You

If you're more excited about the business than they are, that's a problem. You'll end up doing all the work while they collect ownership benefits.

Both partners need roughly equal motivation. Otherwise, you're building a job for yourself and a passive income stream for them.

The Business Idea Depends on One Person's Relationships

"My uncle knows a guy who can get us clients" isn't a business model. If the entire business depends on one person's network and that person loses interest, the business dies.

You need a business model that works regardless of who shows up. Relationships are bonus, not foundation.

You're Only Doing This Because You Feel Obligated

Family pressure to "give them a chance" or "help them get on their feet" is not a reason to start a business together.

Business partnerships require aligned incentives and mutual benefit. If you're doing this out of obligation, the resentment will poison everything eventually.

When Family Businesses Actually Work

Let's end on a realistic note. Family businesses can work, but they require specific conditions:

- Clear Skill Differentiation Each person brings distinct, valuable skills that complement each other. Nobody is redundant.

- Established Communication Patterns You've already proven you can have hard conversations and come out the other side. You don't avoid conflict or sweep problems under the rug.

- Similar Work Ethics You don't need identical approaches, but you need compatible intensity. Someone working 60 hours while someone else works 20 will create resentment fast.

- Mutual Respect for Expertise Each person defers to the other in their area of expertise. The sales person doesn't second-guess the operations person, and vice versa.

- Shared Vision for the Future You both want the same things from this business. Whether that's building a legacy, creating passive income, or just working together while making money—you're aligned on the destination.

- Written Agreements Everything is documented. Roles, responsibilities, compensation, decision-making processes, exit strategies. Nothing is "we'll figure it out later."

- Outside Accountability You have advisors, accountants, or coaches who can call out dysfunction without family baggage influencing the conversation.

- Boundaries That Hold You can actually separate work from family. Business issues stay at work. Family issues stay at home. When boundaries get crossed, you call it out and reset.

If you have most of these conditions, you've got a shot. If you're missing more than a couple, think hard about whether this is worth the risk.

The Bottom Line

Starting a family business isn't for everyone. It's messier than working with strangers because you can't just quit without consequences.

But if you go in with eyes open, clear agreements, and realistic expectations, it can work. You can build something meaningful with people you care about. You can create wealth that stays in the family. You can work alongside people you'd actually want to grab a beer with after work.

Just make sure you're doing it for the right reasons with the right people under the right structure.

And for the love of God, get everything in writing.

Need help setting up your family business structure? Unsexy Businessmen specializes in helping entrepreneurs start practical, profitable businesses—even when those entrepreneurs happen to be related. We've seen what works and what destroys Thanksgiving dinner. Set up a consultation with one of us to avoid becoming a cautionary tale.